Oct 2015

27

Small Benefit Exemption Scheme - Increase in threshold

The Minister for Finance Michael Noonan is set to fast track an increase in the threshold for the Small Benefit Exemption Scheme. The current threshold is €250; this will double and will increase to €500. The last time the threshold was increased was in 2005 when it was increased from €100 to €250. The move is contained in the Finance Bill, published last week. The new rules were expected to be implemented from 1st January 2016 however, The Department of Finance say the change will be implemented in time for Christmas.

Under the Revenue Commissioner’s Approved Small Benefit Exemption Scheme employers can provide employees with a small benefit, this small benefit is not subject to PAYE, USC or PRSI.

The following rules apply:

• The benefit cannot be cash, cash payments are fully taxable

• Only one such benefit can be given to an employee in one tax year

• Where a benefit exceeds the threshold the full value of the benefit is subject to PAYE, USC & PRSI

• The benefit can not form part of a "salary sacrifice" scheme

The small benefit is traditionally given as a voucher often at Christmas, as mentioned above only one such benefit can be given to an employee in one tax year. Where more than one benefit is given in a tax year only the first benefit will qualify under the Small Benefit Exemption Scheme.

Full details of Finance Bill 2015 can be found on Revenue’s website

http://www.revenue.ie/en/practitioner/law/bills/finance-bill-2015/index.html

Oct 2015

15

Budget 2016 – Employer Payroll Focus

Tax Rates and Standard Rate Cut Off Points (SRCOPs)

There has been no change to tax rates or SRCOPs. The standard rate of tax will remain at 20% and the higher rate of tax will remain at 40%.

There has been no change to the SRCOP and Tax Credits on the Emergency Basis of tax.

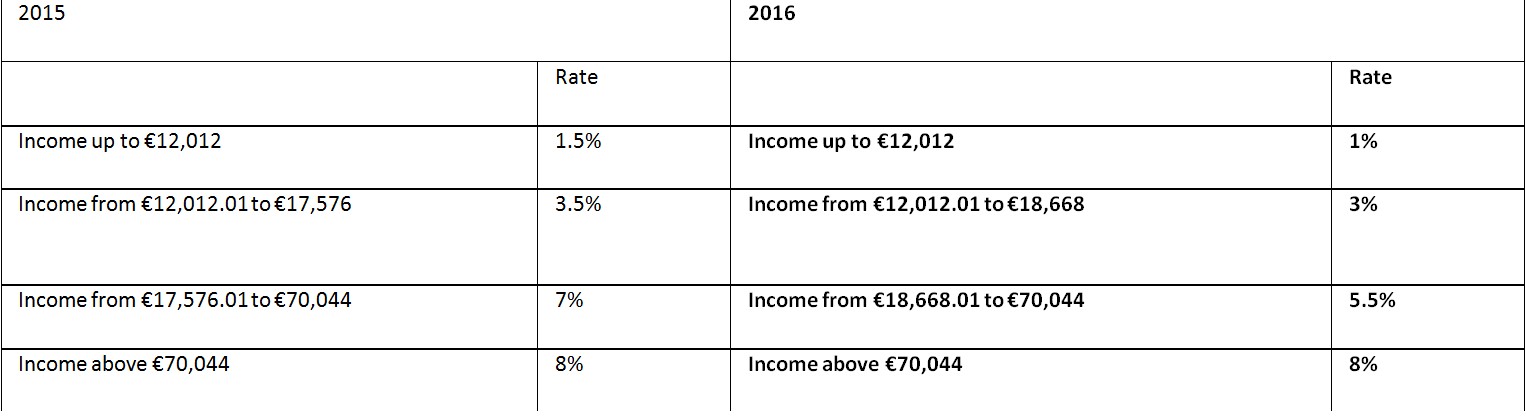

Universal Social Charge (USC)

The annual threshold for USC has been increased to €13,000 from €12,012.

Please note full medical card holders and individuals aged 70 and over whose aggregate income does not exceed €60,000 will pay a maximum rate of 3%.

The emergency rate of USC remains at 8%.

PRSI

Increase from €356.01 to €376.01 in the weekly threshold at which liability to employer’s PRSI increases from 8.5% to 10.75%.

A tapered PRSI credit has been introduced for employee PRSI; the PRSI credit will commence in respect of weekly income of €352.01 and will taper out as a weekly income reaches €424.

For earnings between €352.01 and €424, the maximum weekly PRSI credit of €12.00, is reduced by one-sixth of earnings in excess of €352.01.

Example:

Gross weekly earnings of €377

Maximum PRSI Credit €12

One-sixth of earnings in excess of €352.01

(€377-€352.01 = €24.99/6) (€4.17)

Reduced PRSI Credit €7.83

PRSI @ 4% €15.08

Less: Reduced PRSI Credit €7.83

Employee PRSI Weekly Liability €7.25