Mar 2017

31

Important Information for Employers - Changes to Civil Service Travel Rates

Where employees use their own private cars or motorcycles for business purposes, reimbursement in respect of allowable motoring expenses can be effected by way of flat-rate mileage allowances.

There are two types of mileage allowance schemes which are acceptable for tax purposes if an employee bears all the motoring expenses:

- The prevailing schedule of Civil Service rates; or

- Any other schedule with rates not greater than the Civil Service rates

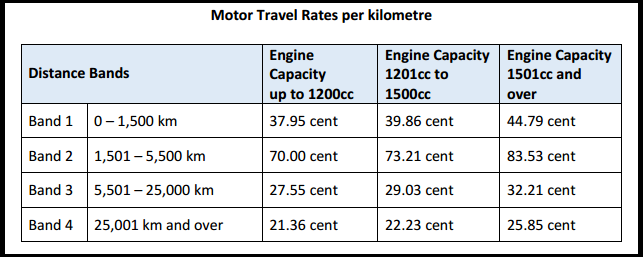

The Department of Public Expenditure and Reform has recently published circulars with new Civil Service Travel Rates, the revised rates are effective from 1st April 2017. The distance bands have increased from two to four with a lower recoupment rate for the first 1,500 kilometres.

Business travel carried out between 1st January and 31st March 2017 will not be affected by these new bands and rates, business travel to date from 1st January 2017 will count towards the cumulative business travel for the year.

Motor Travel Rates - Effective from 1st April 2017

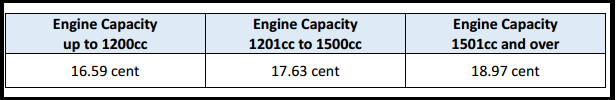

Reduced Motor Travel Rates per kilometre

The reduced rates are payable to Civil Service employees who undertake a journey associated with their job but not solely related to the performance of their duties, such as:

- Attendance at confined promotion competitions

- Attendance at approved courses of education

- Attendance at courses or conferences

- Return visits home at weekends during a period of temporary transfer

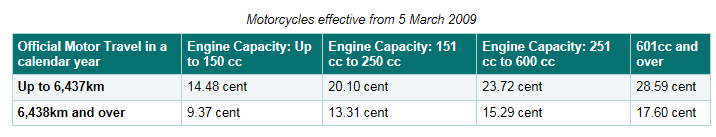

The Motor Travel Rates for motorcycles and bicycles remain unchanged as follows:

Motorcycle:

Bicycle: 8 cent per km

Please note, there are changes to subsistence rates which are also effective from 1st April 2017.

Please click here for the circular on Motor Travel Rates, and here for the circular on Subsistence

Mar 2017

29

Auto enrolment for Ireland?

The current Minister for Social Protection, Leo Varadkar, has, on a number of occasions, mentioned his desire to introduce auto enrolment in Ireland.

This will be a welcome and necessary development as it is unlikely that the current levels of state pension will be sustainable in the medium to long term.

The UK is nearing the end of its auto enrolment roll out and there are, I believe, a number of lessons learnt.

On the face of it, the requirement to enrol an employee into a pension scheme (based on age and earnings), to make deductions/contributions and to allow for opting out, would all appear very straightforward. Not so! Employer guidance extends to many hundreds of pages and the rules are unnecessarily complex.

My first suggestion is to keep it simple. If the minister has his way, auto enrolment may commence around about the same time as Revenue’s Smart PAYE project. This will be a lot to take on board at the one time, particularly if the UK’s auto enrolment rules are anything to go by. Examples of how to make it simpler - link everything to pay date (not pay period) and forego the requirement to apportion.

Next, I would suggest that a common filing standard is adopted at the outset for both enrolments and contributions. This was attempted in the UK, without success. The main problem was the pension companies and their differing systems. Ideally an all encompassing file specification would be mandated and the pension companies would just have to accept. Plus there would need to be common business rules for the various fields in the specification. Lessons learnt here from the SEPA roll out which resulted in similar looking files for the various banks but with very different business rules!

Postponement is a handy feature in the UK system but it does complicate things further. If everything else can be made simple and seamless, then postponement may not be required. Hand in hand with this would be the suggestion that all employees are enrolled no matter what their earnings are and no matter how temporary their employments are for. They would still have the ability to opt out.

Also, the creation of a government backed master trust (similar to NEST in the UK) would further obviate the need for postponement as postponement is generally used to get a pension scheme set up.

In relation to opting out, the opt out window should be linked to the actual pay date of first deduction rather than the auto enrolment date (which itself has many potential definitions) or scheme join date.

Employee communications is another big part of the whole process. The UK communications have evolved and simplified over the last few years and their present format would be fine for Ireland.

Finally, the actual calculation of the pension deduction/contribution should be based on all (taxable) earnings. The UK rules limit the calculation to a portion of the earnings, further increasing its complexity.

The above are my main suggestions and stem from our involvement with the UK system through our UK payroll software, BrightPay, where we have ongoing engagement with employers, accountants, professional bodies, HMRC, the Pensions Regulator, NEST, IFAs and the various pension providers.

Feedback welcome at paul@thesaurus.ie

Mar 2017

20

New Illness, Maternity and Paternity Benefits rates in effect

Almost all welfare benefits and state pensions are to be increased in 2017.

The maximum weekly Illness Benefit payment will increase by €5.00 from €188 to €193 per week from week commencing 13 March 2017.

Illness benefit is considered as income for tax purposes and thus needs to be taken into account for PAYE purposes by an employer. It remains exempt from USC & PRSI.

No payment is made for the first six days of illness and for any Sunday.

Thesaurus Payroll Manager will automatically apply the increased rate of €193 per week as soon as Week 12 is reached in the software, which users should be aware of. Further information on how to process illness benefit in Payroll Manager can be found here:

In addition, standard Maternity and Paternity payments will increase from €230 to €235 per week from 13 March 2017. These are both taxable sources of income but aren’t liable to USC or PRSI. Unlike illness benefit, however, an employer must not tax these benefits through payroll. Instead, the Revenue will tax Maternity and Paternity Benefit via the employee’s tax credit Certificate by reducing the employee's SRCOP and tax credit on receipt of information from the Department of Social Protection.