Aug 2021

31

What happens if I don't submit Revenue’s Employer Eligibility Review Form?

The Irish government has extended the Employment Wage Subsidy Scheme (EWSS) until 31st December 2021. The scheme gives employers impacted by COVID-19, a subsidy per employee to help keep them in employment. On 9 July, Revenue published guidelines to highlight the changes to the EWSS applicable for the period from 1 July 2021. The main change made to the scheme was in relation to eligibility.

To assist employers in ensuring continued eligibility for the scheme, from 30th June 2021, all employers are required to complete and submit an online monthly EWSS Eligibility Review Form (ERF) through ROS by the 15th of each month. Companies claiming EWSS must fill out a monthly eligibility form, showing their revenue for 2021 remains at least 30% below the reference period in 2019 and a declaration to confirm that the information submitted is correct and accurate to the best of their knowledge. Failure to complete and submit the EWSS Eligibility Review Form that confirms the required reduction and related declaration will result in suspension of payment of EWSS claims.

Revenue has stated: “Where Revenue determines that an employer, at any time over the term of the scheme, claimed and received payment by applying accounting practices that are clearly not appropriate, or by deliberately misrepresenting the true financial situation of the business, it will be excluded from the EWSS in its entirety. No further claims will be accepted, and all subsidy paid and PRSI credit issued will be immediately repayable together with interest and penalties. The business may also face possible criminal prosecution.”

The government has paid nearly €4 billion to date in EWSS payments on top of the €2.9 billion paid under the earlier TWSS. Revenue have launched an investigation on companies that are suspected of overclaiming pandemic wage subsidies.

According to Revenue’s code of practice for audits and non-audit interventions, officials can make unannounced site visits, conduct profile interviews with business owners, carry out assurance checks, and initiate investigations. Please ensure you are submitting correct information to avoid any penalties.

Upcoming webinar

Join Thesaurus Software for a free webinar on 30th September where we will be joined by representatives from the Revenue Commissioners to discuss upcoming changes to the Employment Wage Subsidy Scheme in October and the Employer Eligibility Review Forms. There will also be a live Q&A session to answer any questions that you may have.

Limited Places Remaining – Click here to reserve your place.

Related articles:

Feb 2021

1

Q&A - Common Support Queries on EWSS

Due to the changes and updates to the COVID-19 Government schemes, our support team put together the top four common questions – asked by you and answered by us!

When earnings fluctuate and are within the limits for the Employment Wage Subsidy Scheme (EWSS) in some pay periods and not others, do we need to untick EWSS for the employee?

No. There is no need to remove the tick for EWSS, our software will remove the indicator from the payroll submission (PSR) in the pay periods the earnings fall outside the relevant limits.

The subsidy being received is more than we are paying the employees, do we pay the employees the difference or will we owe that money back to Revenue?

In some scenarios the employer will receive a subsidy greater than the wages they are paying; they will not have to repay that money to Revenue. The employee should only be paid the wages that are due and not any extra. In other scenarios the subsidy received from Revenue will be less than the wages they are paying.

What payments are permitted under EWSS e.g., can you pay the employees commission?

Yes. The EWSS is a subsidy payable to employers, therefore, it will not show on employee payslips or in myAccount. Under EWSS employers are required to pay employees in the normal manner i.e., calculating and deducting Income Tax, USC and employee PRSI through the payroll. Employees should be paid the wages that are due to them which can include commission, overtime etc.

When employees are claiming the Pandemic Unemployment Payment (PUP) from the Department of Social Protection, do we need to do anything on the payroll?

Yes. You should ensure that the employee’s payment is changed to zero, continue to update them with zero pay until such time you are paying them wages again.

More information can be found in the COVID-19 guidance section on our website or by visiting the COVID-19 Resources Hub.

Related Articles:

Jan 2021

26

Lockdown 3.0 - What have we learned?

Lockdown hasn't been easy for any of us - you could say it's been a bit of a 'coronacoaster'. COVID-19 has made us realise what’s important to us. Whether that be connecting more with family or re-connecting with old friends through the social platforms we are so grateful to have during this time. As we are currently in lockdown 3.0, let's look back on some of the key lessons learned as a payroll processor over the past year during this time of crisis.

Importance of Remote Access

Payroll is one of the core functions of running any business, and so it is something that needs to be completed on time and without errors. When working from home, your staff might not be able to access all the tools and documents that they would normally be able to access, especially if your systems are on-premises solutions and files and documents are physical hard copies.

Due to COVID-19 and having to work remotely from home, it is now a necessity to be able to access your payroll data from home. Your payroll software should easily facilitate remote working with additional user access. Thesaurus Payroll Manager can be installed on up to 10 PCs per licence key, and this means that payroll processing is possible by up to 10 users, or from 10 different locations. This is very handy for if you have a number of employees working from home, all needing access to the payroll software.

We have also introduced new multi-user features that work in conjunction with Thesaurus Connect, our optional cloud add-on, to improve the working from home experience. These new features include ‘version checking’ when opening an employer, and an ‘other users check’ when opening an employer. This new "working from home" integration gives you all the benefits of the cloud while utilising the power and responsiveness of your local device.

Importance of Reliable Software

The past year has been very frustrating for payroll processors. Not only had you the added workload of processing subsidy claims, but you also had to learn about the various schemes and ensure you kept up to date with the latest guidelines. That’s why it’s so important to use reliable payroll software from a reliable company.

We kept Thesaurus Payroll Manager up to date to cater for the relevant scheme changes, and we tried to automate as much as possible in the payroll software to make your life easier.

In a recent survey, we achieved a 98.7% rating for our overall handling of COVID-19 including customer support, payroll upgrades, COVID-19 webinars and online support. We also won a COVID-19 Hero Award, and this is because of our response to COVID-19 and how we have helped our customers throughout the past few months.

Importance of Cloud Backups

As most businesses are now working remotely for the foreseeable future, it leaves many businesses exposed to data loss. This is why cloud backups are so important.

If you only keep your payroll data on your desktop, you are at risk of losing the information. Have you thought about what would happen if your computer broke down or was hacked? How would you get your payroll data back quickly? Would employees still get paid if the information was lost?

Thesaurus Connect is our optional add-on that works alongside the payroll software. Thesaurus Connect provides a secure and user-friendly way to backup and restore your payroll data on your PC to and from the cloud. It’s simply an added layer of data protection to keep your payroll data safe so you never lose your payroll data again.

Importance of Automation

Whether you’re an employer processing payroll in-house for your business, or an accountant or bureau processing payroll for a number of clients, automation is key. How much time do you spend managing annual leave, answering employee leave balance enquiries, retrieving lost payslips, and communicating with employees in general? Now is the time to eliminate those admin-heavy tasks!

Self-service online portals are changing the way businesses interact and communicate with their employees, whilst providing the cloud functionality to get things done smarter and faster. Thesaurus Connect includes the ability to manage employee leave, communicate with employees, automate payslip distribution, run payroll reports and much more.

Book a demo of Thesaurus Connect today to discover more features that can help you streamline your payroll and HR processes.

Dec 2020

4

The COVID Heroes of the Accounting World

Thesaurus Software is delighted to announce that BrightPay has won the COVID-19 Hero Award (supplier) at the Accounting Excellence Awards. BrightPay is created by Thesaurus Software, and although this was awarded to BrightPay, this is simply what our company is called in the UK - two different names, but the same company and the same 75 employees behind this award.

The judges recognised that we went above and beyond to support payroll professionals at a time when they were under pressure with government schemes and trying to interpret scheme guidance. Paying employees was one of the areas most impacted by COVID-19 and we recognised customers would struggle to implement government schemes.

The main challenge for us has been delivering upgrades to minimise the stress for customers. Our COVID-19 upgrades were released in advance of scheme changes being implemented. In most cases, we were first to the market with upgrade releases with other providers taking longer or needing additional software bug fixes, not automating scheme calculations or not implementing functionality for every change.

Our speedy upgrades to the payroll software focused on automation functionality to accurately calculate scheme payments and claims which meant customers were prepared and compliant.

Our customer support strategy involved additional staffing and increased hours. Our comprehensive webinar, blog and email strategy educated and informed customers about COVID-19 processes and presented demonstrations of how to action these schemes in our payroll products. Our multi-channel approach guided our customers to easily implement government measures.

Speaking at the Accounting Excellence Awards, host extraordinaire Mike Goldsmith said “the judges saw that BrightPay went above and beyond to support their client base and payroll professionals at a time when they were under pressure with furlough claims and interpreting guidance. BrightPay did this through a coordinated strategy that went beyond product enhancement. Their success in this was evidenced by high customer satisfaction and impressive reach with their support material.”

Find out more about our COVID-19 Response Plan and how we have helped our customers throughout the pandemic.

Related Articles:

Payroll in a Pandemic - Make sure your practice isn't left behind

Thesaurus Software’s COVID-19 Response Plan

Free Webinar: EWSS Explained | Guest: Revenue

Oct 2020

14

Revenue Compliance Checks Start and TWSS Reconciliation

The Temporary Wage Subsidy Scheme – also known as TWSS, was in operation since 26th March, and it ended on 31st August. The subsidy was processed through the payroll as a non-taxable addition, and instead, the subsidy will be taxable and USC-able via an end of year review by Revenue.

Employees will be taxed via a reduction in tax credits and cut off points from 2022. Revenue have confirmed that the liability will be collected over 4 years to avoid hardship. Employees will have the opportunity to pay it in full before then if they wish.

Reconciliation Process Stage One

There are two stages to the TWSS Reconciliation process. For stage one, employers are required to report the actual subsidy that they paid to employees on each pay date.

Thesaurus Payroll Manager have made it easy to create these TWSS CSV Reconciliation files within the 'Reports' section on the payroll software. The CSV file can then be uploaded in the Employer Services section on ROS, as per Revenue's requirements. This file must be uploaded to ROS by 31st October. If you do not provide this data about payments to your employees, Revenue will recoup the total temporary wage subsidy paid and related interest charges.

Stage Two of the Reconciliation Process

Stage two of the reconciliation process is due to commence later this month, and during this stage, the total subsidy payable amounts will be compared against the subsidy amounts paid to the employer. Revenue will then determine the amount of TWSS, if any, owing back to Revenue from employers.

A Statement of Account will be sent to your ROS inbox. You will either be paid any additional amount due to you by Revenue or be required to repay any amount that you owe to Revenue.

In some cases, an employer may decide, or Revenue may instruct the employer, to repay to Revenue some or all the subsidy refund payment received from Revenue. Employers can repay excess subsidy values to Revenue via a new facility within ROS, this can be done under Payments & Refunds by selecting ’Submit a Payment’ and then TWSS (Employer). Customers should no longer use the Revenue bank account details previously provided for repayments of TWSS.

Only subsidy amounts should be repaid to Revenue through this method - Do not include any repayments in respect of income tax and USC through this RevPay facility. This should be done separately under PAYE EMP to ensure that the payment is correctly reflected on the employers PAYE EMP balance.

TWSS Compliance Check Programme

To ensure that the TWSS was operated correctly, Revenue are conducting a programme of compliance checks on all employers who availed of the scheme at any stage. Letters are being issued to employers and tax agents. Revenue were previously sending these to certain employers/agents via MyEnquiries. Since the start of October, Revenue have started sending them direct to the main ROS inbox, along with all other correspondence, so there’s a greater chance that they could be missed.

The letter will set out the steps that employers need to take to verify their compliance with the regulations of the TWSS.

Employers will need to confirm:

- That they have met the eligibility criteria (e.g. details of the negative impact suffered, business closure dates, evidence of meeting 25% reduction in turnover)

- That employees received the correct amount of subsidy

- That the subsidy was recorded correctly on the payslips (e.g. copies of payslips)

At this point employers are not expected to provide detailed documentation to prove that they have met the employer eligibility criteria but based on the summary provided, Revenue may look for more detailed information in some cases.

What to do if you receive a letter

If you receive such a letter, please note that there is a 5-day time limit to respond to the Revenue’s request. It is essential that employers respond promptly as failure to do so will lead to immediate escalation. Therefore, it is important that employers keep an eye on both the ROS inbox and MyEnquiries or the letter.

This Revenue compliance check is not part of an audit or intervention. Instead, it is a request for information to provide assurance that the scheme was operated as intended by employers.

In addition, the compliance check programme will address any issues identified in respect of the operation of PAYE Modernisation by employers over 2019 and 2020. It will also provide an opportunity for employers to address any other outstanding tax issues that they may have.

For the latest payroll updates don’t miss our next free webinar, where we are joined by Revenue.

Webinar: Wage Subsidy Scheme with Revenue

10.30am | 19th November

Webinar Agenda

- TWSS Reconciliation

- Employment Wage Subsidy Scheme - Key Points

- Employer & Employee Eligibility Criteria

- Operation of Payroll & Processing of Subsidy Claims

- Operating EWSS with BrightPay & Thesaurus Payroll Manager

- Q&A Panel Discussion

If you are unable to attend the webinar at the specified time, simply register and we will send you the recording afterwards.

Related Articles:

Thesaurus COVID-19 Resource Hub

Blog: Customer update October 2020

On-demand COVID-19 Webinars

Oct 2020

6

Cycle to Work Scheme Changes: What you need to know

In the July Jobs Stimulus Plan, announced by Taoiseach Micheál Martin, changes were introduced to the existing Cycle to Work scheme. The Cycle to Work scheme is a government initiative that was introduced in January 2009 and allows the employer to purchase a bicycle and safety equipment for an employee for travelling to and from work. The cost of the bicycle and safety equipment can be deducted from the employee’s wages in the form of salary sacrifice. This salary sacrifice is set up as an allowable taxable deduction and reduces the gross salary for PAYE, USC and PRSI purposes by the amount of the salary sacrifice. The salary sacrifice cannot be more than 12 months and the employer and employee must agree how the deductions can be made.

The allowance for the cost of the normal bike and safety equipment was €1,000 and in July this was increased by €250 to €1,250. The allowance cost of an electric bike and safety equipment rose to €1,500 from the previous rate of €1,000. The existing period to avail of the scheme every five years is being reduced to every four years. The tax year that the bike is purchased counts as the first year under the scheme. The bike and safety equipment must be used as part of the journey the employee takes between their home and their normal place of work.

If an employer purchases a bike for an employee and does not require the employee to pay for it, the employee will be exempt from tax on the benefit on the cost of a normal bike up to €1,250 and on an electric bike for up to €1,500. If the cost exceeds these exemptions, the employee will have to pay PAYE, USC and PRSI on the balance of the cost of the bike.

An employer does not have to inform Revenue if they have employees availing of the Cycle to Work Scheme but records must be maintained by the employer for any purchases made under this scheme, such as invoices, which employee the purchase was for, payment amounts, etc.

New webinar: Employment Wage Subsidy Scheme (EWSS) - What you need to know

Join our new webinar, Employment Wage Subsidy Scheme (EWSS) - What you need to know, to learn about the latest government scheme and its impact on payroll. As the Temporary Wage Subsidy Scheme has now ended, there is a new Employment Wage Subsidy Scheme which will run until April 2021. Register now.

In this webinar, we discuss what you need to know about TWSS Reconciliation and the Employment Wage Subsidy Scheme (EWSS). We are delighted to be joined by guest panelist Sandra Clarke - President of the Irish Tax Institute & Partner at BCC Accountants. Register now.

Related links:

Don't forget about your July / August EWSS Sweepback!

Increase to CWPS Rates on 1st October 2020

Webinar: Employment Wage Subsidy Scheme (EWSS) - What you need to know

Sep 2020

11

Don't forget about your EWSS July / August Sweepback!

The Employment Wage Subsidy Scheme (EWSS) replaced the Temporary Wage Subsidy Scheme (TWSS) which ended on 31st August 2020. As some employees were excluded from the TWSS, eligible employers can backdate a claim for EWSS to 1st July 2020 in respect of certain employees.

If you are currently eligible for EWSS, you may be entitled to receive subsidies and PRSI credits in respect of employees paid by you during July and August.

- If you previously claimed TWSS for July and August, any employee who did not qualify for TWSS may be eligible for an EWSS claim. Essentially, this means that any employee who started with you on or after 1st March, who was not employed by you at any stage during January or February, should be eligible for EWSS in respect of any payments made to them during July or August. The potential claim can be quite substantial e.g. if you had just one employee qualifying for EWSS being paid by you for July and August, the combined subsidy and PRSI credit could exceed €2,000.

- If you did not previously qualify for TWSS but now qualify for EWSS, any employees paid by you at any stage during July or August should be eligible for EWSS.

In order to make a claim, a CSV file listing the PPSN numbers and Employment IDs for all eligible employees must be uploaded on ROS. Our latest software upgrade (available when you launch our software), includes the ability to prepare the CSV file. It will also calculate the estimated claim value for you. This is available in the 'EWSS' menu in Thesaurus Payroll Manager.

Because of the tight timelines in releasing our upgrade and because we may not have access to all payroll data since the start of the year, we cannot guarantee the calculated claim value and it should therefore be viewed as indicative.

The ROS upload facility is expected to be available from 15th September within the “Employer Services” Section on ROS. All applications must be submitted by the employer or agent through ROS before 14th October.

Following receipt of the sweepback CSV, Revenue will then process these files and validate them against the rules of the scheme. If an employee is deemed eligible, Revenue will calculate the total subsidy due to be paid and will arrange for the subsidy to be paid as soon as practicable after 16th September. Payment in respect of additional submissions received after 16th September in respect of July/August will be made weekly thereafter up until 14th October.

Claims could be quite substantial, so we urge you to run the report and, if applicable, submit your claim as soon as possible.

Revenue guidance on the rules surrounding the sweepback and the claim process can be viewed here.

Free Webinar: Employment Wage Subsidy Scheme

Interested in finding out more about EWSS? Join us for our free webinar on 8th October where we discuss everything you need to know about EWSS eligibility, processing subsidy claims and the new guidance in relation to the July/August Sweepback.

Don’t miss out – Places are limited. Click here to book your place now.

Aug 2020

24

The Temporary Wage Subsidy Scheme comes to an end

The Temporary COVID-19 Wage Subsidy Scheme (TWSS) was introduced in March 2020 to provide financial support to workers affected by the Covid-19 crisis. The scheme enabled employees whose employers are affected by the pandemic to receive significant supports directly from their employer through the payroll system.

The TWSS scheme is ending on 31st August 2020. Therefore, J9 submissions with a pay date after 31st August will be rejected by Revenue.

During the transitional phase of the scheme, Revenue refunded a flat rate of €410 per employee per pay period. In a lot of cases, this amount exceeded the subsidy that the employee was entitled to receive for that week, and this will be rectified when Revenue perform a reconciliation of employer refunds.

The aim of the reconciliation is to:

- Establish the actual subsidy amounts which were paid to each employee

- Determine if the correct amounts were paid to each employee during the transitional phase

- Address any outstanding subsidy refunds or repayments necessary.

Revenue are hoping to commence the TWSS reconciliation in October. TWSS CSV reconciliation files will be uploaded to Revenue to enable them to reconcile the amount of subsidy paid to the employee against the amount refunded by Revenue.

In the interim, to assist in their future reconciliation, employers should continue to retain records of subsidy payments made to employees, records of subsidy refunds and tax refunds received from Revenue and hold any excess of the subsidy payments received for offset against future subsidy payments or for future repayment to Revenue.

In some cases, an employer may decide to repay to Revenue some or all the subsidy refund payment received from Revenue. Employers can repay excess subsidy values to Revenue via a new facility within ROS, this can be done under Payments & Refunds by selecting ’Submit a Payment’ and then TWSS (Employer). Customers should no longer use the Revenue bank account details previously provided for repayments of TWSS.

A new Employment Wage Subsidy Scheme (EWSS) will replace the Temporary Wage Subsidy Scheme from 1st September 2020. It is expected to continue until 31 March 2021.

For more information on the TWSS and EWSS register for our free webinar which takes place on 3rd September. We will be joined by Revenue to discuss what you need to know about both schemes.

Aug 2020

13

The Employment Wage Subsidy Scheme - Important Update

The Employment Wage Subsidy Scheme (EWSS) will replace the Temporary Wage Subsidy Scheme (TWSS) from September 1st 2020. Revenue are currently working through the finer details of the scheme. Below is some information to help you understand the scheme and to help prepare for it should you choose to avail of it.

The scheme provides a flat-rate subsidy to qualifying employers based on the number of paid and eligible employees on the employer’s payroll. The scheme is expected to operate until 31st March 2021.

- It is important to note that TWSS will cease on August 31st 2020.

- Employers wishing to avail of EWSS must register for it via ROS. Revenue are planning to have the registration facility available from August 19th.

- Employers must hold up to date tax clearance to register for the scheme and to receive the subsidy payments.

- Employers must be able to demonstrate that their turnover or customer orders between July 1st and December 31st 2020 are expected to suffer at least a 30% reduction as a result of Covid-19. Further information on the qualifying criteria can be found here.

- Registered childcare providers can avail of the EWSS without the requirement to meet the 30% reduction in turnover or customer orders.

- Employers must review their eligibility status on the last day of every month to ensure they continue to meet the eligibility criteria, if they no longer qualify they should deregister for EWSS with effect from the following day (1st of the month)

- Proprietary directors were due to be excluded from the scheme. It is now expected that they will be included where they retain ‘ordinary’ employees on the payroll.

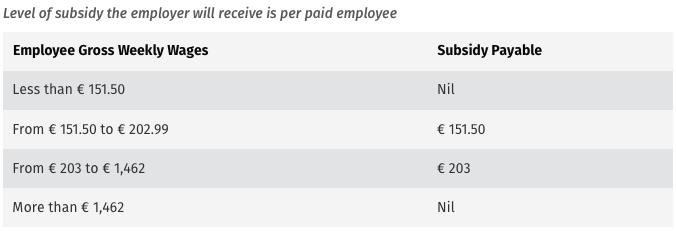

Subsidy Payment:

- The subsidy will be paid to employers monthly after the return due date (14th of the following month).

- Any changes made to payroll submissions after the return due date will not be processed for subsidy payments.

Please note, gross pay includes notional pay and is before any deductions for pension, salary sacrifice etc

Payroll:

- Employers will be required to pay employees in the normal manner i.e. calculating and deducting Income Tax, USC and employee PRSI through payroll.

- EWSS is a subsidy paid to an employer. It will not show on payslips or in myAccount.

Employer PRSI:

A 0.5% rate of employers PRSI will continue to apply for employments that are eligible for the subsidy. This is expected to work as follows:

- PRSI will be calculated as normal via payroll e.g. on PRSI class A1.

- Revenue will calculate a PRSI credit by calculating the difference between the rate on the normal class and the 0.5%.

- The credit will show on the Statement of Account to reduce the employer’s liability to Revenue.

July/August 2020

TWSS and EWSS will run in parallel from 1st July to 31st August. Employees already on TWSS must remain on TWSS until the end of August. Employers wishing to operate the scheme from July 1st i.e. for employees not eligible for TWSS, should process the payroll for these employees in the normal manner and Revenue will review these cases at a later date and refund the subsidy due.

Revenue plan to cater for this via myEnquiries. This will require employers to provide Revenue with the employee details etc. Payment should be made to employers in September.

Publication

A list of employers availing of EWSS will be published in January 2021 and April 2021 to www.revenue.ie.

Software Upgrades (to cater for EWSS)

We plan to release upgrades for Thesaurus Payroll Manager and BrightPay in the week commencing 24th August. Revenue are still fine tuning the details of the scheme and how it will interact with PAYE Modernisation. Therefore, unfortunately, we will be unable to release upgrades any earlier than this.

Jul 2020

28

Make Sure Your Business Is Doing These 5 Things Before You Bring Employees Back

Are you an employer struggling to keep on top of everything you need to do before bringing your employees back to work? The government recently released the Return To Work Safely Protocol. This is a comprehensive 29 page document in which they outline the details of these expectations clearly. In order to ensure that your business is complying with the Protocol, you need to understand exactly what those expectations are and take the appropriate measures to meet them as best you can. The Health & Safety Authority (HSA) has been given powers to inspect businesses and their compliance under the Protocol.

As a result, many employers are feeling overwhelmed as they try to keep track of everything they need to do before bringing their employees back to the workplace. However, when you break it down and get organised, the task at hand isn’t so daunting, and we are here to help.

5 Things Employers Need To Do Before Bringing Employees Back To Work

Whether you’re a business in the retail industry where employees must come into the workplace everyday, or in other industries where employees can largely work from home, all employers must prepare for “the new normal”. From reviewing and amending existing Health And Safety policies to electing a Lead Worker Representative, there’s a lot to do. Thankfully, we’ve put together this list so that you can make sure you’re complying with the Government’s Return To Work Safely Protocol.

-

COVID-19 Induction Training - The Protocol requires that you hold induction training with your employees. This training should be designed to share with your staff all of the changes that you’ve made to the physical workspace, as well as new rules and procedures for work. Depending on your business, these rules might include social distancing measures, the implementation of “one way” traffic zones on your premises, staggered break times, increased hygiene facilities, new communication processes for working from home etc. It should also include any changes you’re making to existing policies, the use of Pre-Return To Work Forms, the Lead Worker Representative and your COVID-19 Response Plan. Read on for more details on these steps.

-

Pre-Return To Work Forms - Pre-Return To Work Forms are required by the government as one of the most important steps a business should take before bringing employees back to work. The Return to Work form must include a list of prescribed questions, as set out in the HSA’s template provided here. The return to work form must be completed by employees at least 3 days before their return to the workplace. There are many other template checklists on the HSAs website, and these are a great way to help your employees prepare for their return to work, reassure them that you’re doing everything possible to make the workplace safe for them, and identify any concerns that they have which you could address.

-

Review Existing Policies - The Protocol also states that all existing policies should be reviewed and amended where relevant. One example of this is your Health And Safety Policy, which should now include a detailed section dedicated to preventing the spread of COVID-19 in the workplace. It is also advisable that you include any changes you will make to how your business is approaching mental health. This is because many of your employees are likely to be experiencing varying levels of anxiety at present.

-

COVID-19 Response Plan - Every business must create a COVID-19 Response Plan. This plan should outline the following areas:

• How the business will handle suspected and/or confirmed cases of COVID-19 among staff

• Any new hygiene practices that have been introduced

• All social distancing measures that have been brought in

• How the business is taking care to promote employee mental health

• A list of internal communication methods used to disperse this information among employees -

Lead Worker Representative - Businesses should appoint a Lead Worker Representative. This person will liaise with management, relaying any concerns/frustrations/questions from staff, assisting in the sharing of information across the company, and representing employees as new policies and procedures are put in place. This is a vital role to ensure that both employer and employees work together in a collaborative effort to make the workplace safer for everyone.

Watch Our Webinars On Demand

Want to learn more about what your business could be doing to follow government guidelines? Check out our previous webinars, all of which you can watch on demand, in which we talk through all of the government advice and what it means for employers.