Import the P2C file / Update from the P2C File

Once you have exported and saved the P2C file from ROS then you can import this file into Thesaurus Payroll Manager to update each employee record with the latest PAYE and USC credit and Cut Off Point detail for the current tax year.

To access this utility go to Utilities > Update from Revenue Tax Credit/P2C file

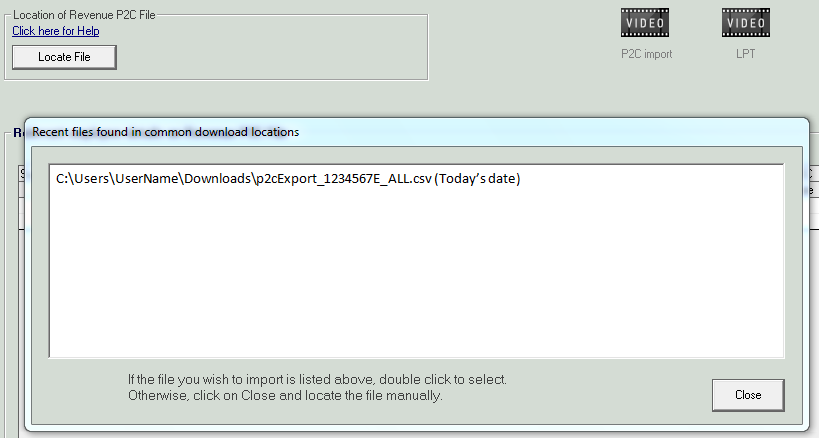

Thesaurus will automatically search for the last saved P2C files.

Only those P2C files which have the same employer PAYE number as that of the open company will be displayed. Only those files which are less than 31 days old will be shown in order to avoid importing old P2C files and inadvertently overwriting more recent Revenue instruction.

Each file found will be indicated by the date it was saved allowing easy identification of the current P2C file. Simply double click on the correct file to initiate import.

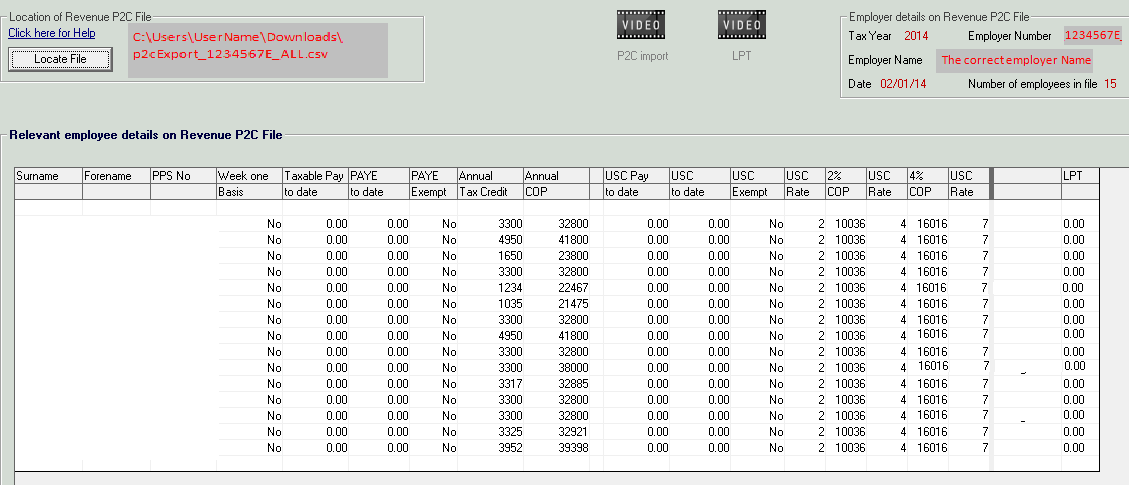

- Double Click on the file to Open it within Thesaurus Payroll Manager. This will not complete the Import but will present the information on screen in a user friendly format.

-

If a file cannot be found you may use the Locate File option to locate the file yourself, alternatively the P2C file may need to be exported from ROS again.

- All contents of the P2C file are displayed on screen

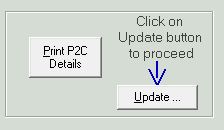

- Click Print P2C Details for a file copy of the contents of the P2C file, this is a copy of the actual P2C file in full as exported from ROS.

- Click Update to update all employee Tax Details as per the P2C (Tax Credit, SRCOP, USC COP, LPT) and previous employment details.

-

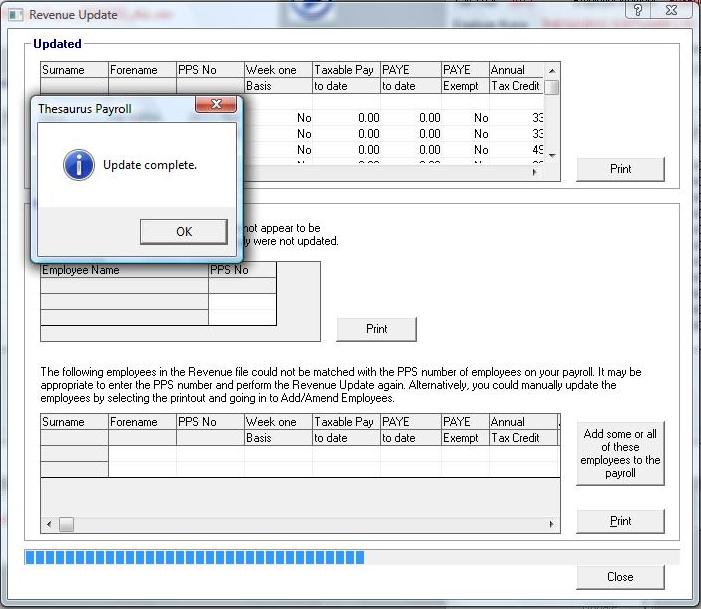

A list of those employees who updated will be shown

-

A list of those employees who are on file but were not included in the P2C file will be shown

-

A list of those employees who are on the P2C file but not in Thesaurus Payroll Manager will be shown.

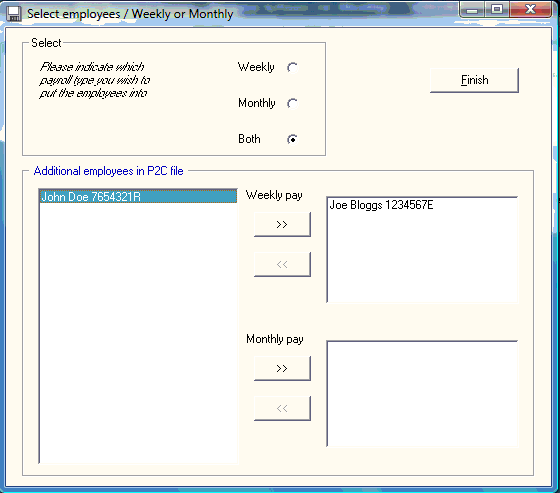

EMPLOYEES IN P2C FILE NOT SETUP IN THESAURUS PAYROLL MANAGER

If there are employees in the P2C file which are not in Thesaurus Payroll Manager you will be given the list of these employees once you select to update from the P2C file.

At time of importing, Thesaurus will identify those employees for whom there is no record within the payroll and allow you to add some/ all of these employees to the payroll from the P2C file.

- Select "Add some or all of these employees to the payroll"

- The list of additional employees contained in the P2C file will be displayed.

- Select the pay frequency you wish to set the employees to

- The full listing of employees will transfer to the right list for addition

- Simply highlight an employee that you do not wish to setup and click the arrow to move them back to the left list removing them from the list of employees to be added.

- Click Finish

- The employees are now set up

The payment method is set to cash and the PRSI Class to A1. You can change these settings in Add/Amend Employees if requires.

Should you wish to set some employees up under a different pay frequency simply select 'Both' instead and use the right arrow key under each pay frequency to move employees across.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.