Holiday calculator

HOLIDAY CALCULATOR

Thesaurus Payroll Manager automatically calculates holiday entitlements as per the Organisation of Working Time Act, 1997. This calculator is intended for guidance only. Professional advice should be sought in the event of any disputes or if in doubt.

To access this utility go to Employees > Holiday/Sick Leave etc.

AS PER THE ORGANISATION OF WORKING TIME ACT, 1997, Holiday entitlements are calculated by using one of the following methods;

· 20 working days per year in which the employee works at least 1,365 hours (unless it is a leave year in which he/she changes employment).

· One third of a working week per calendar month that the employee works at least 117 hours.

· 8% of the hours an employee works in a leave year (but subject to a maximum of 20 working days).

The pay for annual leave must be given in advance, calculated at the normal weekly rate.

In order to ensure accurate holiday calculations, the following information must be reviewed and amended where necessary:

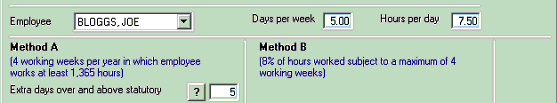

Ø Set working week - Enter days worked per week & hours worked per day

The payroll software sets the working week at 5 days per week and 7.5 hours per day. The working week should be amended where necessary for each employee as it will directly effect calculation of holiday entitlements.

Ø Enter extra day over & above statutory entitlement

Ø Enter unused days/hours carried forward from last year

METHOD A

This method is typically used for employees’ that work at least 117 per month (Full time employees) or Part time permanent employees paid a set weekly/fortnightly/monthly basic.

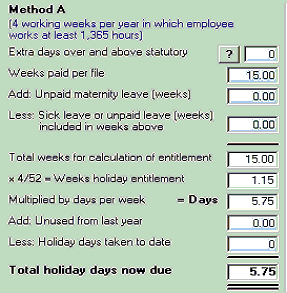

EXTRA DAYS OVER AND ABOVE STATUTORY

If an employee receives more than the statutory entitlement of 20 days/4 weeks holidays, simply enter extra days in this section.

WEEKS PAID PER FILE

This is updated by the software as you process and update your payroll. You can click on the blue box to see where the number of weeks is derived from. This box cannot be amended by the user.

ADD: UNPAID MATERNITY LEAVE

If an employee has any unpaid maternity weeks, these should be entered here.

LESS: SICK LEAVE OR UNPAID LEAVE

Sick leave or unpaid leave is not allowed for calculating holidays due to an employee. It is necessary for the user to input the amount of day’s sick leave or unpaid leave included in the weeks paid per file. This will reduce the weeks worked for calculating the holidays due to the employee. To enter sick or unpaid leave days simply click on the blue box, enter the date, amount of days and comment (optional) and click on update.

TOTAL WEEKS FOR CALCULATION OF ENTITLEMENT

Weeks paid per file + Unpaid Maternity leave - Day’s sick leave/unpaid leave x 4 / 52 = Weeks holiday entitlement

Total qualifying weeks to date multiplied by 4 weeks (annual entitlement) and divided by 52 (total weeks in the year). The result equals the fraction of the 4 weeks the employee is entitled to date.

MULTIPLIED BY DAYS PER WEEK

Number of weeks holiday entitlement multiplied by the amount of days the employee works in a week (days per week is set up the top right hand side of the screen)

ADD: UNUSED DAYS FROM LAST YEAR

Unused days from previous years can be entered by typing the amount of extra days in the blue box provided.

LESS: HOLIDAY DAYS TAKEN TO DATE

Click on the blue box and enter date, amount of days and comment (optional) of any holidays taken to date.

MEMO ONLY:

This is for keeping track of days not recorded elsewhere and is for memo purposes only. The entry here is in days or part thereof so a half a day would be entered as 0.5 days. Negative amounts may also be entered to correct mistakes etc.

TOTAL HOLIDAY DAYS NOW DUE

Holiday Days Due + Unused days from last year - holiday days taken to date = Holidays Due to date

METHOD B

This method is typically used for employees’ that are paid by the hour, and are entitled to 8% of hours worked, subject to a maximum of 4 working weeks per annum (unless they leave your employment).

HOURS WORKED PER FILE

This is updated by the software as you process and update your payroll. You can click on the blue box to see where the number of hours is derived from. This box cannot be amended by the user.

ADD: ANNUAL LEAVE, MATERNITY ETC. (HOURS) NOT INCLUDED IN HOURS ABOVE

If an employee is on unpaid Maternity Leave or is entitled to extra annual leave, these hours are used for calculating holiday entitlements so therefore must to be added to the actual hours an employee worked. To enter these hours click on the blue box and enter the date, amount of days and comment (optional)

TOTAL HOURS FOR CALCULATION OF ENTITLEMENT

Hours worked per file + hours of annual/maternity leave etc.@ 8% = Hours Holiday Entitlement

DIVIDED BY HOURS PER DAY

Total qualifying hours divided by the normal hours worked per day (top right hand side of the screen).

ADD: UNUSED DAYS FROM LAST YEAR/EXTRA DAYS

Unused days or hours from previous year or extra day’s holidays being allocated to an employee can be entered by typing the amount of extra days in the blue box provided.

LESS: HOLIDAY DAYS TAKEN TO DATE

Click on the blue box and enter date, amount of days and comment (optional) of any holidays taken to date.

ALTERNATIVELY: LESS HOLIDAY HOURS TAKEN TO DATE

Click on blue box, enter date, number of hours taken and comment (optional) of any holidays taken to date.

MEMO ONLY:

This is for keeping track of days not recorded elsewhere and is for memo purposes only.

The entry here is in days or part thereof so half a day would be entered as 0.5 days. Negative amounts may also be entered to correct mistakes etc.

TOTAL HOLIDAY DAYS NOW DUE:

Holiday Days Due + Unused days from last year/extra days - holiday days taken to date = Holiday days due