Employment - General

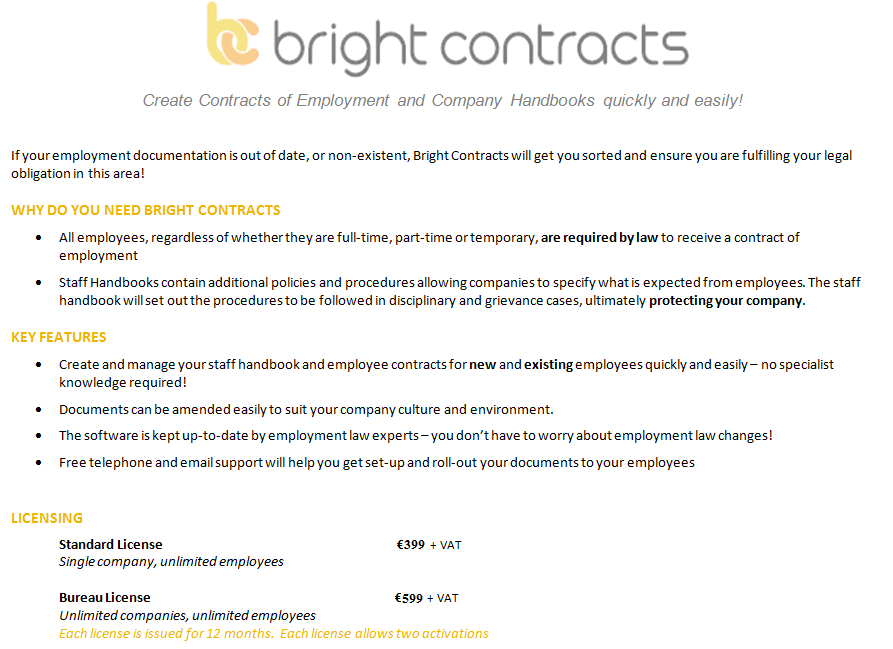

Thesaurus Software Ltd launched Bright Contracts in 2012 to automate the creation of employee contracts and company handbooks so that employers can meet their legal obligations towards their employees.

Each time a new employee is added to the payroll you will be prompted to set up the employee contract, Bright Contracts offers an automated solution for this.

To download a free trial or find out more about the license fees simply visit www.brightcontracts.ie or call 01-8499699

CONTRACT OF EMPLOYMENT

Anyone who works for an employer for a regular wage or salary has

automatically a contract of employment whether written or not. Section

23 of the Industrial Relations Act, 1990, states that a contract of

employment, for the purposes of the Industrial Relations Acts, 1946 to

1990, may be 'expressed or implied, oral or in writing'. Many of the

terms of a contract of employment may emerge from the common law,

statutes or collective agreements made through trade unions or may

be derived from the custom or practice in a particular industry. The

Terms of Employment (Information) Act, 1994 and 2001 provides that

an employer must provide an employee with a written statement of

certain particulars of the terms of employment.

Employers are required by section 14(1) of the Unfair Dismissals Act,

1977 to 2001 to give a notice in writing to each employee setting out the

procedure which the employer will observe before, and for the purpose

of, dismissing the employee. This must be given not later than 28 days

after entering into a contract of employment.

The Payment of Wages Act, 1991, gives every employee the right to a

written statement every pay day of wages and with every deduction

itemised.

TERMS OF EMPLOYMENT

TERMS OF EMPLOYMENT

The Terms of Employment (Information) Act, 1994 and 2001 which has

effect from 16th May 1994, requires employers to provide employees with a

written statement of certain particulars of the employee’s terms of

employment. The Act, in general, applies to any person

- working under a contract of employment or apprenticeship

- employed through an employment agency or

- in the service of the State (including members of the Garda Siochana

and the Defence Forces, civil servants and employees of any local

authority, health board, harbour authority or vocational education

committee).

The Act does not apply to a person who has been in the continuous service

of the employer for less than 1 month. Prior to December 20, 2001 the Act

did not apply to a person who was normally required to work for the

employer for less than 8 hours a week. However, from that date the

Protection of Employment (Part-Time Work) Act, 2001 has removed the

exclusion relating to the number of hours worked.

In the case of agency workers, the party who pays the wages (employment

agency or client company) is the employer for the purposes of this Act and

is responsible for providing the written statement.

The written statement of particulars must be provided by the employer

within two months of the date of commencement of employment. In the

case of employees whose employment commenced before 16th. May,

1994, (the commencement date of the Act) the written statement must be

provided by the employer within two months of being requested to do so by

the employee.

The written statement, which is not, of itself, a contract must include

particulars of the terms of employment relating to the name and address of

the employer, the place of work, job title/nature of the work, date of

commencement of employment, nature of contract (temporary or fixed

term), pay and pay intervals, hours of work (including overtime), paid leave,

incapacity for work due to sickness or injury, pensions and pension

schemes, notice entitlements, collective agreements. The statement

must also indicate the pay reference period for the purposes of the

National Minimum Wage Act 2000, and furthermore must state the

employee is entitled to ask for a statement of the employee’s average

hourly rate of pay for any pay reference period falling within the

previous 12 months as provided for in section 23 of the National

Minimum Wage Act 2000.

As an alternative to providing some of the details in the statement, an

employer may use the statement to refer the employee to certain other

documents containing the particulars provided that the document is

reasonably accessible to the employee.

An employer is also required to notify an employee of any changes to the

particulars contained in the written statement within 1 month after the change

takes effect. Where an employee is required to work outside the State for a

period of not less than one month, the employer is obliged to add certain

particulars to the written statement and to provide the statement prior to the

employee’s departure.

Regulations made under the Act, require employers to give to their workers

under 18 a copy of the official summary of the Protection of Young Persons

(Employment) Act together with other details of their terms of employment

within one month of taking up a job.

The Act provides a right of complaint to a Rights Commissioner where an

employee believes that his/her employer has failed to provide a written

statement in accordance with the terms of the Act or failed to notify the

employee of changes to the particulars contained in the statement. There is a

right of appeal by either party to the Employment Appeals Tribunal from a

recommendation of a Rights Commissioner.

The Act also repeals sections 9 and 10 of the Minimum Notice and Terms of

Employment Act, 1973 relating to terms of employment as those sections are

overtaken by the provisions of this Act.

WAGES

WAGES

Pay rates are normally determined by the contract of employment.

Rates of pay where specified in collective agreements between trade

unions and employers may also be incorporated expressly or by

implication in the individual worker’s contract of employment.

The National Minimum Wage Act 2000 became law on 1st April 2000

and provides that an experienced adult worker must be paid an

average hourly rate of pay of not less than €8.65. Lesser rates apply in

certain circumstances.

Legal minimum rates of pay for particular categories of workers are

also laid down through Joint Labour Committees (JLCs) set up by the

Labour Court under the Industrial Relations Act, 1946. Legally binding

Employment Regulation Orders are made by the Labour Court on the

basis of proposals submitted by the JLCs.

The categories of workers covered by JLCs include agricultural

workers, grocery assistants, contract cleaners, hairdressers in Dublin

and Cork, law clerks and hotel and catering workers in certain areas.

Minimum pay rates are also set down in certain Registered

Employment Agreements. These are collective agreements covering a

particular class, type or group of workers which, when registered with

the Labour Court under the Industrial Relations Act, 1946, become

legally binding on all employers and workers concerned.

The duty to pay wages is a fundamental aspect of an employer’s

obligations. If the employer fails to do so an employee may sue for

wages due in the ordinary courts. Alternatively, if their employees’ pay

is governed by an Employment Regulation Order or a Registered

Employment Agreement, employers will be guilty of an offence under

the Industrial Relations Acts if they pay less than the prescribed legal

minimum and the Department of Enterprise, Trade and Employment

will seek to recover the arrears for the worker.

The Payment of Wages Act, 1991, provides that every employee has

the right to a readily negotiable mode of wage payment. The list of

modes provided in the Act include cheque, credit transfer, cash,

postal/money order and bank draft.

The Act applies to any person

- employed under a contract of employment

- employed through an employment agency or through a

subcontractor

- in the service of the State (including members of the Garda

Siochana and the Defence Forces, civil servants and employees

of any local authority, health board, harbour authority or

vocational education committee).

In the case of agency workers, the party who pays the wages is the

employer for the purposes of the Act.

The Act obliges employers to give to each employee with every wage

packet a written statement of gross wages and itemising each

deduction. If wages are paid by credit transfer, the statement of wages

should be given to the employee soon after the credit transfer has

taken place.

Employers may not make deductions from wages or receive payment

from their workers unless:

- required by law, such as PAYE, USC or PRSI;

- provided for in the contract of employment, for example, certain

occupational pension contributions; or to make good such

shortcomings as bad workmanship, breakages or till shortages;

or for the provision of goods and services necessary for the job

such as the provision or cleaning of uniforms;

- made with the written consent of the employee, for example VHI

payment or trade union subscriptions.

Special restrictions are placed on employers in relation to deductions

(or the receipt of payments) from wages which:

(a) arise from any act or omission of the employee or

(b) are in respect of the supply to the employee by the employer

of goods or services which are necessary to the employment.

Employees have the right under the Act to complain to a Rights

Commissioner against an unlawful deduction or payment.

Transitional arrangements apply to employees who were paid their

wages in cash immediately before the coming into operation of the Act

on 1 January, 1992. These employees are entitled to continue getting

their pay in cash until such time as they come to an agreement with

their employer to be paid in some other legally acceptable form.

Transitional arrangements also apply to employees who were paid

their wages by a mode other than cash, on the coming into operation of

the Act, in accordance with an agreement under the Payment of Wages

Act, 1979.

TERMS OF EMPLOYMENT

TERMS OF EMPLOYMENT WAGES

WAGES