Exporting P2C files from ROS

EXPORTING P2C FILES FROM ROS

The electronic Tax Credit File (P2C) issued to the Employer can be exported from your ROS Inbox.

To access this utility go to www.revenue.ie > Login to ROS > enter your login details

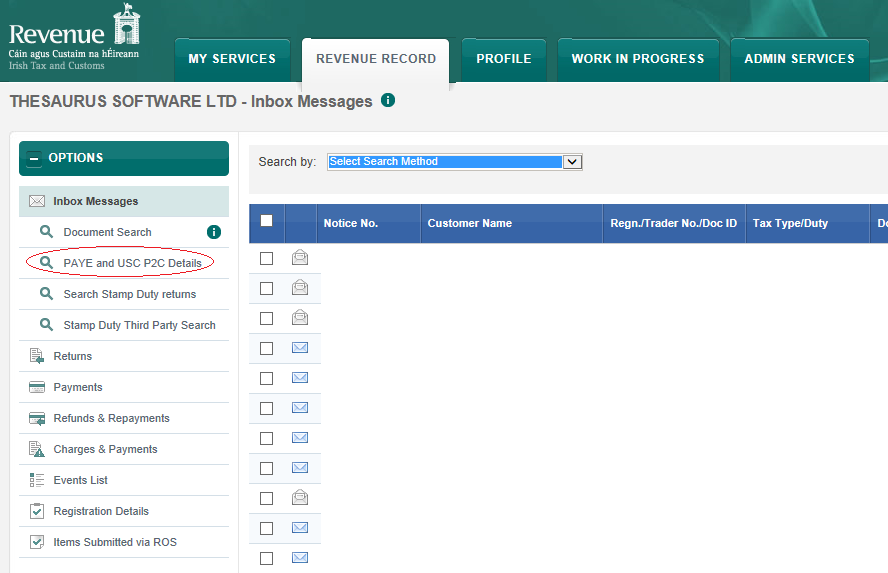

- Click Revenue Record

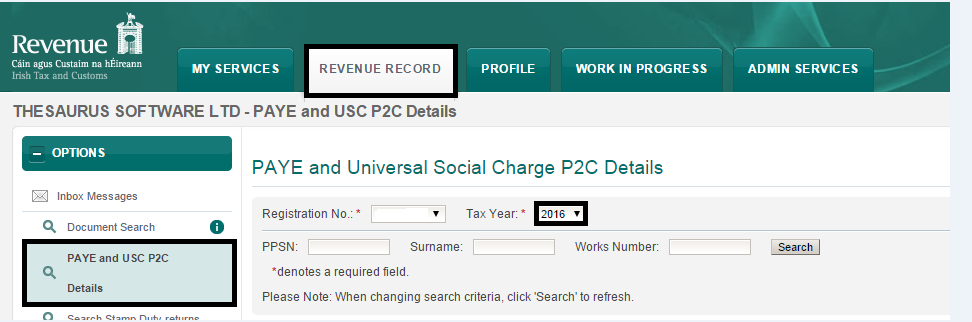

- Choose PAYE and USC P2C Details

- Choose the tax year you require the P2C files for, e.g. 2016

- Click Search

- The employee listing will be displayed on screen along with their 2016 tax certificate information

- Select Export Complete List - if you wish to export ALL P2C files. This is normally done at the beginning of a new tax year.

- Select Export Amendments only- if you wish to export new P2C files only.

Once a P2C/tax credit record has been exported the flag against that employee record changes from:

Y - Not yet exported

to

N - Previously exported

At no time is an employee file deleted or removed from this listing. The only purpose of the flag is to determine which employees are to be included in the export, either all employees are only those who have been changed.

When exporting, if “Amendments Only” is selected then only those employees with a Y against the record will be included in the exported list, i.e. those with N stating they were already exported will not be included in the amendment export.

If “Export Complete List” is selected then all employees within the listing for that tax year will be exported regardless of the status of Y (Yet to Export) of N (Previously Exported).

If there is multiple records for the one employee within the listing (i.e. tax certs with a later date) then only the latest dated (newest dated) tax details will export.

The Complete listing of Employees can be exported any number of times.

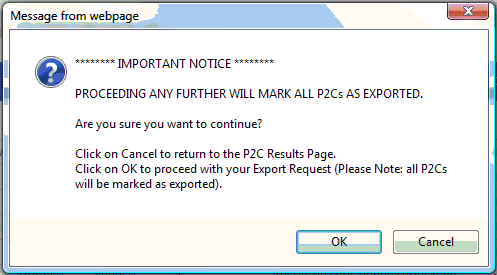

- Click OK to continue

- You now be prompted if you wish to open or save the file. Select "Save" so that you can import it into Thesaurus Payroll Manager

- If you choose Save, the P2C file will automatically save to your Downloads folder. Thesaurus Payroll Manager will automatically look towards this folder to import the P2C file to your Thesaurus Payroll Manger.

- Alternatively to choose a directory into which to save the P2C file simply click on the arrow beside Save and choose Save As

- Select the desired location/directory to save the file to

-

Click Save

You do not need to Open the folder into which the P2C file is saved as you can view the file in a more user friendly format within Thesaurus Payroll Manager. Simply close the Open option using the x in the corner of this message.

The P2C file is now ready for import to Thesaurus Payroll Manager. Open Thesaurus Payroll Manager to complete the import.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.