Payments File

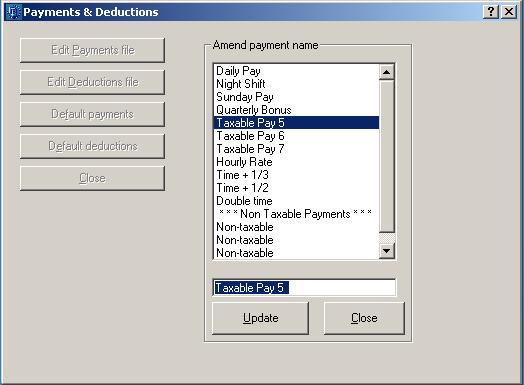

- Click Edit Payments File

- Select Taxable Pay 1

- Rename Taxable Pay 1 to description required e.g. Night Rate, Premium Rate etc.

- Click Update to save the change to the header

- Repeat this step for all taxable pay & non taxable pay types

- If the user will be paying by the hour then the default hourly rate headers which are already setup should be used. Any additional hourly rates not already catered for can be setup using one of the default Taxable Pay headers by simply renaming it to suit.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.