P30 Quarterly Return - Feature

P30 RETURNS

IMPORTANT NOTES

Reduced Frequency of Filing Tax Returns and Payments

Reductions in the filing and payment frequencies for VAT, PAYE/PRSI and RCT by smaller businesses have been extended to eligible customers from 1 January, 2014.

-

Businesses making total annual VAT payments of less than €3,000 are eligible to file VAT returns and make payments on a 6 monthly basis;

-

Businesses making total annual VAT payments of between €3,000 and €14,400 are eligible to file VAT returns and make payments on a 4 monthly basis;

-

Businesses making total annual PAYE/PRSI payments of up to €28,800 are eligible to make payments on a 3 monthly basis;

-

Businesses making total annual RCT payments of up to €28,800 are eligible to file RCT returns and make payments on a 3 monthly basis.

What are the benefits to eligible businesses?

The benefits are two-fold:

-

Improved cashflow by only having to make payments at the end of each 3, 4 or 6 monthly period, as appropriate.

-

Reduced costs of administration through less frequent filing of tax returns

P30 RETURNS

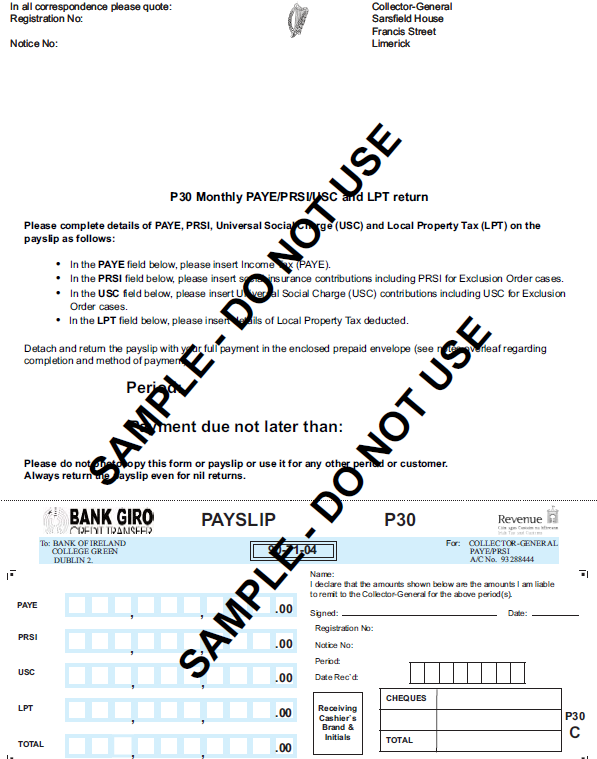

Form P30 is a monthly or quarterly return of PAYE, USC, Local Property Tax & PRSI to the Revenue Commissioners.

The P30 is the total of:

-

the tax deducted from the pay (PAYE, USC, LPT) of all employees less any tax refunded to them

plus

-

the total PRSI contributions (the amount deducted from pay plus the amount payable by the employer)

and should be remitted to the Collector General within 14 days from the end of the income tax month during which the deductions were made.

With effect from 1 January 2009, for employers who file their returns and associated tax payments via ROS, the existing time limits have been extended to the 23rd of the month immediately following the income tax month during which the deductions were made.

Where a return and associated payment are not made electronically by the new extended deadlines, the extended time limits will be disregarded so that, for example, any interest imposed for late payment will run from the former due dates and not the extended dates.

With each payroll processed Thesaurus Payroll Manager builds the P30. To access this report go to ROS > P30

Select P30 by week number OR P30 by date

P30 by week number

The P30 by week number report calculates PAYE, USC, Local Property Tax & PRSI liability in line with Revenue's Payroll calendar. With Revenue the first month of every quarter is a five week month - therefore your January, April, July and October P30 return prepared by week number will always be a 5-week month, regardless of the pay date. Monthly and Quarterly amounts will be shown.

P30 by date

The P30 by date report, however, calculates PAYE, USC, Local Property Tax & PRSI liability according to your pay dates. Therefore if the first 4 weeks of your payroll, for example, have a January pay date and week 5 a February pay date, only the first 4 weeks of liability will be included in your January P30 prepared by date. Monthly and Quarterly amounts will be shown.

PLEASE NOTE: Both P30 returns are acceptable and will result in the same overall liability at the end of the tax year. To avoid inconsistencies in payments made to Revenue, however, it is important that users choose a P30 report to use at the start of the tax year and continue to use the same report throughout the year.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.