Entering CSO Details

The CSO section must be completed for each employee if you would like the software to compile CSO statistics for the EHECS (Earnings, hours & employment costs survey).

The Earnings, Hours and Employment Costs Survey enables the Central Statistics Office to compile regular and timely labour cost indices for the purpose of monitoring change in labour costs in Ireland and across the European Union.

If selected to complete these surveys, you are obliged by law to fully complete and return these forms to the Central Statistics Office. These forms can be uploaded online to the Central Statistics Office from the payroll software. Further information about EHECS can be found at www.cso.ie

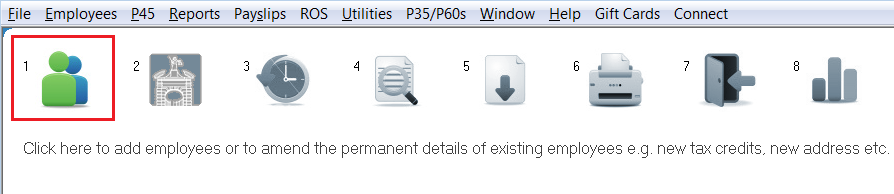

To enter the required CSO information for each employee, go to Process ICON no. 1:

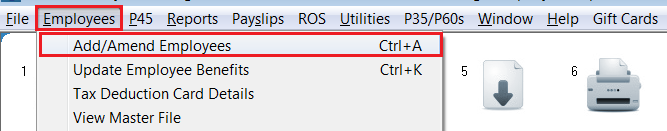

or Employees > Add/Amend Employees:

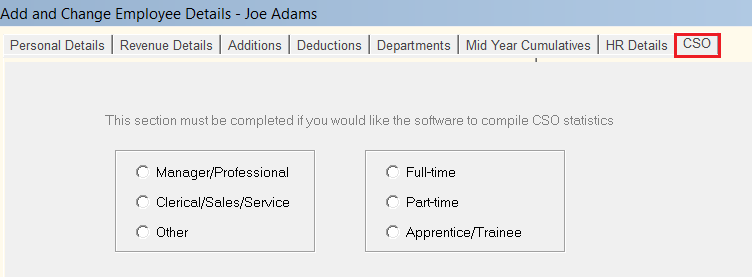

Within the employee record, select the 'CSO' tab:

a) Select one of the following three occupational groups for your employee:

- Managers/Professional - for example: legislators and senior officials, corporate managers, managers of small enterprise

- Clerical/ Sales/ Service - for example: clerks, office workers, service & sales workers

- Other - for example: plant & machine operators, skilled craft & trade workers and other manual occupations

b) Select the employee's status:

- Full-time

- Part-time

- Apprentice/Trainee

c) For an employee NOT paid an hourly rate, enter the Number of hours normally worked per week (excluding overtime) in the field provided

d) If the employee's pay is less than or equal to the National Minimum Wage - tick the box provided

e) If the employee is to be excluded from the CSO returns - tick the box provided. This would apply if the employee is only being paid a pension by you and is not in receipt of any salary or the employee is a CES worker.

f) Click Update to save your entries

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.