Entering Mid Year Cumulatives

Important Notes

- This section of the software is only to be used if you have chosen to start using Thesaurus Payroll Manager mid tax year and you already have payroll records for your employees in the tax year up to this point and you wish to continue where you have left off.

- This is one of the most important sections within the payroll software. Cumulative pay information entered here will then determine the amount of PAYE, USC etc. that the employee will pay going forward. With this in mind, users should ensure that the cumulative details for each employee are correct before proceeding to process any payroll.

Entering Mid Year Cumulatives

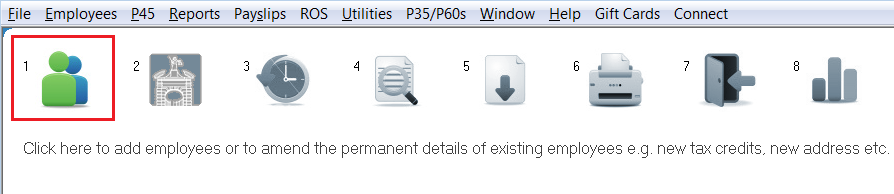

To enter mid year cumulatives, go to Process ICON no. 1:

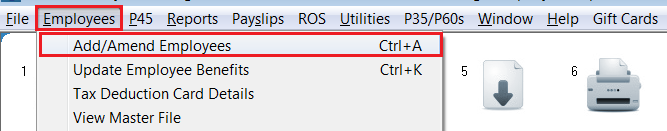

or Employees > Add/Amend Employees:

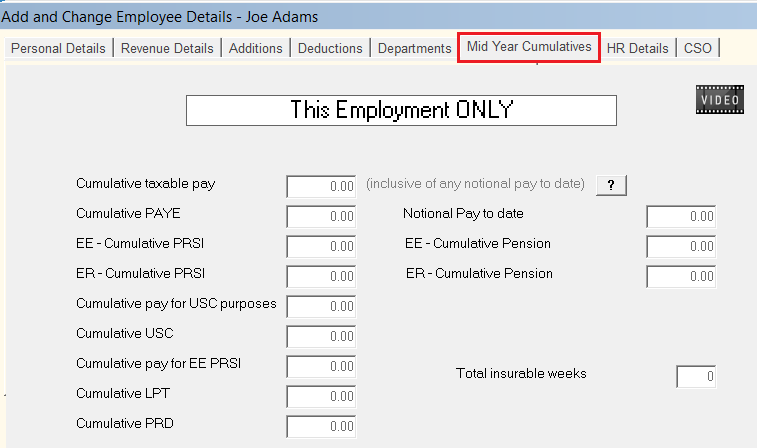

Within the employee record, select the 'Mid Year Cumulatives' tab:

-

Specify the Start Week/Month number for which Thesaurus Payroll Manager is to process as the first pay period

-

Enter the employee's personal details, revenue details etc. as required

-

Click Mid Year Cumulatives

-

Enter the Cumulative Taxable Pay (This employment only)

-

Enter the Cumulative PAYE (This employment only)

-

Enter the Employee Cumulative PRSI (This employment only)

-

Enter the Employer Cumulative PRSI (This employment only)

-

Enter the Cumulative Pay for USC (This employment only)

-

Enter the Cumulative USC (This employment only)

-

Enter the Cumulative Pay for EE PRSI (This employment only)

-

Enter the Cumulative Local Property Tax (LPT ) (This employment only)

-

Enter the Cumulative PRD (Pension Levy) (This employment only)

-

Enter the Notional Pay to date if applicable

-

Enter the Cumulative Pension EE if applicable

-

Enter the Cumulative Pension ER if applicable

-

Enter the Total insurable weeks of employment - this refers to the number of weeks the employee has been paid so far in this tax year in this employment.

-

Select PRSI Classes & enter the number of Weeks at Class

-

Click the Enter button (do not use the Tab key) to transfer the PRSI Class to the PRSI class summary box

-

If the employee has had more than one PRSI class already during the tax year, follow the two steps above until the weeks at class in the PRSI summary box match the total number of insurable weeks entered.

-

At the time of performing the mid year setup, if an employee has already left your employment in the tax year, enter their cumulative details as above but also include their date of leaving and week number of leaving in the fields provided. This will ensure that the employee's pay information will be included on the P35 at the end of the tax year.

-

Click Update to save the employee's pay information

Please Note: If the employee has income and deductions from a previous employment that has taken place in the same tax year, then these must be entered in their Revenue Details section.

It is only the income and deductions from THIS employment which should be entered to the Mid Year Cumulatives screen.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.