Net to Gross Payments

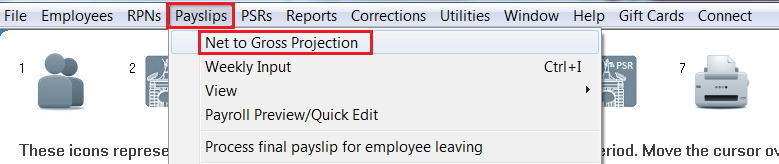

To process a net to gross payment, go to Payslips > Net to Gross Projection:

From the list of employees, simply click on the employee for whom you wish to enter the Net (Take Home) Pay figure for.

Enter Desired Take Home Pay

Once an employee has been selected, a pop up box will appear on screen, “Enter desired take home pay”. Within this field, enter the absolute take home pay figure for the employee. *This should equal the PAYMENT figure.**

The gross wage will be calculated automatically for you and displayed on screen. The user must then indicate if they wish to continue based on the figures entered and the associated automated calculations.

Additions/Deductions

If you wish to include additions and/or deductions to your employee(s) salary, all the additions and deductions options must be entered on the employee record under the menu Employees > Add/Amend Employees.

Select the employee from the drop down list and click into the Additions or Deductions tab. Set up any relevant additions (taxable and non taxable) and deductions (allowable and non allowable).

Simply type the associated narrative in the relevant box on the left hand side, under the appropriate addition or deduction heading, and enter the amount of the addition/deduction in the box to the right hand side. The narrative and amount will be displayed separately to the basic pay details on the payslip.

Any figures entered will be applied to all future payments made to the employee until the user returns to this menu to remove the figures.

A preview of the employee’s payslip will automatically be shown on screen. Click on Close in order to proceed to the next employee for update or to return to amend the figures for the last employee. Once all employees have been updated, click on Close to exit to the menu and proceed to the next process.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.