Sep 2022

28

Budget 2023 - An employer focus

On 27th of September 2022, Minister for Finance, Paschal Donohoe, and Minister for Public Expenditure and Reform, Michael McGrath, presented the 2023 budget. Minister McGrath called the budget a “Cost of Living Budget”, and said it was focused on helping individuals, families and businesses deal with rising prices.

Below, we've listed some of the measures from the budget which will most affect employers.

Income Tax

There are no change to tax rates for 2023, the standard rate will remain at 20% and the higher rate at 40%.

• The Standard Rate Cut Off Point (SRCOP) has been increased by €3,200 from €36,800 to €40,000

• The Personal Tax Credit increased by €75 from €1,700 to €1,775

• The Employee Tax Credit increased by €75 from €1,700 to €1,775

• The Earned Income Credit increased by €75 from €1,700 to €1,775

• The Home Carer’s Tax Credit will increase by €100

Universal Social Charge (USC)

• Exemption threshold remains at €13,000

• There are no changes to the rates of USC

• The 2% USC rate band has increased by €1,625, from €21,295 to €22,920

USC Rates & Bands 2023

• €0 – €12,012 @ 0.5%

• €12,013 – €22,920@ 2%

• €22,921 – €70,044 @ 4.5%

• €70,045 + @ 8%

Medical card holders and individuals aged 70 years and older whose aggregate income does not exceed €60,000 will continue to pay a maximum rate of 2%.

The emergency rate of USC remains at 8%.

Non-PAYE income in excess of €100,000 will continue to be subject to USC at 11%.

Rent Tax Credit

Any taxpayer that are renting a property and are not receiving housing supports will qualify for a rent tax credit of €500 per annum. In the case of married couples or civil partners this credit will be doubled. This will come into effect in 2023 but can be claimed for rent paid in 2022 in early 2023.

Tax Relief for Remote Workers

The tax relief for remote workers remains unchanged at claiming relief of to 30% of the cost of vouched expenses for heat, electricity and broadband in respect of those days spent working from home.

Small Benefit Exemption

The Small Benefit Exemption has been increased from €500 to €1,000, with employers permitted to give employees two vouchers per year, as opposed to one voucher which was permitted to date. This applies for 2022 and years following.

ASC

There are no changes to the ASC rates for 2023.

National Minimum Wage

The National Minimum Wage will increase by 80 cent from €10.50 to €11.30 per hour from 1st January 2023.

Pay Related Social Insurance (PRSI)

Due to the increase in the minimum wage on 1st January 2023 the upper threshold for paying the 8.8% Class A rate of employer PRSI is being increased from €410 to €441 from the 1st January 2023. There is no change to the PRSI credit.

VAT

The reduced rate of 9% VAT for the tourism and hospitality sector and electricity and gas bills will continue to apply until the 28th February 2023. 0% rate of Vat is introduced in respect of newspapers and news periodicals, including digital editions, defibrillators, hormone replacement and nicotine replacement therapies, and certain period products from 1st January 2023.

Social Welfare Payments

There will be a €12 increase to core weekly Social Welfare payments with effect from January 2023. The maximum personal rate of Illness Benefit will be increased to € per week. Maternity/Paternity/Adoptive /Parent’s Benefit will increase to €262 per week from 1st January 2023.

Related articles:

- What’s the craic with Statutory Sick Pay in Ireland?

- BrightPay Customer Update: October 2022

- Employee paid sick leave: What you need to know

Feb 2021

8

Thesaurus Connect: Two Factor Authentication Explained

As security is a large concern for many businesses nowadays as data breaches are a threat to all entities, Two Factor Authentication can now be enabled as a feature for users of Connect and Thesaurus Payroll Manager. Two Factor Authentication is a second layer of protection to re-confirm the identity for users logging into Connect through an internet browser or through Thesaurus Payroll Manager. This improves security and protects against fraud and lowers the risk of data breaches as users can access sensitive employer and employee data in Connect with the increased security layer.

Thesaurus Connect is an optional cloud add on feature that works with Thesaurus Payroll Manager. Thesaurus Connect provides a secure, automated and user-friendly way to backup and a self-service dashboard to both accountants and employers so they can access payslips, payroll reports, amounts due to Revenue, annual leave requests and employee contact details.

How it works

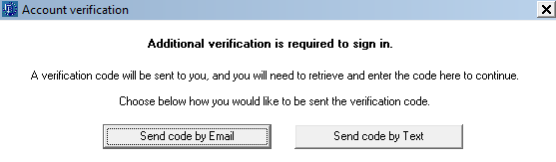

If Two Factor Authentication is enabled for a Connect account, when any user on the Connect account tries to sign into Connect via their internet browser here or through Thesaurus Payroll Manager, they will be asked to enter in a security code that needs to be sent to them. The user can select to have the security code to be sent by email or by text to the user.

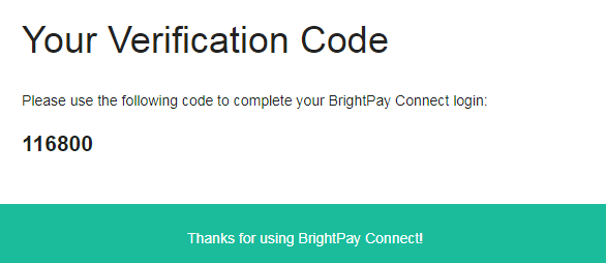

Once the user receives the security code the user enters this in the 'verify code' field and selects 'Verify Code'. The user will only be able to access the security code if they have access to the email account or mobile device. The random generated 6 digit security code will expire after fifteen minutes so a new code will have to be sent if the code is not used in the time limit.

This Two Factor Authentication uses a second security measure of identification ensuring the user is the correct user when logging into Connect. It adds an additional layer of security to an already secure hosted platform and gives the user more reassurance that their payroll data is safer and more secure.

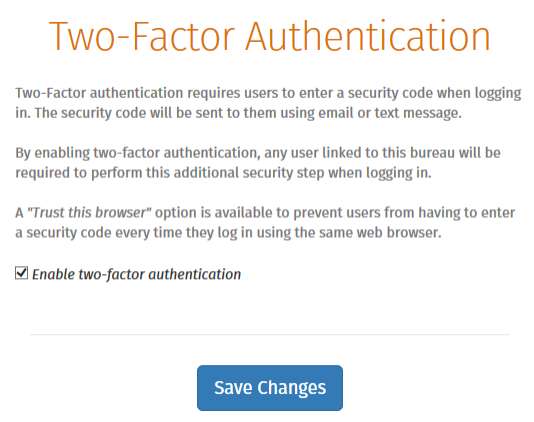

To Enable this option in Connect when you are logged in > Go to 'Settings' > Go to 'Two Factor Authentication' > Tick the box > 'Save Changes'.

Related Articles:

- GDPR: Frequently Asked Questions

- GDPR and Thesaurus Software

- Amazing payroll software that’s simple to use

Jan 2021

6

Thesaurus Connect Calendar Updates

The calendar functionality in Thesaurus Connect has been updated and improved, making it more user friendly and graphically appealing for both employers and employees. Improvements such as calendar and leave view, custom leave types and requesting leave are part of the new enhancements.

Calendar Display

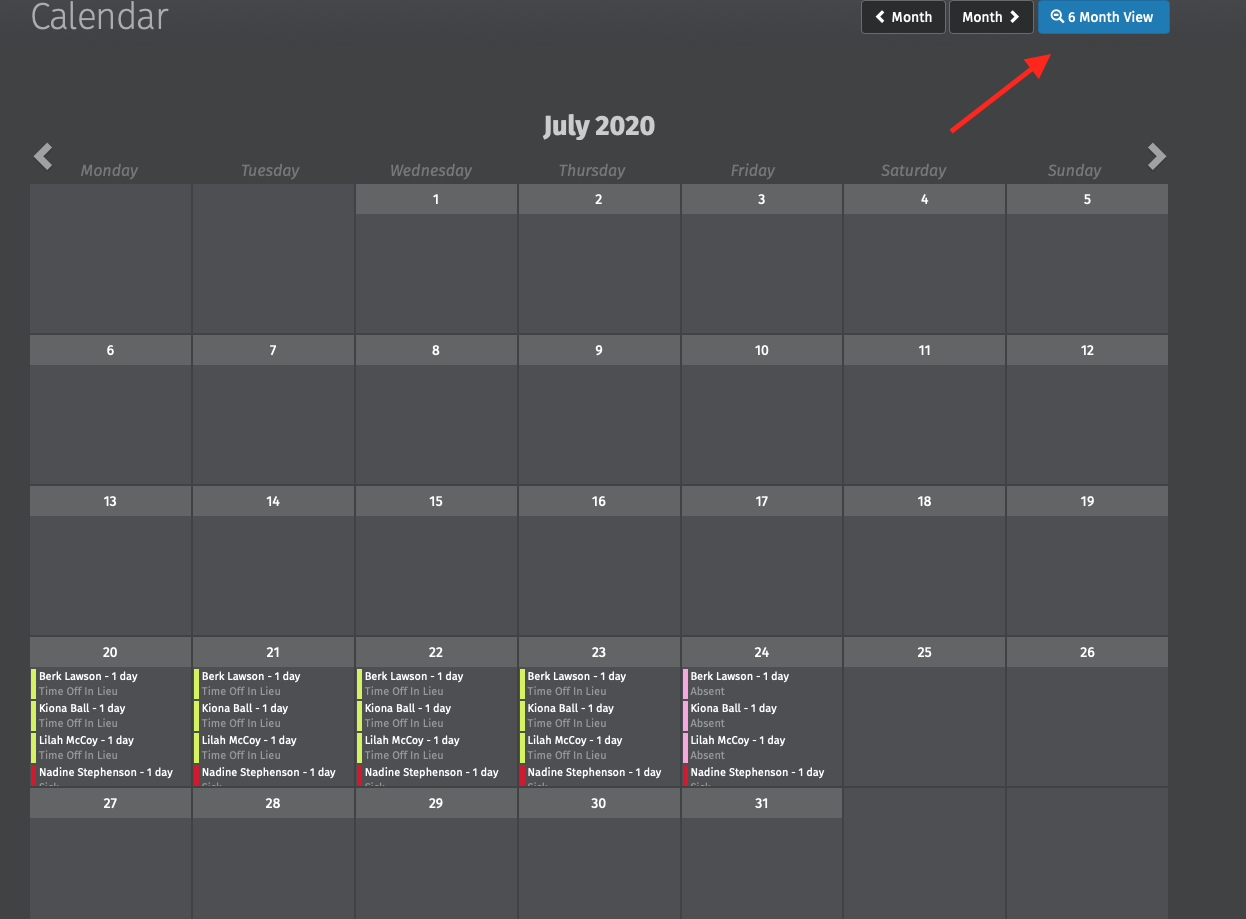

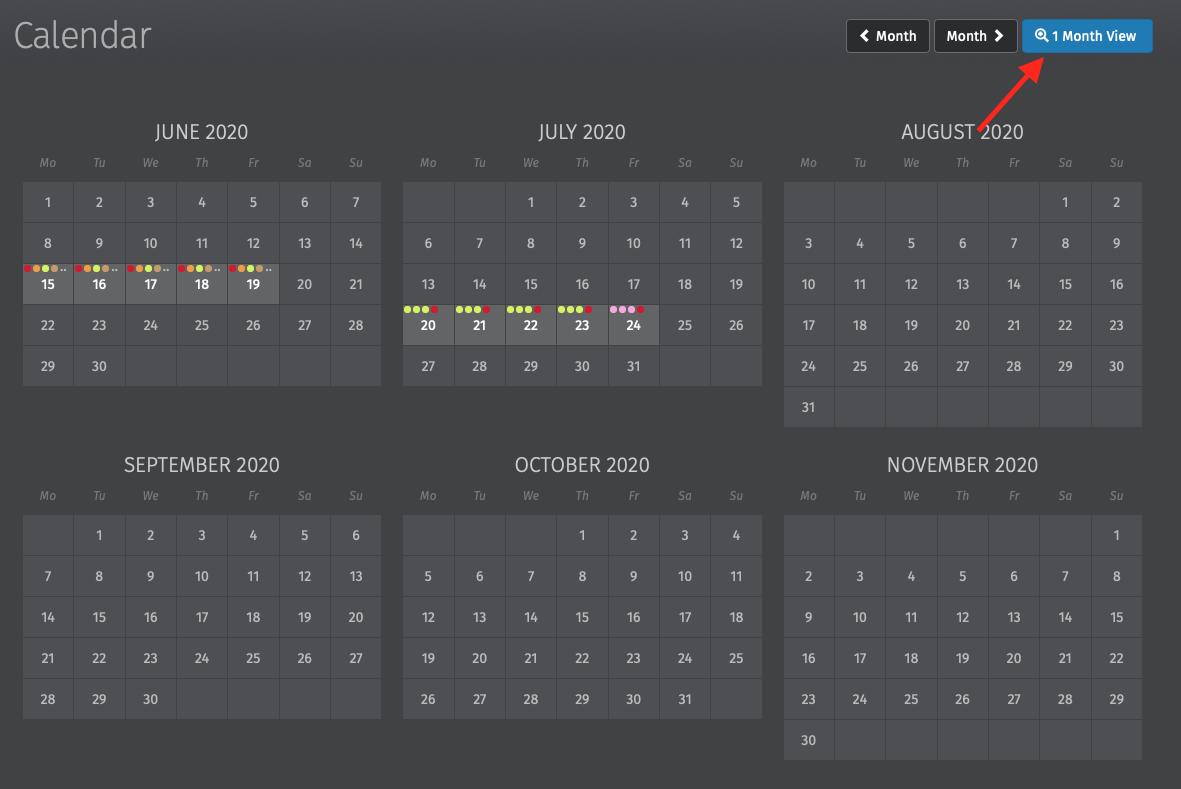

The number of months displayed on the calendar for both employers and employees can be selected, the options available are 3 months, 6 months, 9 months and 12 months. This can be selected under the Settings tab in the Employer portal, further details can be found here.

On the Employer or Employee Calendar in Connect, the calendar can be displayed for one month or multiple months. One month view can be seen by selecting the '1 Month View' option. The view can be returned to the default number of months view by selecting ‘3 / 6 / 9 / 12 Month View’. On the ‘1 Month View,’ there are new widgets for scrolling up and down through the number of leave entries on a particular date.

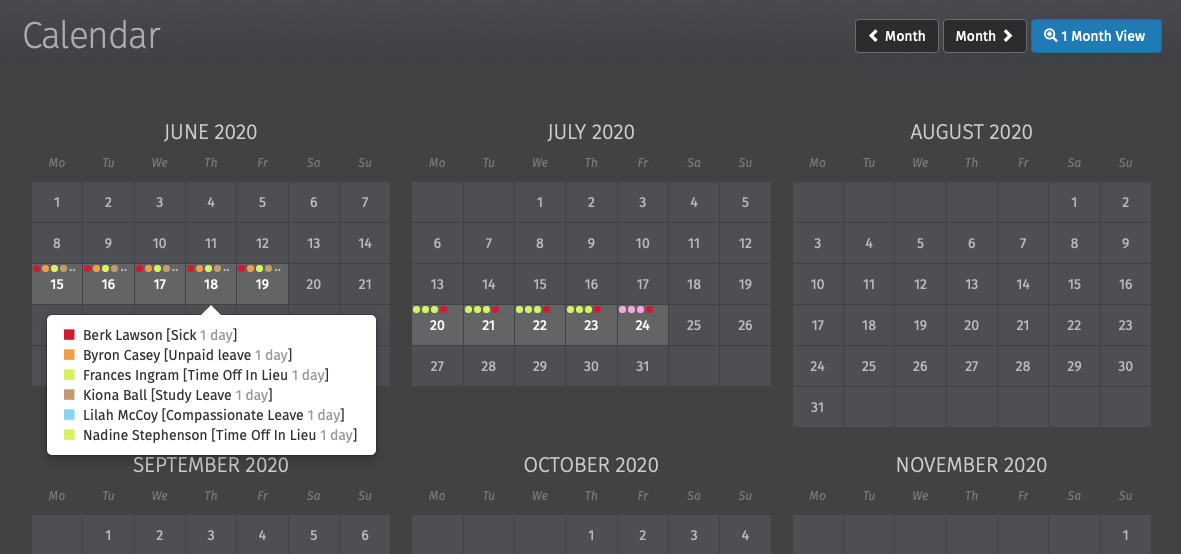

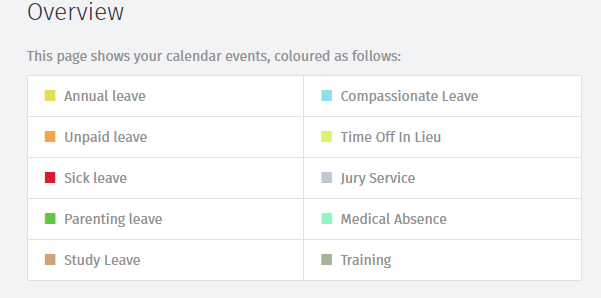

Dates with multiple types of events are dotted with the relevant colours. To see the breakdown, simply hover your mouse over the date. By selecting a date on the calendar, a dialog box will open to show all the entries on that date without having to scroll.

Custom Leave Types

Custom leave types are now available in Thesaurus Connect. When a custom leave type is entered, the leave type will be displayed on the calendar for both the employer and the employee to view on their online portal or mobile app. Custom leave can only be entered on an employee’s calendar by a user in Connect. Employees cannot request any custom leave types. Please note: You cannot edit the custom leave types in Thesaurus Connect, they are preset.

Adding/Requesting Leave

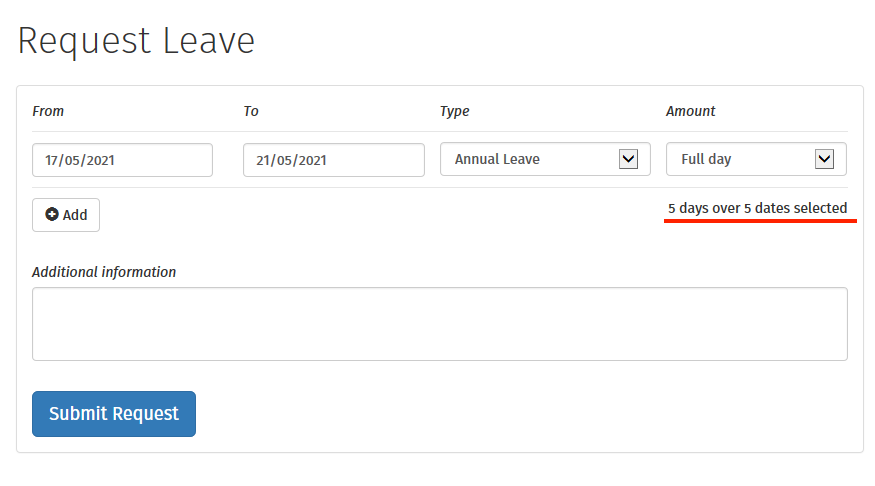

When employers are adding leave on an employee’s calendar in Connect or an employee is requesting leave, they are now entered as date ranges simplifying leave dates being selected.

Interested in finding out more about how Thesaurus Connect can streamline your leave management processes? Book an online demo of Thesaurus Connect today.

Nov 2020

17

National Minimum Wage to increase by 10c per hour

The National Minimum Wage is going to increase from €10.10 per hour to the new rate of €10.20 per hour and this comes into effect from 1st January 2021. This increase will affect around 122,000 employees, increasing their national minimum wage by 0.9%. An employee working 40 hours a week will see their gross wages increase by €4.00 per week.

Minister for Social Protection, Heather Humphreys advised the minimum wage has increased by approximately 18% from the rate of €8.65 per hour in 2016 to the new rate of €10.20 per hour for 2021. She also assured that the PRSI thresholds would be changed in order to reflect the increase in the Minimum Wage.

Heather Humphreys stated that:

“I also want to ensure that the increase in the minimum wage does not result in employers having to pay a higher level of PRSI charge solely due to this increase. I will make regulations that will increase the employer PRSI threshold from €395 currently to €398 from 1st January 2021.”

The General Secretary of the retail union Mandate, Gerry Light, and the General Secretary of the Irish Congress of Trade Unions, Patricia King, resigned from their positions in the Low Pay Commission as they felt the 10c increase in the National Minimum Wage was not sufficient in meeting the needs of the minimum wage employees.

Make sure you keep up-to-date with the latest legislation changes. Subscribe to our newsletter today.

Oct 2020

6

Cycle to Work Scheme Changes: What you need to know

In the July Jobs Stimulus Plan, announced by Taoiseach Micheál Martin, changes were introduced to the existing Cycle to Work scheme. The Cycle to Work scheme is a government initiative that was introduced in January 2009 and allows the employer to purchase a bicycle and safety equipment for an employee for travelling to and from work. The cost of the bicycle and safety equipment can be deducted from the employee’s wages in the form of salary sacrifice. This salary sacrifice is set up as an allowable taxable deduction and reduces the gross salary for PAYE, USC and PRSI purposes by the amount of the salary sacrifice. The salary sacrifice cannot be more than 12 months and the employer and employee must agree how the deductions can be made.

The allowance for the cost of the normal bike and safety equipment was €1,000 and in July this was increased by €250 to €1,250. The allowance cost of an electric bike and safety equipment rose to €1,500 from the previous rate of €1,000. The existing period to avail of the scheme every five years is being reduced to every four years. The tax year that the bike is purchased counts as the first year under the scheme. The bike and safety equipment must be used as part of the journey the employee takes between their home and their normal place of work.

If an employer purchases a bike for an employee and does not require the employee to pay for it, the employee will be exempt from tax on the benefit on the cost of a normal bike up to €1,250 and on an electric bike for up to €1,500. If the cost exceeds these exemptions, the employee will have to pay PAYE, USC and PRSI on the balance of the cost of the bike.

An employer does not have to inform Revenue if they have employees availing of the Cycle to Work Scheme but records must be maintained by the employer for any purchases made under this scheme, such as invoices, which employee the purchase was for, payment amounts, etc.

New webinar: Employment Wage Subsidy Scheme (EWSS) - What you need to know

Join our new webinar, Employment Wage Subsidy Scheme (EWSS) - What you need to know, to learn about the latest government scheme and its impact on payroll. As the Temporary Wage Subsidy Scheme has now ended, there is a new Employment Wage Subsidy Scheme which will run until April 2021. Register now.

In this webinar, we discuss what you need to know about TWSS Reconciliation and the Employment Wage Subsidy Scheme (EWSS). We are delighted to be joined by guest panelist Sandra Clarke - President of the Irish Tax Institute & Partner at BCC Accountants. Register now.

Related links:

Don't forget about your July / August EWSS Sweepback!

Increase to CWPS Rates on 1st October 2020

Webinar: Employment Wage Subsidy Scheme (EWSS) - What you need to know

Sep 2020

17

Increase to CWPS Rates on 1st October 2020

The Construction Workers' Pension Scheme (CWPS) is an industry-wide, occupational pension scheme providing pension solutions for employees in the construction and related industries, providing economic pension and protection benefits to both employees and employers.

It is designed to allow construction workers and their families retirement and low-cost protection cover. CWPS has over 30,000 active members employed by over 2,000 employers and is amongst the biggest occupational pension schemes in Ireland.

An increase in the rates will take effect on 1st October 2020 as agreed in the Sectoral Employment Order. The employer contribution total increases by 2.7% from €29.79 to €30.60 and the employee’s contribution total increases by 2.7% from €20.03 to €20.57.

A breakdown of the new rates are below:

| With effect from 1/10/2020 | |

| Pension Contribution Employer | €28.09 |

| Pension Contribution Employee | €18.73 |

| Life Assurance Contribution Employer | €1.17 |

| Life Assurance Contribution Employee | €1.17 |

| Sick Pay Contribution Employer | €1.34 |

| Sick Pay Contribution Employee | €0.67 |

| Total Employer Rate | €30.60 |

| Total Employee Rate | €20.57 |

There are no changes for the additional voluntary extras of Construction Workers Health Trust member contribution of €1.00 and the Benevolent Funds of employer contribution of €0.19 and member contribution of €0.50.

Jul 2020

24

July Jobs Stimulus Plan – Employer Focus

Newly appointed Taoiseach Micheál Martin announced the July Stimulus package worth €5.2 billion which included 50 new measures to help businesses and in turn help with the recovery of our economy. The major measures introduced in this package are as follows:

- From September 1st the current Temporary Wage Subsidy Scheme (TWSS), which is due to end on 31st August, will be replaced by the Employment Wage Subsidy Scheme (EWSS). This new scheme will run for 6 months until 31st March 2021. Under this scheme, employers and new firms in sectors impacted by Covid-19 whose turnover has fallen 30% will receive a flat-rate subsidy of up to €203 per week for each employee, including seasonal staff and new employees.

- Employers will receive an incentive of €2,000 to take on apprentices in 2020 under the Apprenticeship Incentivisation Scheme.

- If an employer hires an employee under the age of 30 who is on the Live Register or the Pandemic Unemployment Payment, a recruitment subsidy of up to €7,500 over two years will be available under the JobsPlus Scheme.

- Legislation will be passed to confirm that businesses affected by Covid-19 can delay payment of their PAYE and VAT debts in part or in full for a particular period without collecting interest or penalties.

- The standard rate of VAT will be cut by 2% for a 6 month period commencing September 2020, reducing the rate to 21%.

- A new Stay and Spend Incentive has been introduced, any taxpayer spending over €625 on accommodation and meals including non-alcoholic beverages between October 2020 and April 2021 can claim back up to €125 through a tax credit.

- Changes have been made to the existing Cycle to Work scheme. The new allowance of €1,250 has increased by €250 from the old rate of €1,000 to promote expenditure on cycling. The allowance has increased by €500 to €1,500 for electric bikes. The existing period to avail of the scheme of five years is being reduced to four years.

Jul 2020

16

3 extra weeks of Parents’ Leave for Pandemic Parents

Roderic O’Gorman, Minister for Children has announced that three additional weeks of parents leave has been proposed for Cabinet approval for parents of children born during the Covid-19 pandemic. This means parents leave will increase from two weeks to five weeks for new parents with children born after 1st November 2019. The rate of pay for this additional parents leave will be €245 per week. But this additional parents’ leave will not be available until it comes into effect in November 2020.

Every parent is currently entitled to two weeks’ parents leave in the first year when their child is born or adopted on or after 1st November 2019. Parental leave is different where a parent is entitled to take unpaid leave from work up to a current maximum of twenty two weeks to look after their children. This is changing to twenty six weeks on 1st September 2020.

Subscribe to our mailing list for more information on this and other important updates.

Oct 2019

9

Budget 2020 – Employer Focus

Finance Minister Paschal Donohoe announced Budget 2020 with very few changes:

- There is no change to tax credits, cut off points or the rates of PAYE

- There is no change to the rates of Universal Social Charge (USC)

- The Earned Income Tax Credit will increase by €150 to €1,500

- The Home Carer Tax Credit will increase by €100 to €1,600

- The Benefit In Kind will remain as 0% on electric vehicles provided by an employer to an employee until 2022

- The Minimum Wage increase of 30c recommended by the Low Pay Commission has been deferred due to the threat of a no-deal Brexit. The current rate of €9.80 per hour will remain until there is more clarity on Brexit.

PRSI:

The National Training Levy which is collected as part of Employer PRSI will increase by 0.1% from 0.9% to 1% in 2020 to fund further and higher education.

| 2019 | 2020 | |

| Employer PRSI Class A Reduced Rate | 8.7% | 8.8% |

| Employer PRSI Class A Higher Rate | 10.95% | 11.05% |

| Employer PRSI Class H | 10.25% | 10.35% |

Sep 2019

12

CWPS rates to increase on 1st October 2019

The Construction Workers' Pension Scheme (CWPS) is a multi-employer occupational pension scheme providing pensions solutions for workers in the construction and related industries, at a low cost to both employees and employers. It is designed to allow construction workers and their families retirement and low cost protection cover.

The pension rates for CWPS agreed in the Sectoral Employment Order will increase from 1st October 2019. The employer contribution total will increase by 78 cents and the employee’s contribution total will increase by 53 cents.

The new rates are as follows:

| Employer Contribution | Employee Contribution | Total | |

| Pension Contribution | €27.35 | €18.24 | €45.59 |

| Death in Service Contribution | €1.14 | €1.14 | €2.28 |

| Sick Pay Contribution | €1.30 | €0.65 | €1.95 |

| Totals | €29.79 | €20.03 | €49.82 |

The additional voluntary extras of Construction Workers Health Trust member contribution of 1.00 and the Benevolent Funds of employer contribution of 0.19 and member contribution of 0.50 will remain the same as the current rates.