Employer Does Not Pay Sick Leave

All employers must deduct PAYE from any Illness Benefit received by the employee, from the Department of Social Protection, regardless of whether or not the employer pays the employee while they are out of work on sick leave.

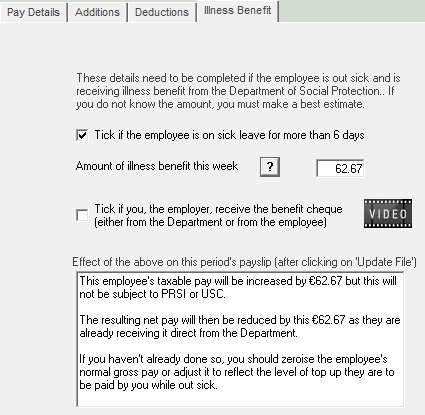

If you do not know how much Illness Benefit the employee is receiving then you must make a best estimate and deduct PAYE from it in the week it is due to the employee. The below fields must be used in order to allocate the correct PAYE treatment to the Illness Benefit.

-

No payment is made for the first six days of Illness or for any Sunday during the Ill period.

-

The normal weekly rate of Illness benefit is €188.00, or €31.33 per day.

-

Employees will receive the 6 day payment even if they normally work 5 days.

llness Benefit is subject to PAYE only, not USC or PRSI. It is taxable from the first day of payment by the employer.

There are three scenarios that an employer must deal with in considering the treatment of Illness Benefit;

-

Employer does not pay the employee while they are out sick

-

Employer pays the employee while they are out sick, employee retains the Illness Benefit payment from DSP (does not give it to his employer)

-

Employer pays the employee while they are out sick, employer receives the Illness Benefit payment from DSP

EMPLOYER DOES NOT PAY THE EMPLOYEE WHILE THEY ARE OUT SICK

-

Employer reduces the employee's working hours to zero for the sick period.

-

Employee claims and retains the DSP Illness Benefit of €188.00 per week

-

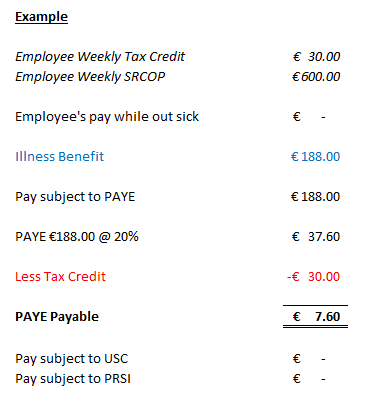

Even though the employer is not paying the employee he must collect the tax on the Illness Benefit that the employee is receiving from DSP and record that he has taxed the Illness Benefit

- Employer does not make any payment to the employee.

- Employer must collect €7.60 in PAYE due on the Illness Benefit received by the employee directly from DSP.

To tax the Illness Benefit in Thesaurus Payroll Manager

Payslips> Weekly/Monthly Input> Select the employee

-

Zeroise the employee hours or basic pay so that the employer reflects zero pay for the period.

-

Select the Illness Benefit tab

-

Indicate that "... the employee is on sick leave for more than 6 days"

![]()

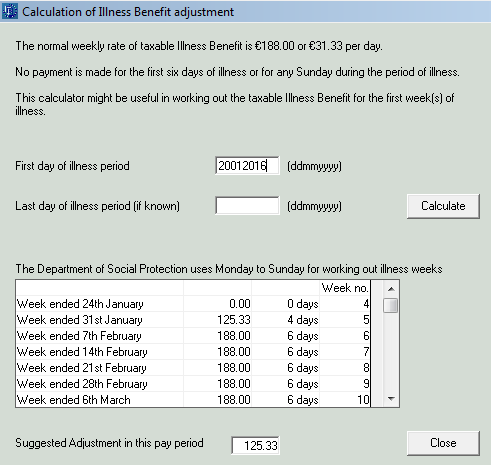

Illness Benefit Calculator

A built in Illness Benefit calculator will help you to calculate how much Illness Benefit the employee is eligible for in the pay period.

To access the calculator select the "?"

Enter the first date of sick leave (not the start date of Illness Benefit)

The calculator will predict the Illness Benefit that the employee is eligible for in this pay period and all future pay periods for as long as the sick leave continues.

The calculator will determine start dates from the date of the last pay period.

Entering the Illness Benefit

- Enter the Illness Benefit for which the employee is eligible in this pay period (you must collect PAYE on this amount)

-

Indicate that "... the employee is on sick leave for more than 6 days"

-

Enter the amount of Illness Benefit the employee is entitled to in this pay period (regardless of whether they have actually received it or not)

-

Click Update File

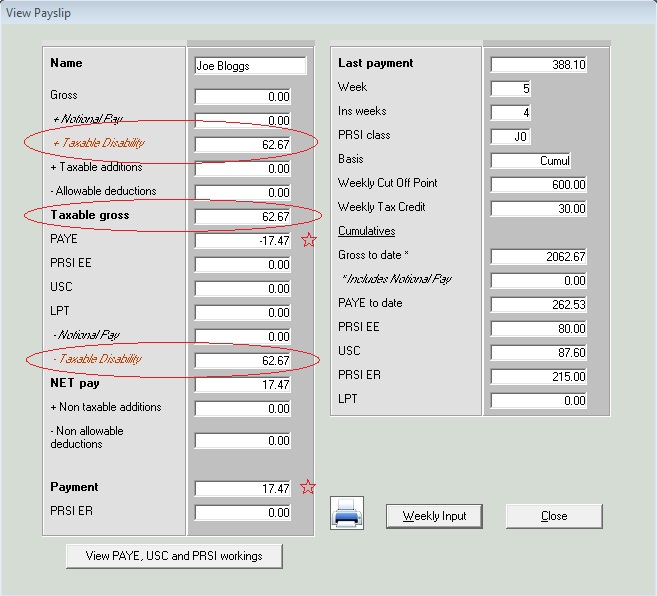

Illness Benefit is carried through to the payslip and taxed accordingly. The majority of single person circumstances will have sufficient tax credit and standard rate cut-off points to cover any tax liability arising.

Should the employee be in a tax repayable position then this should be paid to the employee.

Should the PAYE tax credit or accumulated credits not be sufficient to cover the PAYE due on the Illness Benefit then the payslip will reflect a nill PAYE deduction.

The PAYE due will accumulated in the background and be deducted from the employee when they return to work and are paid a salary again.

The PAYE due is the employees bill to pay, should the employee not return to work and a P45 is issued without the PAYE deduction then this is a matter between the employee and Revenue.

PLEASE NOTE: Employers must use the dedicated Illness Benefit feature in order to isolate the Illness Benefit figure from the employees normal pay as it must be declared to Revenue on all employee related Revenue returns:

-

P45

-

P35

-

P60

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.