BIK Cars and Vans

BENEFIT IN KIND - CARS & VANS

BENEFIT IN KIND ON VANS

To access this utility go to Employees > Update employee benefits > Click Cars/Vans

Ø Select Van

Ø Enter Make, Model or Reg of van

Ø Enter Original Market Value of van

The Original market value of a van is the price (including any duty, VRT or VAT) which the van might reasonably have been expected to fetch, if sold in the State singly in a retail sale in the open market, immediately before the date of its first registration in the State or elsewhere.

Ø Enter From Date

The date the employee first started using the van in the current tax year.

Ø You do not need to enter cumulative business mileage

It is NOT necessary to enter business mileage in relation to a van as the employee will pay a set rate of 5% of the OMV of the van regardless of business mileage.

Ø Enter Cumulative Contribution

This is any amount made good by the employee directly to the employer towards to the cost of providing and running the vehicle.

Ø When you have completed the above click Update file and show calculation of Notional Pay

The 'Notional Pay' will be added to the employee's gross income each pay period to ensure that the correct PAYE, Universal Social Charge and PRSI is charged.

BENEFIT IN KIND ON CARS

To access this utility go to Employees > Update employee benefits > Click Cars/Vans

Ø Select Car

Ø Enter Make or Model of car

Ø Enter Original Market Value of car

The Original market value of a car is the price (including any duty, VRT or VAT) which the van might reasonably have been expected to fetch, if sold in the State singly in a retail sale in the open market, immediately before the date of its first registration in the State or elsewhere.

Ø Enter From Date

The date the employee first started using the car in the current tax year.

Ø Enter Cumulative Business Km's to date

Business km's to date will determine the amount of Notional Pay an employee will pay so it is important to read the following screen carefully to ensure that you are calculating business kms correctly.

Calculating Cumulative Business Km's to date:

Annual Business km's / by 52 or by X No.of weeks car is used by the employee

e.g. Annual Business Km's : 26,000km's/52 weeks = 500 km's per week

500 km's x 10 weeks = 5000 km's

Annual business mileage is defined as total business mileage less a minimum of

8,000 private km's. In line with Revenue Regulation employees should submit periodical mileage records to the Employer when an employee is provided with a company car.

Cumulative kilometers to date should be adjusted accordingly within the payroll to record an accurate value to the benefit given to the employee.

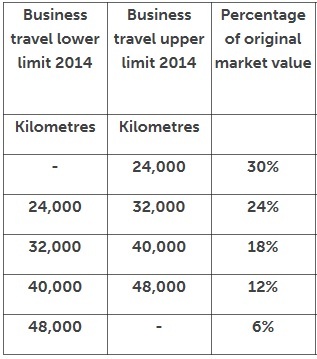

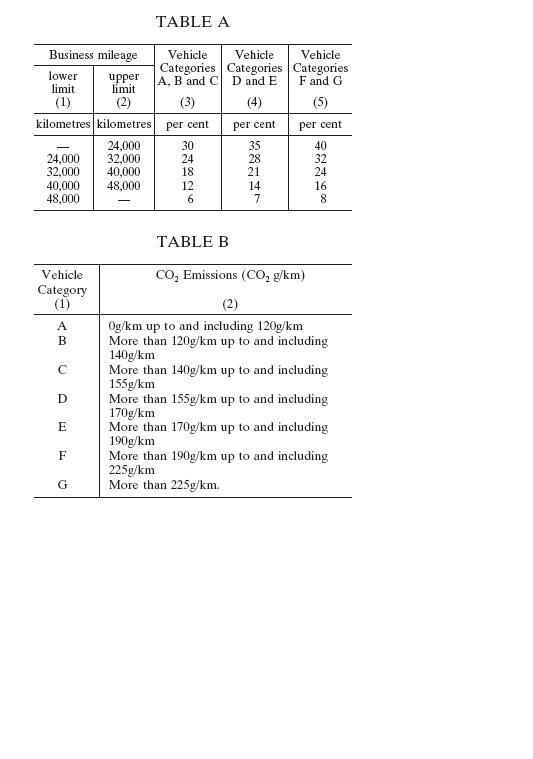

The following new table of kilometres are effective from 01st January 2014:

Ø Enter Increment of business km's

This is the annual business km's estimate divided by 52 (weekly paid employees) or by 12 (monthly paid employees). The payroll software will automatically increment the business km's each pay period, so there is no need to input km's manually.

Ø Enter Cumulative Contribution

This is any amount made good by the employee directly to the employer towards the cost of providing and running the vehicle.

Ø Tick if 70% away if applicable

Tick this box if an employee works an average of not less than 20 hrs per week, travels at least 8000 business km's per year and spends at least 70% of his or her working time away from the employers premises and retains a log book detailing business mileage.

Ø When you have completed the above click Update file and show calculation of Notional Pay

Ø Enter end date of original car or van

This is the date that the employee returned the car or van to the company or received a new company car or van. It is very important that you do NOT remove the original car or van.

Ø Click for further vehicle entries

Ø Enter Make or Model of new vehicle

Ø Enter Original Market Value of new vehicle

The Original market value of a car or van is the price (including any duty, VRT or VAT) which the van might reasonably have been expected to fetch, if sold in the State singly in a retail sale in the open market, immediately before the date of its first registration in the State or elsewhere.

Ø Enter From Date of new vehicle

The date the employee first started using the car or van in the current tax year.

Ø Enter Cumulative Business Kms to date (NOT NECESSARY FOR VANS)

Business kms to date will determine the amount of Notional Pay and employee will pay so it is important to ensure that you are calculating business kms correctly.

Ø Enter Increment of business kms (NOT NECESSARY FOR VANS)

This is the annual business kms estimate divided by 52 (wkly paid employees) or by 12 (mthly paid employees). The payroll software will automatically increment the business kms each pay period, so there is no need to input kms manually.

Ø Enter Cumulative Contribution

This is any amount made good by the employee directly to the employer towards to the cost of providing and running the vehicle.

Ø Tick if 70% away if applicable (NOT NECESSARY FOR VANS)

Tick this box if an employee works an average of not less than 20 hrs per week, travels at least 5000 business miles per year and spends at least 70% of his or her working time away from the employers premises and retains a log book detailing business mileage.

Ø When you have completed the above click Update file and show calculation of Notional Pay

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.