Pension Related Deduction (PRD) or Pension Levy

Pension Related Deduction (PRD) / Pension Levy

With effect from 01st March 2009 the Pension Related Deduction must be applied to the remuneration of public servants.

Who does the Pension Related Deduction apply to?

The Pension Related Deduction applies to public servants who:

(i) Are members of a public pension scheme

(ii) Are entitled to benefit under such a scheme

or

(iii) Receive a payment in lieu of membership in such a scheme

What pay does the Pension Related Deduction apply to?

The Pension Related Deduction applies to all Schedule E remuneration covering all elements of gross pay, including overtime, arrears, all taxable allowances, Notional Pay on Benefits and taxable portions of Illness Benefit.

PRSI Relief on Pension Related Deduction Abolished

With effect from 1st January 2011 Gross income before the PRD deduction will be subject to PRSI.

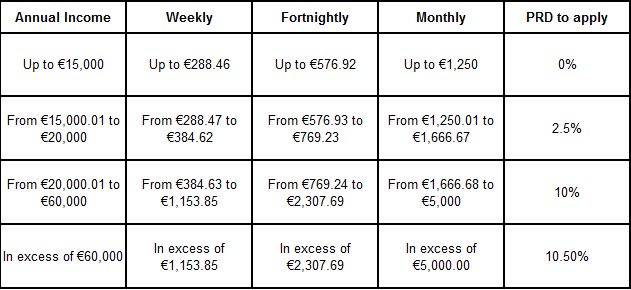

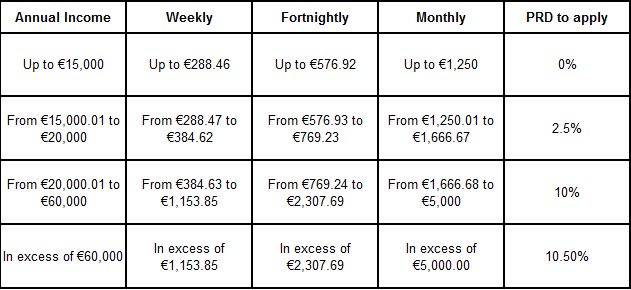

PRD RATES AND THRESHOLDS 2014

Budget 2014 did not introduce any changes to the PRD rates or thresholds however, under current legislation the 5% rate, which applies to annual earnings between €15,000 and €20,000, will be reduced to 2.5% from 1st of January 2014.

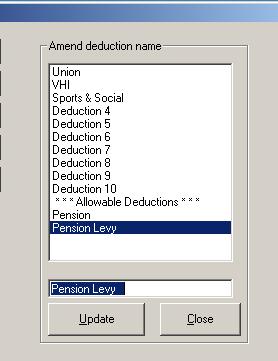

Setting up the Pension Related Deduction within Feature Payroll

To set up the Pension Levy within Feature Payroll go to:

Employees > Feature Payroll > Payment / Deduction Setup>

Edit Deductions File

To assign a deduction field to the Pension Levy Deduction choose “Edit Deduction File”. Within the list of Deductions choose the “Allowable Deduction”. You must assign the name of this deduction as “Pension Levy”, using any other narrative will not apply the Pension Levy rules to the deduction calculation. Click “Update” to save the change.

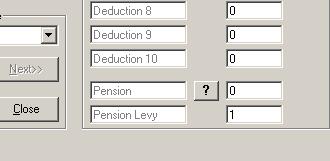

Default Deductions

Enter the “Default Deduction” as 1.00. The Pension Levy will automatically calculate within the Periodic Input screen when processing payroll.

Periodic Input

Enter the periodic pay details as normal, once all payments and deductions have been entered then simply double click on the “Amount” field of the “Pension Levy” deduction field.

The breakdown of earnings across each band and rate will display on screen with the applicable deduction. If in agreement with the calculation then simply enter the amount into the Pension Levy deduction field.

Once all relevant fields are complete simply click “Update” to save the entries and continue to the next employee.

Benefits

Any Benefits setup for an employee are not displayed within the Periodic Input screen. You must manually calculate the total levy applicable earnings, taking benefits into account, and enter the adjusted amount into the field.

Payslips

The Pension Levy will display separately on the Employees Payslip.

Additions / Deductions >

Once the Pension Levy is set up in the above sequence then the “Other Allowable Deduction” field within the “Add/Amend Employee” menu will be automatically updated as the “Pension Levy” update.

The amount of the deduction will automatically update from the “Periodic Input” screen.

This will facilitate reporting of the Pension Related Deduction at a later stage.