Prepare ROS P45

PREPARE & SUBMIT ROS P45

The P45 Part 1 can be submitted online through Revenue Online Services website (www.ros.ie).

This utility is only available if you have registered to use ROS. If you wish to register - Go to

www.ros.ie > Click Register > Complete Steps 1-3.

The P45 Part 1 can be submitted online through Revenue Online Services website (www.ros.ie). This utility is only available if you have registered to use ROS.

If you wish to register go to www.ros.ie > Click Register > Complete Steps 1-3.

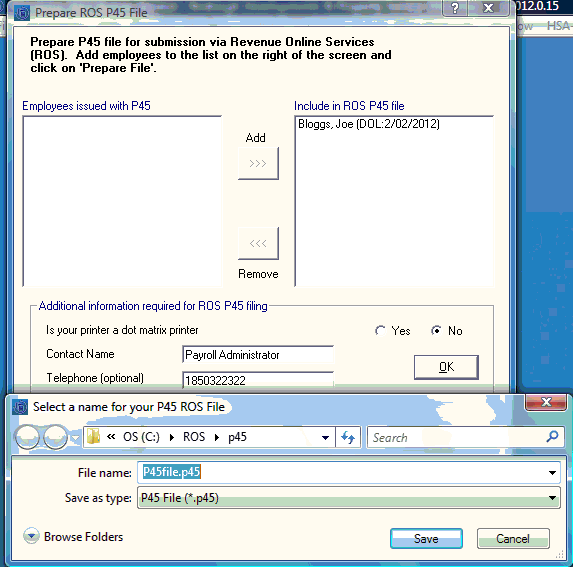

To access this utility go to P45 > Prepare ROS P45

Each employees P45 must be issued before proceeding. To issue P45 - Go to P45 > Issue P45 > Click F1 for help.

To prepare ROS P45 file:

Ø Select Employee

Ø Click Add

Ø Repeat this step until the all employees are listed on the right of the screen

Ø Click Prepare File

Ø Enter Contact name

Ø Enter Telephone Number

Ø Click OK

Ø Save P45 file - the file name can be amended if applicable

Ø Click Save

You can now submit this file to ROS.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.