P35 - Medical Insurance eligible for tax relief

Please note that where you have employees for whom you are paying medical insurance and in respect of which BIK arises, you are required to return on the P35 the portions of these premiums that are eligible for tax relief.

Because you will generally be unable to calculate these amounts yourself by virtue of not having all the information to hand, the medical insurance providers will give you the amounts for each employee and you can then input these amounts in to the software.

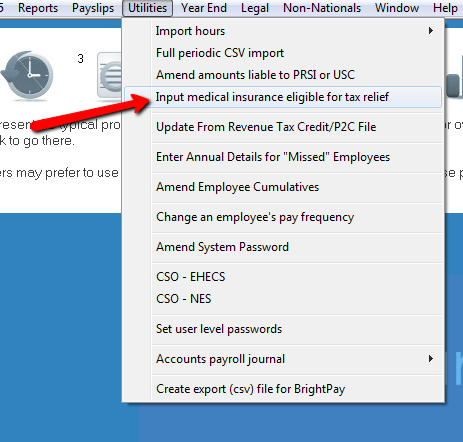

This can be done in the Utilities menu.

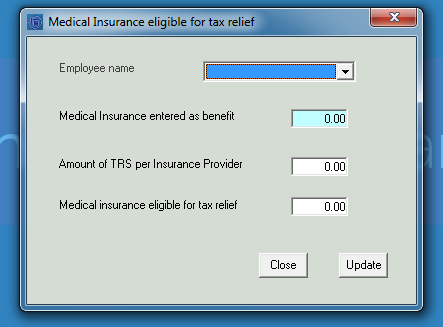

The input screen will allow you to select each employee and input the eligible amount. It will show you the benefit amount already on file and will not allow you enter an eligible amount in excess of the benefit amount.

The information provided by VHI or other insurance provider will be the TRS (tax relief at source) amount. Simply enter this in the relevant box and the "Medical Insurance eligible for tax relief" will automatically populate. Because the tax rate for tax relief at source is 20%, the amount that is eligible for tax relief will be 5 times the TRS amount.

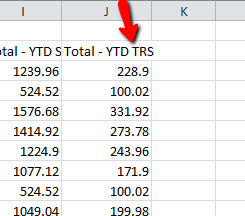

The VHI report that you need to access in your VHI Online Group Profile (OGP) is the "TRS Year to date report" to December 2014. The TRS amounts for input into the above screen are in column J.

More information can be found here.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.