Thesaurus Software's COVID-19 Resources Hub

How to use Thesaurus Payroll Manager if you need to work from home

While Thesaurus Payroll Manager remains a desktop solution, the software can be activated at ten different locations on ten different PCs or laptops. Thesaurus Payroll Manager's program location can be set as a cloud environment like a shared server, Google Drive or Dropbox. This flexibility will allow users to continue to operate their payroll as normal. In addition, you can log into your Thesaurus Connect account to view your payroll information at any time. Read our step-by-step guide that explains how to use Thesaurus Payroll Manager when working remotely.

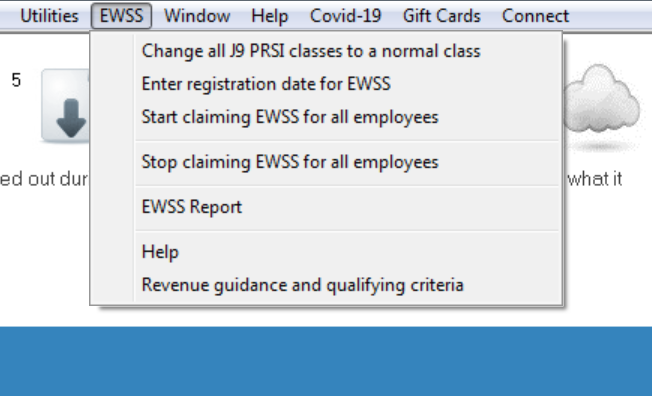

Employment Wage Subsidy Scheme

The Employment Wage Subsidy Scheme (EWSS) came into effect on 1st September 2020 and will continue until 30th April 2022. Where the scheme is being operated, an indicator will be included on the payroll submission (PSR) to indicate that an employee is an eligible employee for EWSS. On receipt of your payroll submission, Revenue will then determine the applicable subsidy amount payable.

Returning To Work After COVID-19

The Government’s 'Work Safely Protocol' sets out a number of measures employers must consider as they reopen their businesses and bring staff back to work safely, such as designating a Lead Worker Representative, providing COVID-19 induction training for employees and developing a COVID-19 Response Plan. Thesaurus Payroll Manager's sister product, Bright Contracts, has been updated to include a template COVID-19 Response Plan. This document is the perfect starting point for any small employer getting to grips with COVID-19 and preventative workplace measures.

Free Resources:

We have created some sample letters that employers can use:Thesaurus Customer Support - Business as Usual

All of our staff can perform their roles from home, and all staff are issued with laptops and access to our phone and email systems. Our customer support is still very much open for business and we will continue to support our customers through the COVID-19 pandemic. Apologies if you hear any domestic background noise while talking to a support operative. This may be unavoidable and we ask that you bear with us for the duration. If you have any further questions or concerns, please contact our customer support team here.

Free Webinar: Employment Wage Subsidy Scheme Extended

During this webinar, we discuss what you need to know about the extension of the EWSS, including enhanced eligibility rules. Plus, we will highlight important tips to remember as you return to the workplace (and what mistakes you should avoid).