Jul 2022

12

Modernise your annual leave in 2022 with an online company calendar

.png) Do you often feel that your annual leave process is scattered and unorganised? Maybe you’ve missed an employee’s email, only to discover weeks later that certain dates have been double-booked, leaving you short-staffed. This can frustrate employees and employers alike, especially during busy periods. That’s why we recommend having a system in place that can deal with employee annual leave requests in a straightforward and fair way, while reducing the likelihood of errors such as double-booking from occurring.

Do you often feel that your annual leave process is scattered and unorganised? Maybe you’ve missed an employee’s email, only to discover weeks later that certain dates have been double-booked, leaving you short-staffed. This can frustrate employees and employers alike, especially during busy periods. That’s why we recommend having a system in place that can deal with employee annual leave requests in a straightforward and fair way, while reducing the likelihood of errors such as double-booking from occurring.

What annual leave system should I use?

We recommend using a cloud-based annual leave system, ideally one that syncs with your payroll software. This can automate the process even further for you, which we will explain in greater detail further down. An online, companywide leave calendar can revolutionise how you manage annual leave and streamline your business’ processes. Here are 3 ways an online company calendar can transform your business.

1. View all of your company’s leave in one central location

A company leave calendar allows you to view all of your employees’ past and scheduled leave from one central location. No longer do you need to spend hours editing excel spreadsheets and scrambling through emails – you can now process everything from one central hub.

A company calendar allows you to have a complete overview of your employees’ leave, letting you see, at a glance, who is on leave and when. This allows you to make better decisions when dealing with leave requests. It also allows you to spot patterns of absence more easily, meaning you can deal with unauthorised absenteeism before it becomes an issue. It can also save your business time by reducing the likelihood of errors that can crop up due to mismanaged annual leave.

2. Improves employee satisfaction

With a company leave calendar, employees can view their total leave for the year, including their leave taken and leave remaining. This reduces the likelihood of employees constantly contacting you about how much leave they have left, as they can now view it themselves, whether on an employee app or via an internet browser. This in turn, gives your employees more control over their leave and personal data, streamlining communication and reducing stress levels across the board.

3. Modernises your business

Implementing an online company calendar can also modernise your business by improving your carbon-footprint. Digitalising paper-based systems can cut down on supply costs for paper, printer ink and envelopes. This also keeps your company up to date with modern business practices, making sure that you stay in line with competition.

How Thesaurus Connect’s company calendar can help

Thesaurus Payroll Manager’s online company calendar is an intuitive and user-friendly calendar that’s available through their cloud extension, Thesaurus Connect.

As an employer, you can view your company calendar via a secure employer dashboard. From here, you can also be notified of annual leave requests from employees, which you can then easily approve or reject. Employees on the other hand, can access their calendar through a self-service employee app. Employees can simply login to view how many annual leave days they have taken and how many days they have left. They can simply choose the dates within the calendar that they wish to book, and the notification will be sent to the person responsible for taking care of that particular employee’s request. The leave will then be automatically added to the online employee calendar.

Thesaurus Payroll Manager’s cloud extension, Thesaurus Connect, allows you to streamline many other payroll and HR tasks, including:

- Payslip distribution

- HR document uploads

- Storing employees’ payslips

- Revenue payment deadlines

- Automatic payroll data backups

Discover how our cloud-extension can benefit your business today by booking a free online 15-minute demo. We are a fully Revenue compliant and are one of Ireland’s leading payroll software providers.

Dec 2021

15

How to avoid employees carrying over their annual leave into the new year

For most employers in Ireland, their annual leave year runs from January to December and an employee’s annual leave entitlements will depend on how much they’ve worked that year. As we get closer to the end of 2021, you may notice some employees who still have days or maybe even weeks left to take. Depending on what type of business you’re in, this could be a real headache to deal with. For example, if you are in retail, giving employees time off at Christmas could be impractical.

Some employees may ask if they can carry over their leftover leave into 2022. According to Citizen’s Information, annual leave should be taken within the leave year it was earned. Whether or not an employee can carry over annual leave entitlements will depend on the policy you have in place. Some employers will agree to allow employees to carry over untaken annual leave within 6 months of the relevant leave date, while others may allow employees to carry over leave even further. It is important to note, if an employee is on extended sick leave, then legally, they are allowed to carry over any unused leave for up to 15 months after the end of the year it was earned.

While in most cases allowing an employee to carry over annual leave shouldn’t be a problem, it can become impractical, especially when you have a lot of employees wanting to do so. Making sure your employees take their annual leave within the year it was earned can help avoid employee burnout as it encourages them to take more regular breaks. It also prevents employees saving up their annual leave and using it all in one go which could result in your business being short staffed for a long period.

Whatever you decide, it is important that you have an annual leave policy in place which clearly outlines whether employees can carry over leave from one year to the next. If you would rather a “use it or lose it” policy where employees must take their leave within the year it was earned, then it is important that you carefully track employees’ leave taken and remaining. Doing this will help you avoid having employees on leave, when you may need them most.

If you would like a ready-made annual leave policy which you can tailor to your own needs, visit our sister company Bright Contracts to find out more, or book a free online demo with a member of their team today.

How can I keep track of employees’ annual leave?

If you have a lot of employees, it can be difficult to keep track of everyone’s annual leave. Luckily, your payroll software can help. Thesaurus Payroll Manager used alongside our optional cloud add-on Thesaurus Connect has an annual leave management feature which allows employers and employees to keep track of annual leave taken and remaining.

1. View a company-wide calendar of employees’ past and scheduled leave

When you open up Thesaurus Connect’s employer dashboard, from the calendar tab, you can view a company-wide calendar which shows all your employees past and scheduled leave. The calendar makes it easier for you when you need to decide whether or not you will approve an employee’s request for time off.

2. Let employees request leave through their phone

Thesaurus Connect also includes an employee smartphone app which the employee can use to request leave. From the app the employee simply selects the days which they would like off, the type of leave (paid or un-paid) and the times (e.g. a half day). Employees can request leave anytime, anywhere, even on the go. Once a leave request is approved the calendar on the employer dashboard is automatically updated.

3. Let employees know how much leave they have remaining without having to ask you

Another great feature of the Thesaurus Connect’s employee app is that when an employee opens the app, they can see how much leave they have used so far that year and the amount of leave they have remaining. When an employee can easily keep track of the amount of leave they have used it means they will be less likely to have leave left over by the end of the year.

While some employees will still need an extra nudge to remind them to take their full annual leave entitlements before the end of the year, Thesaurus Connect can greatly help payroll processers in keeping track of who has leave left to take. This can help avoid employees carrying over annual leave days and having too many employees requesting to take leave at the end of the year.

To learn more about how Thesaurus Connect can help you manage your employee’s annual leave, why not book a free online demo today.

Related articles:

Nov 2021

22

Christmas bonuses and One4All gift cards: your festive payroll guide covered

It’s coming close to the end-of-year madness, and as payroll processors you’re likely to be particularly busy in the lead-up to Christmas. Between managing the annual leave requests, Christmas bonuses, and holiday pay, there are a quite a few payroll tasks to sort out. To help you with this, we’ve put together a few key points to remember if you’re processing the payroll this Christmas.

Christmas Bonuses:

A Christmas bonus can put a smile on every employee’s face and can be the perfect way to say ‘thank you’ for all the hard work done during a difficult year. However, it’s important you don’t get caught out on tax implications.

Under Revenue’s Small Business Exemption Scheme, employers can gift employees and directors a small benefit of up to €500 in value, tax free, each year. Certain guidelines must be followed:

- This benefit cannot be in cash.

- Only one such benefit can be given to an employee in one tax year. Only the first one qualifies for tax free status, even if you do not offer the full €500.

With this tax-free benefit, you have the potential to save up to €653.65 in tax per employee as the total cost of a net €500 gift paid through payroll is €1,153.65. Remember though, if a benefit exceeds €500 in value, the full value of that benefit is subject to tax.

In order to qualify for the small benefit exemption, it is important that gift cards are not given to employees as a salary sacrifice. This means you cannot fund the bonus from a deduction of your employee’s salary. The rewards must be invoiced and paid external to payroll.

Vouchers:

- Tax-free vouchers are a popular way of gifting a Christmas bonus to employees.

- Tax-free vouchers can be used only to purchase goods or services.

- The tax-free vouchers must be purchased from the business bank account or credit card.

- Employees or directors cannot purchase a voucher themselves and seek reimbursement for it.

One4all gift cards are commonly used as they allow employees to choose a gift from over 11,000 retailers. They also don’t charge over administration, service, or delivery.

If you’re a Thesaurus Payroll Manager customer, you can purchase One4all gift cards through the software. The software's integration with One4all allows you to easily purchase the cards, and more importantly, it can keep track of your purchases. This ensures that you’ll be notified if you attempt to purchase more than one gift card for an employee in any one tax year. Click the link to discover more about how the integration between Thesaurus Payroll Manager and One4All works.

Please note: to use the One4All feature on Thesaurus Payroll Manager you must have upgraded to the latest version of the software.

When to pay employees in December:

It’s common for many businesses to have a different payroll date in December. Often, employees will be paid earlier in December so they can cover their holiday expenses and because many businesses are closed at the end of the month.

It's likely only your monthly paid employees will be affected by this. If you plan to pay employees early, make sure you give yourself enough time to process the payroll in advance. Give your employees notice of the change in pay date and enough time that they can submit their expenses if they have any. Remember to make provisions to ensure that you report your employees’ pay to Revenue on or before the pay date.

Managing annual leave requests:

Christmas can be a very busy time for many businesses, and it may also be a time when employees are most looking to take annual leave. While you need to ensure you have enough employees working to cover this busy period, you should also look to be as fair as possible.

It’s recommended that you have a clear policy on holiday requests. Most often, a “first-come, first-served” approach is used. This provides a fair and transparent method for all employees. One way of achieving this is by using an employee app. Thesaurus Connect, a cloud add-on to Thesaurus Payroll Manager, includes an employee self-service platform which can be accessed online or through the Thesaurus Connect employee app. The app gives employees access to a self-service portal that they can use to request leave at any time. Once a request has been made, the employer or their manager, will be notified of it. When a request has been made it is time stamped, allowing you to see the order in which they come in. The employee will then be notified if the request has been accepted or rejected. Thesaurus Connect also includes a company-wide calendar for the employer to view so that you can ensure that there is adequate staffing before approving an annual leave request.

Discover more

Interested in learning more about annual leave management on Thesaurus Connect? Book a free online demo here for a detailed walkthrough of everything Thesaurus Connect has to offer you and your business.

Related Articles:

May 2021

13

Managing the Annual Leave Backlog as the Country Reopens

Employers are well used to staff wanting to take holidays at the same time. It is inevitable that certain times of year like Easter or Christmas will be more popular than others. As we remain in lockdown, many employees will have saved their time off for when more restrictions are lifted, and they can enjoy their free time as much as possible.

With Hotels, B&Bs, guesthouses, self-catering accommodation and outdoor hospitality set to reopen in early June, we can expect a scramble in workplaces for employees to get their holiday requests in. While it might not be possible to please everyone and give them time off on their preferred dates, it is important that you deal with annual leave requests in a way which is transparent and fair. If they wish to, employers are permitted to specify when an employee should take their holidays, provided they give the required notice. However, this can leave some employees feeling hard done by and annoyed that they do not have control over the dates that they take off, especially if they are forced to take time off during COVID-19 restrictions. So, what is the best option for all parties involved?

An employee app that manages staff holidays

Thesaurus Connect, an optional add-on to Thesaurus payroll software, is the simplest way to manage your staff's annual leave – headache free. Thesaurus Connect streamlines leave requests and leave approval. This is how it works:

1. The employee requests leave from the calendar in their Thesaurus Connect mobile app or from their PC or tablet. This means employees can request leave anytime, anywhere.

2. The employer (or the person who has been assigned to oversee the management of that employee’s annual leave) is notified of the request on the dashboard of their own Thesaurus Connect account.

3. The employer/manager can then either approve or deny the request at the click of a button.

4. The employee will receive a notification on their device informing them of whether their request has been approved or denied.

The most popular policy of granting annual leave is on a first come, first served basis. While this policy is the most fair; depending on the system in place, it can still be difficult to keep track of which employee requested the leave first. With Thesaurus Connect, you don’t have that problem as you will be able to see the order in which requests come in. Employees also have the ability to request half days or request to cancel leave which has already been granted.

In the employer’s dashboard, from the calendar tab, the employer can view a real time, company-wide calendar. At a glance, employers see which employees are on leave and the type of leave. This is especially handy nowadays when staff may be working from home and it is hard to keep track of who is off and who is not.

Using Thesaurus Connect to manage employee’s leave means less conflict in the workplace and less stress all round. Book a demo today to find out the many other ways Thesaurus Connect can improve employer/employee relationships.

Why not register now for our upcoming free webinar where we will discuss the EWSS scheme and highlight important tips to remember as you return to the workplace.

Related articles:

Jan 2021

19

4 ways to introduce payroll as a service to clients

More than ever, accountants are under pressure to diversify their service offering as the profits from doing compliance increasingly diminish. To the profession’s immense credit, firms have embraced new ways of working to not only stay afloat but thrive.

But with more competition, it’s become hard to stand out. Offering payroll services has become an overlooked way to set yourself apart. Perhaps understandably: in the past, payroll processing wasn’t a particularly dynamic, easy or, most importantly, profitable service to offer.

Things have changed, however, with the advent of new software that has made offering payroll services more profitable, simpler and innovative.

Thesaurus Connect and Cloud Access

Thesaurus Connect is a cloud add-on that seamlessly slots into Thesaurus Payroll Manager on your desktop. The payroll is still processed on the Thesaurus Payroll Manager desktop application, but the payroll information is stored online on a secure cloud server. By introducing the cloud into your payroll services, you can demonstrate value and power up what you offer to clients.

Here are four ways you can introduce a cloud system with payroll access like Thesaurus Connect to clients:

- The client self-service dashboard: Clients can see their employer details, employee's contact details and payslips, any outstanding amounts due to Revenue and any reports from the payroll software. It’s a collaborative sort of payroll processing that clients will never have experienced before.

- The employee smartphone and tablet app: Not just employers, but their employees too. The self-service app provides a digital payslip platform which employees can access anytime, anywhere. Through the app, your client can offer employees GDPR compliant self-service tools.

- Annual Leave Management Tool: It’s not just payroll or payslips. Thesaurus Connect can save your clients money and time with an in-built leave management tool in the self-service portal. Approved leave is automatically added to the employee calendar with full visibility for both clients and their employees.

- Secure Cloud Backup: Clients will get the safety and security of a cloud payroll backup when you use Thesaurus Connect. The software will securely backup payroll files to the cloud where a chronological history of backups will be maintained which can be restored at any time.

Make your and the client’s life easier

There’s so much complication in our modern economy. Businesses and individuals are assaulted on all sides by different technologies and demands for their attention and time.

But it’s important to remember that the right tech can also radically simplify peoples’ lives too. Thesaurus Connect, with its suite of HR-centred features, will make payroll processing simple and collaborative.

By empowering your clients via the cloud add-on, you’ll lessen the admin burden on yourself, leaving you to focus on getting the details right. For your client (and their employees), Thesaurus Connect will give them control over their leave and payroll data.

Things can – and should – be much simpler. And with Thesaurus Connect, that’s the new reality of payroll processing. Book a demo of Thesaurus Connect today.

To keep up with the latest payroll news, check out our new Bright website. There, you'll be able to register for any of our upcoming payroll webinars and download our payroll guides.

Jan 2021

6

Thesaurus Connect Calendar Updates

The calendar functionality in Thesaurus Connect has been updated and improved, making it more user friendly and graphically appealing for both employers and employees. Improvements such as calendar and leave view, custom leave types and requesting leave are part of the new enhancements.

Calendar Display

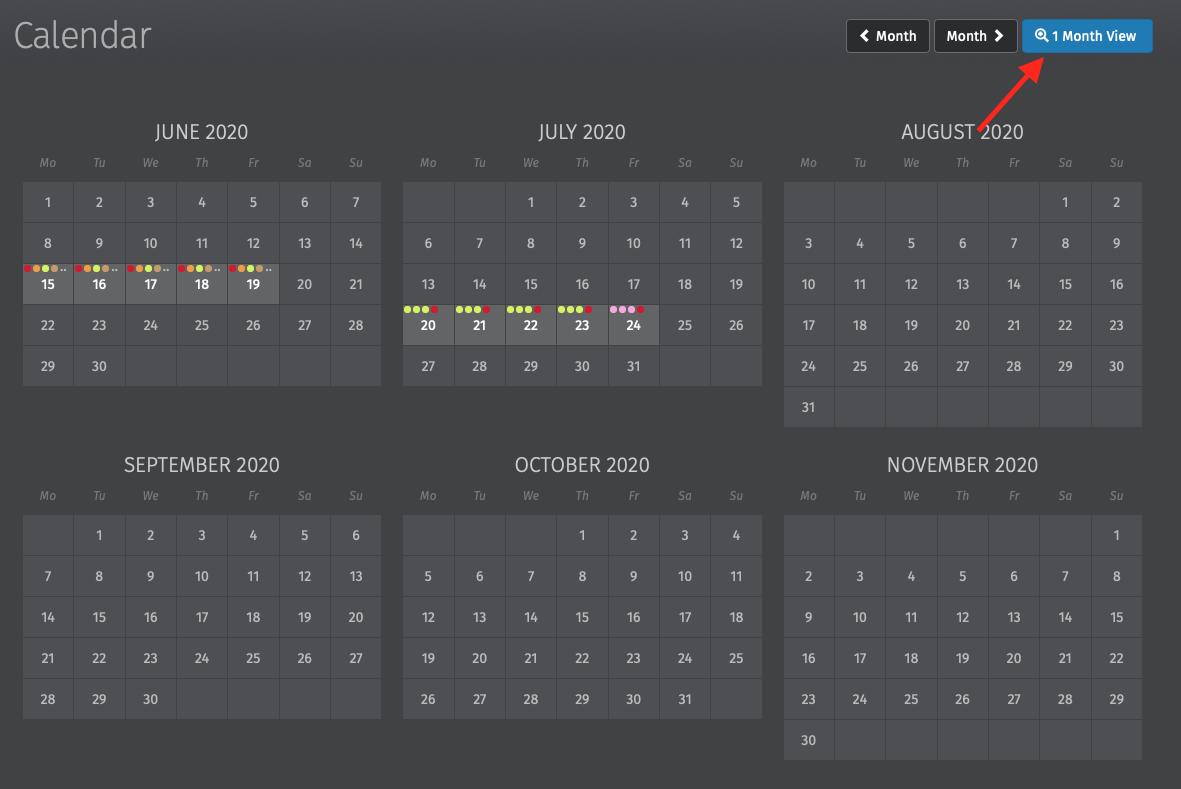

The number of months displayed on the calendar for both employers and employees can be selected, the options available are 3 months, 6 months, 9 months and 12 months. This can be selected under the Settings tab in the Employer portal, further details can be found here.

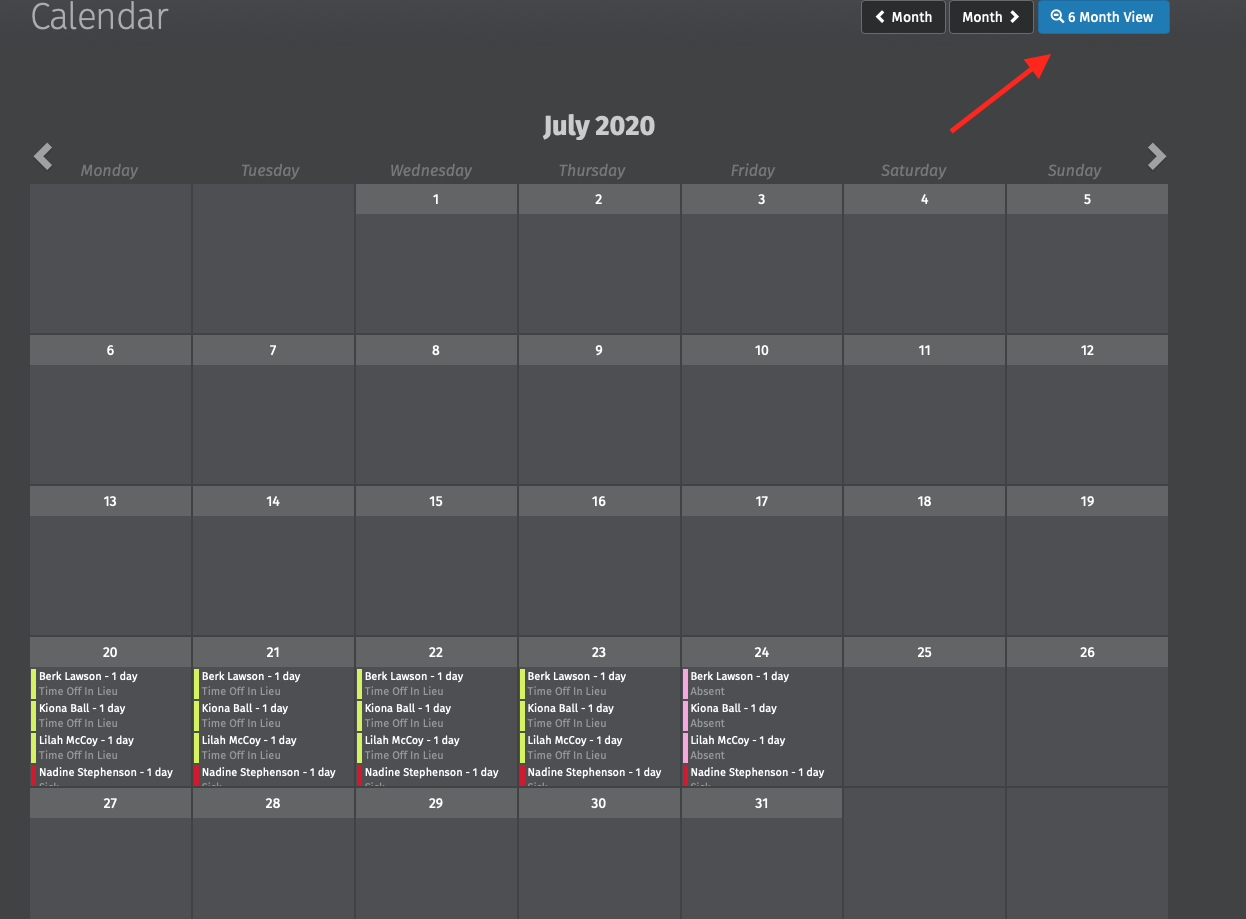

On the Employer or Employee Calendar in Connect, the calendar can be displayed for one month or multiple months. One month view can be seen by selecting the '1 Month View' option. The view can be returned to the default number of months view by selecting ‘3 / 6 / 9 / 12 Month View’. On the ‘1 Month View,’ there are new widgets for scrolling up and down through the number of leave entries on a particular date.

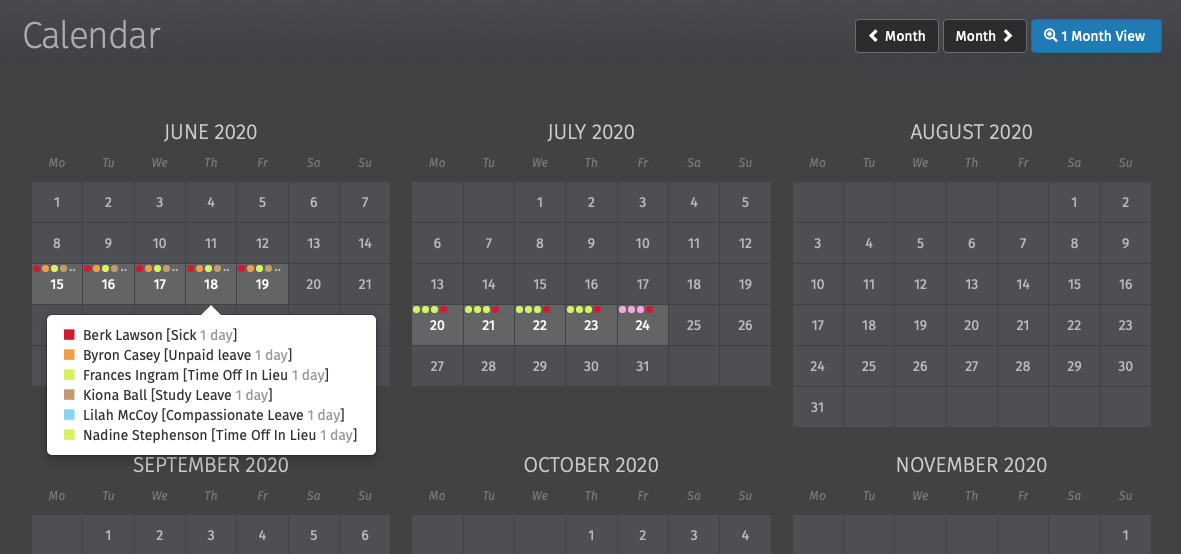

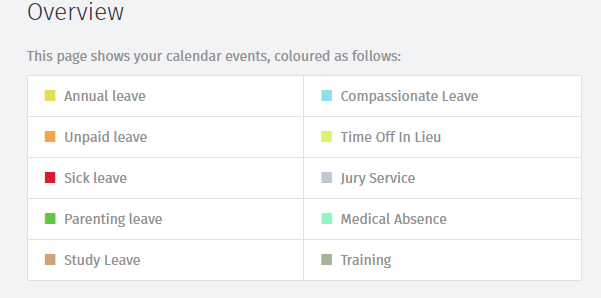

Dates with multiple types of events are dotted with the relevant colours. To see the breakdown, simply hover your mouse over the date. By selecting a date on the calendar, a dialog box will open to show all the entries on that date without having to scroll.

Custom Leave Types

Custom leave types are now available in Thesaurus Connect. When a custom leave type is entered, the leave type will be displayed on the calendar for both the employer and the employee to view on their online portal or mobile app. Custom leave can only be entered on an employee’s calendar by a user in Connect. Employees cannot request any custom leave types. Please note: You cannot edit the custom leave types in Thesaurus Connect, they are preset.

Adding/Requesting Leave

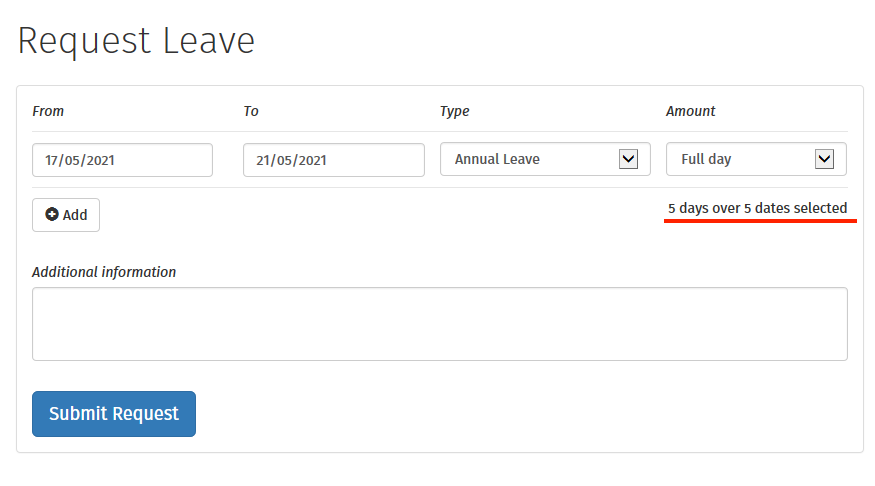

When employers are adding leave on an employee’s calendar in Connect or an employee is requesting leave, they are now entered as date ranges simplifying leave dates being selected.

Interested in finding out more about how Thesaurus Connect can streamline your leave management processes? Book an online demo of Thesaurus Connect today.

Jul 2020

10

Annual Leave and COVID-19 - Your Questions Answered

COVID-19 has presented countless challenges to every kind of business you can imagine. Whether you’re in retail or construction, banking or manufacturing, navigating the current circumstances while trying to keep your business afloat has been the cause of much confusion, frustration and anxiety. And one of the most commonly cited points of debate has been how the pandemic does or doesn’t affect annual leave for employees, and how employers should handle this moving forward.

These concerns aren’t unwarranted. There have been significant changes to how businesses can and in many cases, must, grant annual leave to employees. Understandably, many employers and managers are worried about denying employees their statutory rights and any potential circumstances arising from that.

So, with those concerns in mind, here’s everything you need to know about annual leave and COVID-19.

1. Do Employees Continue To Accrue Annual Leave?

Yes, and no. Employees who have been laid-off as a result of the pandemic will continue to accrue public holidays as normal that occur during the first 13 weeks. However, they will not accrue annual leave during the period of lay-off. Employees working short-time will continue to accrue leave for the hours they work.

The annual leave that employees accrue up until the point of being laid off will remain intact and employers should not pay employees in lieu of this annual leave. Instead, it should be made available to the employee to take once they return to work.

Given the exceptional circumstances that we are currently living in, it could well be the case that an employee genuinely cannot take their accrued annual leave this year. If this situation arises employers should try to be flexible in terms of allowing an employee to carry over leave into the next calendar year.

2. Do Employees Have To Take Annual Leave During Lay-Off?

Many employers are asking that their employees take annual leave while they can’t work during the lock-down period. However, some employees are resisting this and employers are wondering if they are within their rights to require that their staff take their holidays now.

Although employees have a statutory right to take any annual leave accrued, they can only take these holidays at a time that suits their employer. This rule is in place to avoid all employees taking their holidays at the one time, or during particularly busy periods (such as Christmas time for retail businesses). As such, employers can ask their staff to take their annual leave during lockdown as this ensures that they will be available to work when the business reopens.

However, it is advisable that employers try to be as accommodating as possible in this regard. Annual leave is typically used to rest and relax, often on holidays abroad. As this option isn’t available to employees who are cocooning/shielding, it could be prudent to allow those employees to take their holidays later in the year when they have more flexibility to enjoy them, where possible.

3. Can Statutory Annual Leave Be Carried Over To Next Year?

Yes. Given the extraordinary circumstances in which we all find ourselves now, employers should be as flexible and accommodating as possible when it comes to carrying over annual leave into 2021.

4. What If I’m Ready To Re-open My Business, But My Employee Wants To Take Annual Leave?

If your employee has holidays accrued, then he or she is entitled to take those holidays. However, as the employer you do have discretion when it comes to when your employees can take their holidays.

If, for example, you are in the retail industry and are expecting high levels of traffic in your premises once you reopen, then you can choose to have more staff than usual on the shop floor at a time in order to meet high customer demand. In this case, you can refuse holiday requests for this time as you have a sincere need to have all employees available for work.

At the end of the day, it is your choice when you allow your employees to take their holidays. While it’s important to be as accommodating as possible in order to maintain positive relationships with staff, if you need them to be available for work you are within your rights to ask them to take their holidays later in the year.

Keep Up-To-Date on the Latest COVID-19 Guidelines for Employers

At Thesaurus Software we know how important it is to keep abreast of the most recent developments when it comes to COVID-19, especially as we navigate unchartered territories together. That’s why we’re holding regular webinars to share with you all news relating to Revenue updates, what employers need to know and how you can make sure you’re complying with best practices at all times.

Register for our upcoming webinar where we cover everything from important COVID-19 payroll updates to return to work government policies.

To receive email notification letting you know when we’re holding our next webinar, sign-up to our mailing list and ensure you don’t miss out on the latest updates for your business.

Jun 2019

18

5 ways Connect can help your business

In case you haven’t already heard, Thesaurus Connect is our exciting new add-on to Thesaurus Payroll Manager that introduces powerful new features such as a free self-service app for employees and a web based self-service dashboard for employers. It also includes a secure and user-friendly way to backup and restore your payroll data on your PC to and from the cloud.

- Security – Never lose your payroll data again. With Connect, you can safely and securely backup your payroll data to the cloud. Thesaurus Connect maintains a chronological history of your backups. You can restore or download any of the backups to your PC at any time. You can restore a backup onto your existing PC, or you can simply download a backup onto a new computer.

- Productivity – Save time and man hours. Connect takes the hassle out of managing your HR duties. Track, approve and analyse your Leave Calendar anytime, anywhere. Issue, track & store employee documents and distribute them at the click of a mouse. The employee app allows your employees to view and download their own payslips, request leave and update their personal details without taking up their manager’s time.

- Connectivity – Stay connected 24/7. Have instant access to all your vital payroll & HR information. You can access your employees annual leave calendars, upload documents for your employees, see your Revenue reports and much, much more.

- Compliance – Don’t risk a €5,000 fine or a jail sentence! With the advent of GDPR, PAYE Modernisation and the recent changes in employment contract law, Connect is the best tool to help you stay compliant and up to date.

- Peace of Mind – Thesaurus Connect is hosted by Microsoft Azure. It's fully encrypted, totally secure and completely GDPR compliant.

Aug 2017

17

Paternity Leave – Uptake lower than expected

In September 2016, fathers of children born in Ireland became eligible for the first time to take up to two weeks’ paternity leave and to receive Paternity Benefit from the Department of Social Protection. Statistics collated from the first few months of the scheme show, however, that just one in four fathers eligible for the scheme chose to avail of it. This is in stark contrast to the expectation that 60% of eligible fathers would avail of the scheme when it was first announced.

Just over 5,000 paternity benefit applications were awarded during the first three months of the scheme going live, with County Longford, Kerry, Roscommon, and Clare having the fewest applicants. A larger uptake, however, was seen in County Dublin, Cork and Kilkenny.

A further 7,500 paternity benefit claims were subsequently awarded in the first four months of 2017. Under the new scheme, eligible fathers are entitled to two weeks of paternity leave. The two-week leave can be taken at any point within 28 weeks of the birth or adoption of a child, but the two weeks must be taken together.

A social welfare benefit of €235 per week is paid for the two weeks. It is at an employer’s discretion if they wish to top up this payment to the full weekly wage normally earned by the employee. Despite the low uptake so far, it is hoped that the number of applicants will increase as the scheme enters its second year in September.

Current statistics also don’t reflect fathers who may be delaying their paternity leave, for example, fathers whose child was born on February 28 this year can take it at any time up to September 1, 2017.

Guidance on how employers should treat Paternity Benefit and when it should be entered in Thesaurus Payroll Manager can be found here: https://www.thesaurus.ie/docs/2017/paternity-benefit/taxation-of-paternity-benefit/

Related article: Equality for working Dads with new Paternity Leave

Jun 2014

4

Changes to Holiday Pay Calculations

As we enter the summer holiday season employers need to ensure that they are paying their employees correctly during annual leave.

A recent decision by the European Court of Justice (ECJ) will impact how some annual leave pay is calculated.

Do you pay employee’s commission? Is the commission calculated based on the amount of sales made or actual work carried out? If yes, according to the ECJ, holiday pay should include commission pay.

The decision was made in the case of Locke v British Gas Trading and Others. Locke was a Sales Representative whose commission made up approximately 60% of his remuneration. After taking two weeks leave in 2011, Locke suffered financially as he was unable to generate sales for the period he was on annual leave.

The ECJ ruled that the purpose of annual leave is to allow a worker to enjoy a period of rest and relaxation with sufficient pay. By not including commission payments with holiday pay, employees are less likely to take annual leave so as to avoid financial hardship.

It has been left to the national courts to determine how to calculate the commission to which a worker is entitled, however the court did suggest that taking an average amount of commission earned over a certain period, e.g. the previous 12 months.

Employers are advised to review their commission policies to establish which, if any, payments need to be included in annual leave pay.