Universal Social Charge

UNIVERSAL SOCIAL CHARGE

USC operates in the same manner as PAYE, varying by employee;

- USC credits and Cut Off Points are issued per employee

- Employers are advised of these rates and COP along with the basis on the P2C

- Employer does not alter treatment from the P2C instruction unless a new P2C is issued

- Employer is not required to change how an employee is treated for USC based on personal circumstance (medical card/over70)

EMPLOYERS ARE TO OPERATE USC STRICTLY ON THE EMPLOYEE ASSIGNED USC RATES AND CUT-OFF POINTS AS ADVISED BY REVENUE IN THE P2C FILE, WITHOUT EXCEPTION.

P2C

Employer Tax Credit Certificates (P2Cs), as well as displaying PAYE rates and cut-off points, will now feature USC rates and cut-off points.

P45 and P45 Supplement

The Forms P45 and P45 Supplement include USC details.

Individuals aged 70 and over whose aggregate income is less than €60,000

and

Individuals who hold full medical Cards whose aggregate income is less than €60,000

It is NOT the responsibility of the employer to determine amendments to the operation of USC based on an employee’s personal circumstance. Where lower rates of USC apply in certain circumstances, for example, in the case of employees aged 70 and over whose aggregate income is less than €60,000, or where employees hold full medical cards whose aggregate income is less that €60,000, these lower rates will be stated on the P2C issued by Revenue. Where lower rates are not stated on the P2C currently held, the employee should be advised to contact their local Revenue office in order to update their USC status with Revenue.

USC Exemption

The 2015 USC exemption income threshold is €12,012 (formerly €10,036 for 2014).

Where Revenue determines that a USC exemption applies, it will be advised to the employer on the P2C. The employer does not make any adjustment unless advised to do so via the P2C / Tax Credit Certificate issued to them for an employee.

USC Emergency basis

No cut-off points are allowed. The emergency rate of USC is the highest rate applicable to a PAYE employee, currently 8% for 2015. While the rules applicable to emergency tax operable in PAYE include a gradual escalation in emergency tax rates over a given period, in USC there is just a flat % rate (with no cut-off point) applied to all payments.

What are employers to do where they have not received 2015 P2Cs in time to run January 2015 payroll(s)?

Revenue commenced issuing 2015 electronic Tax Credit Certificates (P2Cs) to all employers in December 2014. In the situation where an employer has not received 2015 P2Cs in time to run January 2015 payroll, then, as with PAYE, the 2014 USC rates and COP are to be applied until the 2015 P2C is issued.

The rates and thresholds of the Universal Social Charge (USC) are changed with effect from 1 January 2015. In December 2014, Revenue will issue to employers/pension providers 2015 Tax Credit Certificates (P2Cs) for all employees, advising the rates and thresholds applicable from 1 January 2015.

In the situation where an employer has not received 2015 P2Cs in time to run January 2015 payroll(s), the following instructions apply:

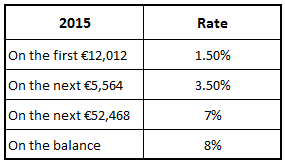

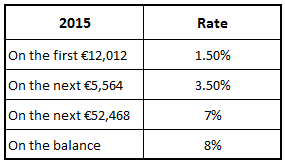

- Where standard rates (2%, 4% & 7%) were advised in the 2014 P2C, employers should use the following 2015 Standard USC rates and thresholds from 1 January 2015, until the 2015 P2C is received:

Thesaurus Payroll Manager will automatically apply the above 2015 rules on import from 2014 as appropriate.

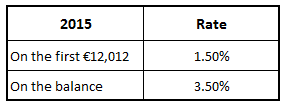

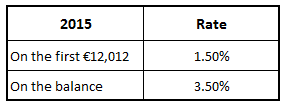

- Where reduced rates (2% & 4%) were advised in the 2014 P2C, employers should use the following 2015 Reduced USC rates and thresholds from 1 January 2015, until the 2015 P2C is received:

Thesaurus Payroll Manager will automatically apply the above 2015 rules on import from 2014 as appropriate.

- Where USC Exemption was advised in the 2014 P2C, employers should continue to apply USC Exemption from 1 January 2015, until the 2015 P2C is received.

- Where the emergency basis of USC deduction applied, employers/pension providers should continue to apply the emergency basis of USC from 1 January 2015, until the 2015 P2C is received. The 2015 emergency USC rate is 8%.

It is imperative that once 2015 P2C files are received by an employer that they are imported to 2015 Payroll Manager immediately and before any further payroll is updated.

CESSATION OF EMPLOYMENT

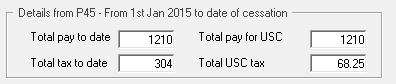

The P45 there is a dedicated section for the return of USC information and must be completed by all employers when an employee ceases to be employed by them.

*********************IMAGE TO BE INSERTED*******************

EMPLOYEES COMMENCING EMPLOYMENT

When a new employee starts in your employment and provides you with a 2015 P45 the USC cut off points are to be used from that P45 on a week 1 / month 1 basis until advised otherwise by Revenue on the P2C file.

The Revenue screen facilitates the recording of the additional USC information from the P45.

Where the week 1 basis is used, the tax credits and cut-off points (both tax and USC) information on the P45 can be used on a week 1 basis but the previous pay, tax, pay for USC and USC deducted should not be used to operate the cumulative system. The previous pay, tax, pay for USC and USC deducted will be notified to the employer on the P2C issued by Revenue.

USC EXEMPTION MARKER

The annual income exemption threshold of €12,012 applies for 2015, the process of employee self election to Revenue still applies.

Where Revenue determine that the employee/pensioner’s total annual earnings (from all USC-able sources) will not exceed the USC exemption threshold of €12,012 (formerly €10,036 for 2014), the USC exemption will be stated on the P2C issued by Revenue. This USC exemption marker is an instruction to the employer/pension provider not to deduct USC from payments being made.

Where the employer holds a P2C which does not show exemption and the employee/pensioner advises them that USC exemption applies to them, the employee/pensioner must contact Revenue themselves to inform Revenue that their earnings will not exceed €12,012 in the tax year. Revenue will then issue a revised P2C to the employer with an updated USC instruction.

Once a new P2C is used to the employer which indicates that USC exemption is to be operated then any previous USC deducted will be refunded to the employee on the subsequent payslip.

CALCULATING USC ON WEEK 53

New Revenue guidelines (December 2015) now state that USC should be calculated in Week 53 on a normal Week One basis. Therefore employees who have normal USC thresholds will receive the benefit of these thresholds in Week 53. The details below are now obsolete.

Week 53 calculation of USC operates as:

|

Payroll basis

|

USC Deduction

|

|

Where payroll is operating on a cumulative basis

|

Continue to operate on a cumulative basis for the 53rd week, using the cumulative Cut-Off Points. Unlike PAYE, there are no additional thresholds granted in Week 53. Where the employee has used up all of their USC Cut-Off Points at cumulative Week 52, they will have no unused Cut-Off Points left to set against their Week 53 pay, and will therefore pay USC at the highest rate stated on the P2C on all their Week 53 pay.

|

|

Where payroll is operating on a week 1/month 1 basis

|

No cut off points, apply the top rate as per the P2C or where no P2C is in effect, from the P45.

|

|

Where the P2C advises that USC exemption applies

|

Continue to apply the exemption. Do not deduct USC from the Week 53 pay.

|

|

Where payroll is operating on the emergency basis

|

Continue to apply the emergency basis.

|