Submitting a P45 to ROS

SUBMITTING A P45 PART 1 TO ROS

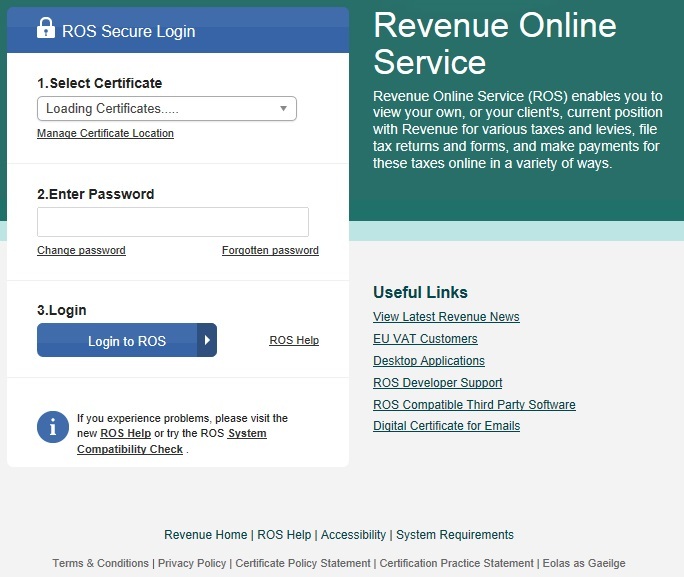

The P45 Part 1 can be submitted online through Revenue Online Services website (www.revenue.ie > Login to ROS).

This utility is only available if you have registered to use ROS.

Ø Log in to ROS at www.revenue.ie > Login to ROS

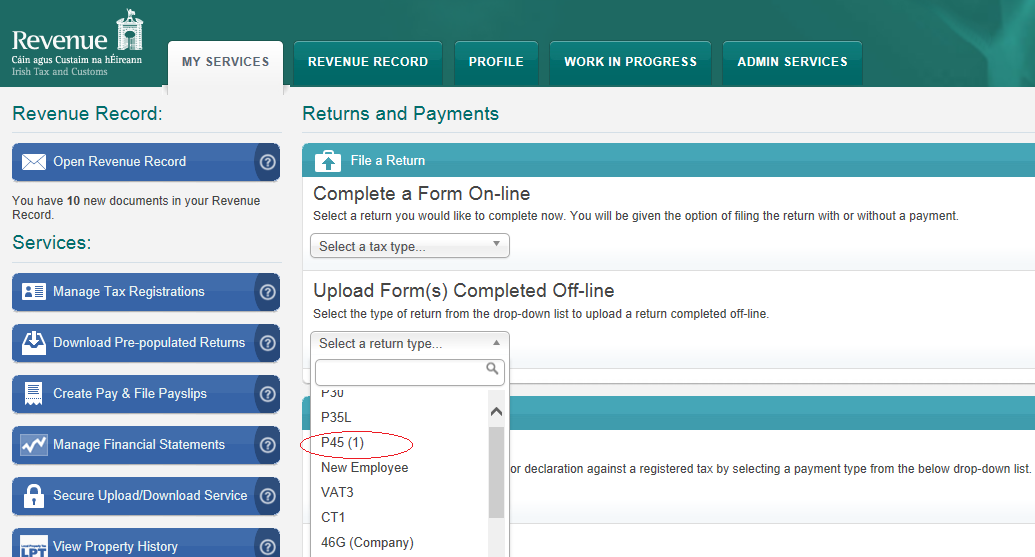

Ø Under My Services - Select Upload Forms Completed Offline

Ø Select P45 (1)

Ø Click Upload File

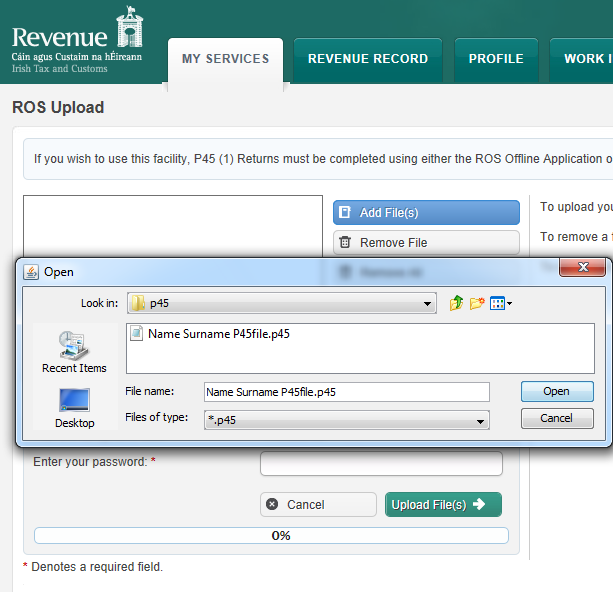

Ø Click Add File

Ø A browser will open, select the drive and directory where you saved the P45 file to.

Ø Selectthe P45 File

Ø Click Open

Ø Select Certificate

Ø Enter Password

Ø Click Upload File(s)

When the upload is completed successfully a confirmation number for the return will display on screen.

Access your ROS Inbox to view, save and print parts 2, 3 and 4 of P45. P45 stationery is available from Revenue’s Forms & Leaflets section (1890 30 67 06).

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.