TWSS - Operational Phase (effective from 4th May until 31st August 2020)

PLEASE NOTE THIS SCHEME HAS NOW ENDED.

The Operational Phase of the Temporary Wage Subsidy Scheme comes into effect on the 4th May 2020 and ends 31st August 2020.

This supersedes phase 1 of the Temporary Wage Subsidy Scheme and will apply to payroll submitted to Revenue on or after 4 May 2020, with a pay date on or after that date.

During the Operational Phase of the scheme, Revenue will calculate employees' previous average net weekly pay and their maximum personal subsidy amount and provide this information to employers. This will be in the form of a Revenue instruction (in CSV format), which employers must download from within their ROS account and import into their payroll software.

The purpose of this Revenue instruction is to provide employers with sufficient information to ensure each eligible employee will get the correct wage subsidy due. It will take into consideration all the employee’s active employments, including those that the employer may not be aware of.

Revenue will subsequently refund the applicable wage subsidy having regard to the maximum wage subsidy and the level of gross pay reported by the employer for each eligible employee.

Full Revenue guidance on the Operational Phase of the Temporary Wage Subsidy Scheme can be accessed here.

Qualification Criteria

There is no change to the qualification criteria for employers who operate this second phase of the Temporary Wage Subsidy Scheme

The Subsidy Scheme is open to employers who self-declare to Revenue that they have experienced significant negative economic disruption due to COVID-19.

They should be able to show that they meet the criteria laid out in Revenue’s published Guidance on Employer Eligibility and Supporting Proofs

Rates of Subsidy to apply from 4th May 2020

Employees previously earning up to €586 net per week

- An 85% subsidy shall be payable in the case of employees whose previous average net weekly pay does not exceed €412.

- A flat rate subsidy of up to €350 shall be payable in the case of employees whose previous average net weekly pay is more than €412 but not more than €500.

- A 70% subsidy shall be payable in the case of employees whose previous average net weekly pay is more than €500 but not more than €586, with the maximum cap of €410 applying.

Employees previously earning in excess of €586 net per week

For employees whose average net weekly pay is greater than €586 per week but not more than €960 per week, the temporary wage subsidy shall not exceed €350 per week, and shall be calculated with reference to the gross salary paid by the employer and its effect on net average wages as follows:

- A subsidy of €350 shall be payable to employees with average net weekly pay greater than €586, where the employer pays sufficient gross salary which equates to an amount up to 60% of the employee’s net weekly earnings;

- A subsidy of €205 shall be payable to employees with average net weekly pay greater than €586, where the employer pays sufficient gross salary which equates to an amount that is more than 60% but not more than 80% of the employee’s net weekly earnings;

- No subsidy shall be payable to employees with average net weekly pay greater than €586, where the employer pays sufficient gross salary which equates to an amount that is more than 80% of the employee’s net weekly earnings.

Tapering of the subsidy shall apply to all cases where the gross pay paid by the employer plus the subsidy amount exceeds the previous average net weekly pay.

This is calculated by subtracting the gross pay paid by the employer from the previous average net weekly pay and ensures that no employee would be better off under the Scheme.

The single exception to tapering is where an employer wishes to pay an employer contribution which when added to the wage subsidy for the employee does not exceed €350 per week. In such cases, tapering of the temporary wage subsidy shall not be applied.

Revenue Instruction

In the operational phase, Revenue will now provide all employers with details of the maximum subsidy and maximum top up for all their employees currently on a J9 PRSI class, and for any employees who might be placed on a J9 class, during the remainder of the scheme.

This Revenue instruction is in the form of a CSV file which must be manually downloaded from ROS and imported into Thesaurus Payroll Manager before processing any subsidy payments that fall under the operational phase.

This will (in most cases) be a one time download, as the figures in the downloaded file will be based on payroll submissions made for January and February. However where employers re-hire staff who have been laid off due to Covid-19 or where one of their employees is re-hired by another employer, Revenue will issue an amended instruction which must be downloaded from ROS again and re-imported into the payroll software.

Employers/agents should therefore check before each pay run for any amended Revenue instruction.

For assistance with downloading this Revenue instruction from ROS, please click here for instructions.

Processing a Subsidy Payment in Thesaurus Payroll Manager under the Operational Phase

1) After downloading your Revenue instruction (TWSS file) from ROS as per the above, the first step is to import this in to Thesaurus Payroll Manager.

This is a once-off exercise (unless, in the unlikely event, Revenue issue you with an amended instruction)

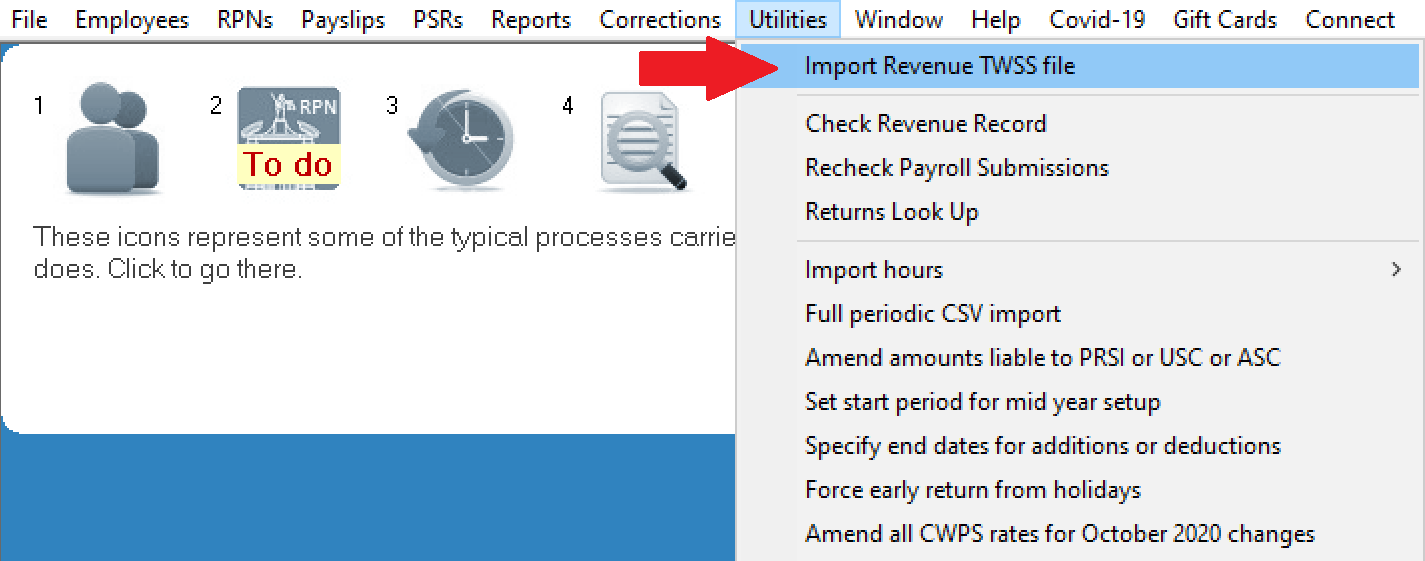

- Go to Utilities > Import Revenue TWSS file:

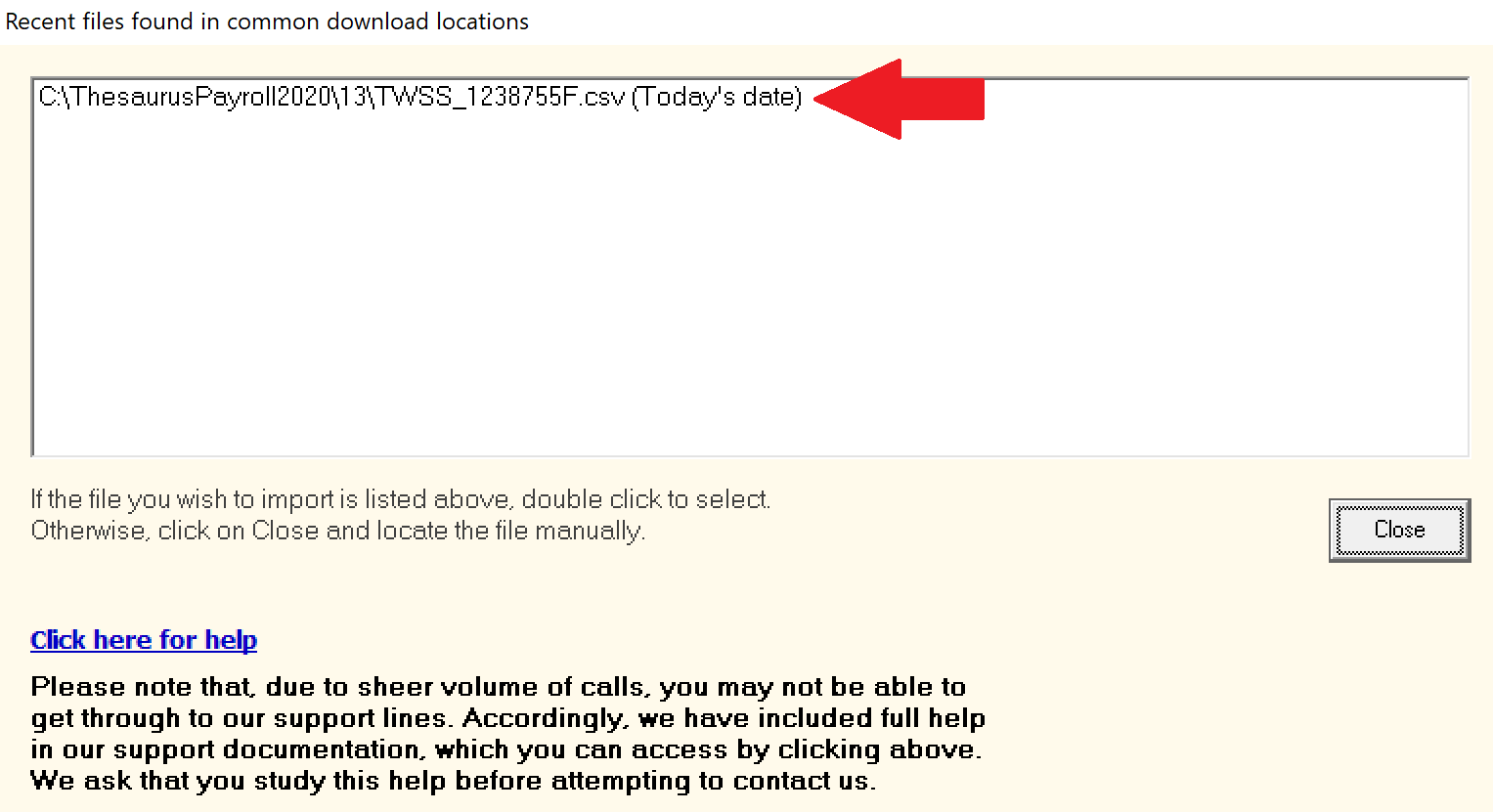

- Thesaurus Payroll Manager will now automatically search your PC for the most recently downloaded TWSS file. If the software locates this on your PC, then a window will appear entitled 'Recent files found in common download locations'.

- Simply double click on the TWSS file to begin the import.

- If the software is unable to locate your TWSS file automatically, simply click Locate File instead at the top left of the screen and manually browse to where you have saved it. Your TWSS file will be in CSV file format.

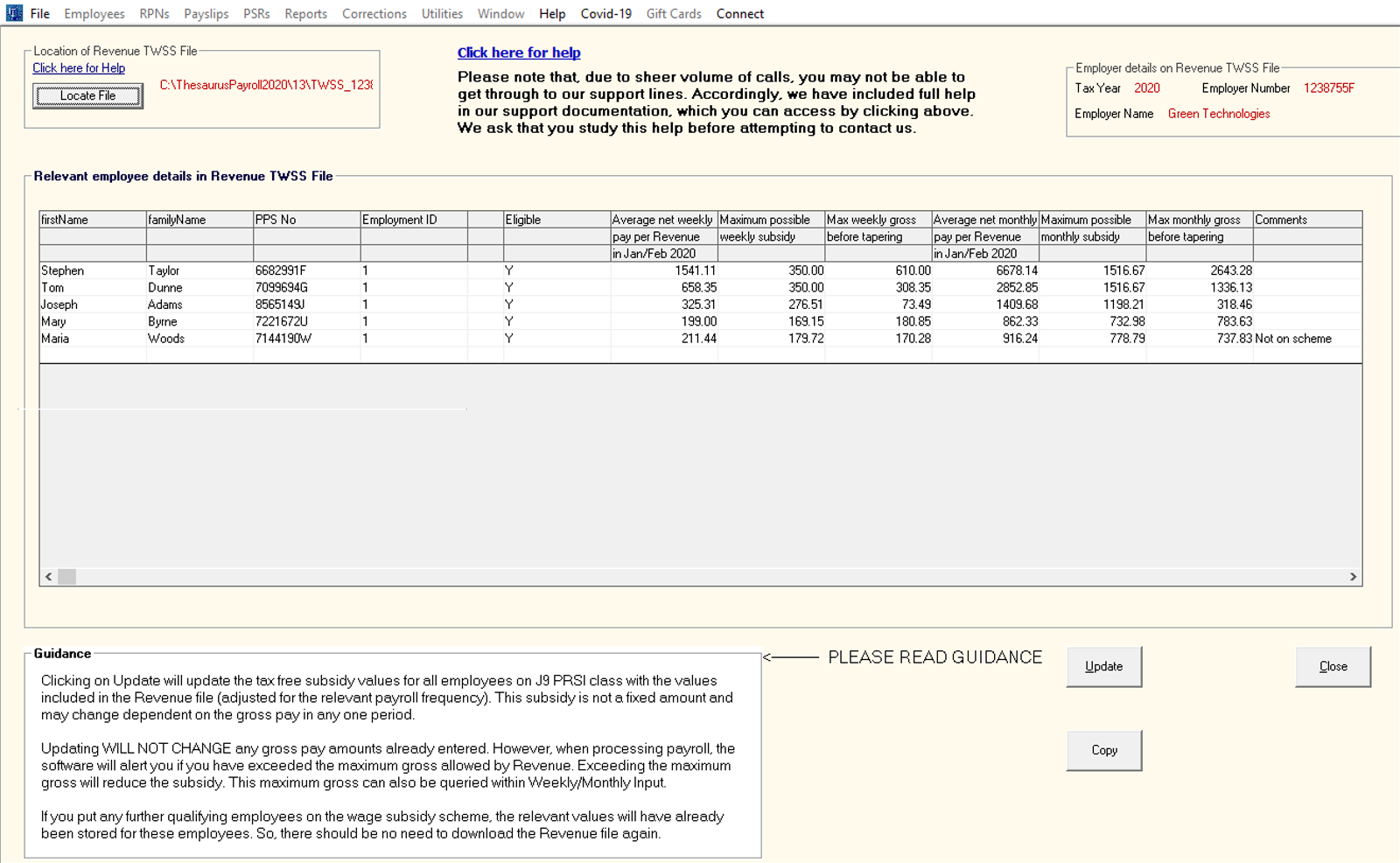

The information contained in the Revenue TWSS file will now be displayed on screen. Read the guidance panel first to understand how the information displayed will be applied in your payroll.

For each employee, the information displayed will confirm:

- whether they are eligible for the scheme or not

- their average net weekly/monthly pay for January and February 2020, as ascertained by Revenue

- the maximum weekly/monthly subsidy that can be paid to them

- the maximum weekly/monthly top-up amount that can be paid to them (before tapering applies)

- if the employee is currently not on the scheme (i.e. not on a J9 PRSI Class)

- When ready, click Update

Notes to the above:

- Clicking 'Update' will now update the tax free subsidy for all your employees on a J9 PRSI Class with the applicable values included in the Revenue TWSS file.

- Where an employee qualifies for the Temporary Wage Subsidy Scheme after you have imported the TWSS file, there is no requirement to import the TWSS file again. Simply assign the J9 PRSI Class to the employee within their 'Revenue Details' utility in their employee record and the subsidy amount instructed by Revenue will be automatically applied.

2) The importing of the TWSS file will not change any gross pay amounts you already have entered for each employee, so it is important to now review and amend any gross pay amounts, where necessary.

- To do so, go to Weekly/Fortnightly/Monthly Input

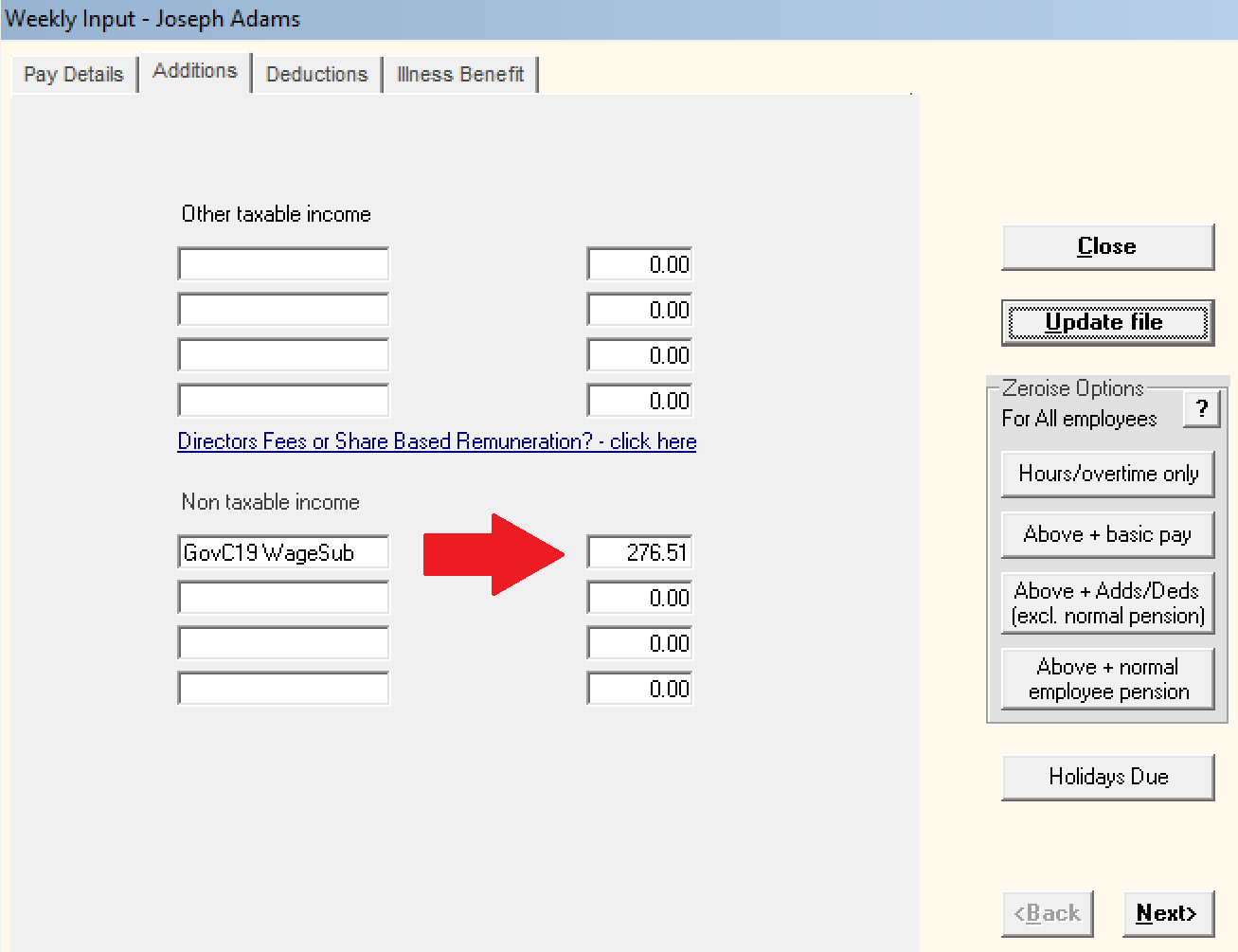

- Where an employee is on a J9 PRSI Class, their subsidy payment as instructed by Revenue will be automatically entered under their Additions tab:

- Next, review the employee's gross pay.

a) If you don't wish to top up your employee's subsidy payment, simply enter a basic pay amount of €0.01 - this €0.01 will act as a notional gross pay amount in order to generate a payroll submission.

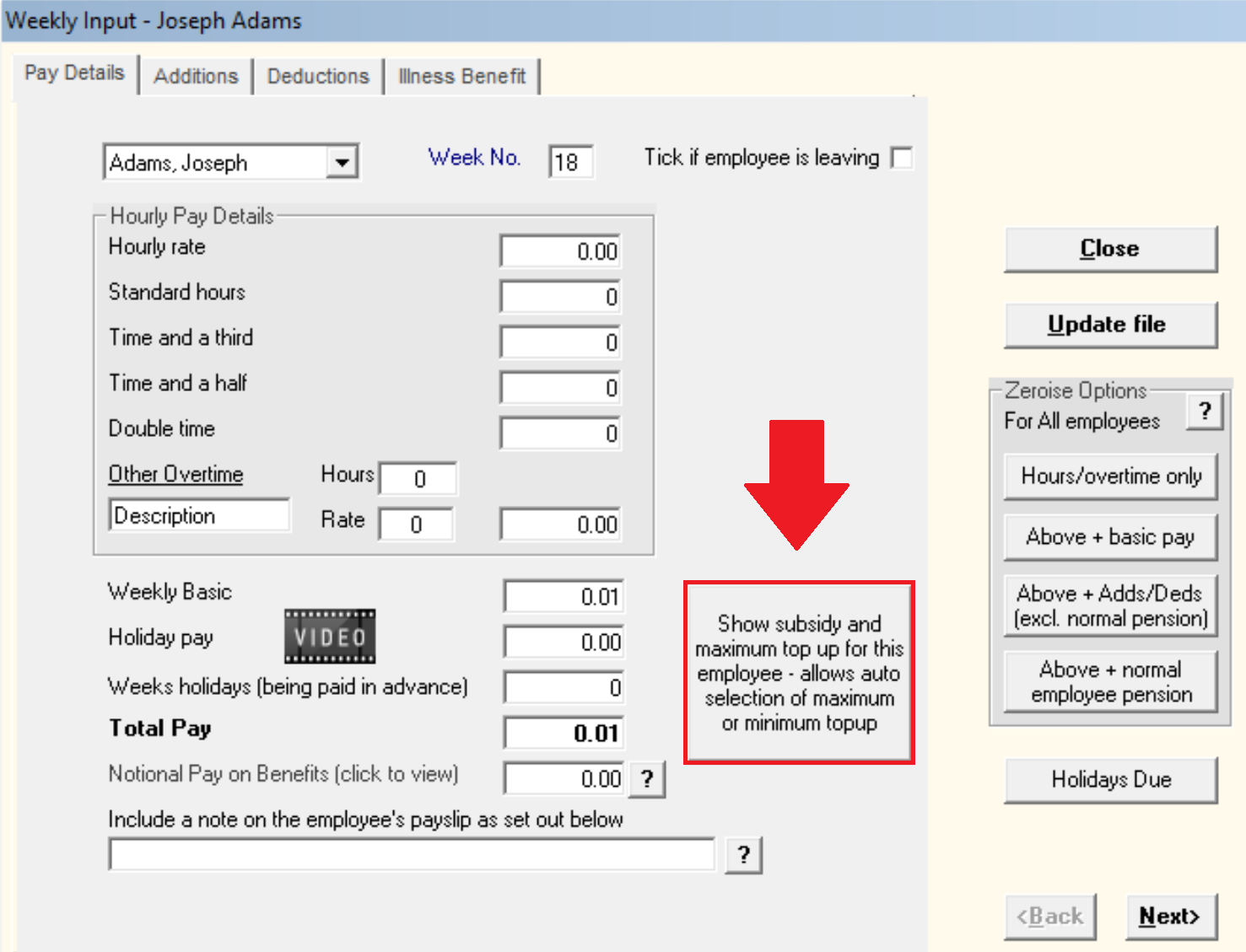

b) if you do wish to top up your employee's subsidy payment, click the 'Show possible subsidy and maximum top up available for this employee' button on the employee's Pay Details screen in order to establish the maximum top-up (gross pay) amount you can pay to the employee without affecting their subsidy payment:

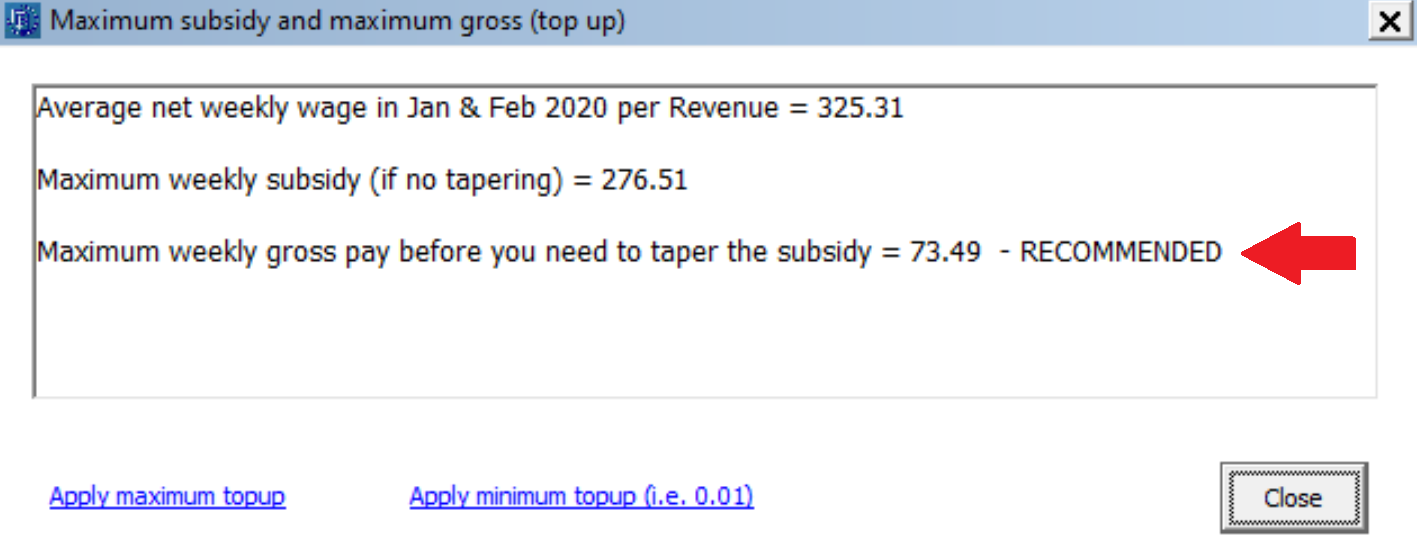

- An information screen will appear confirming this maximum gross pay amount as instructed by Revenue:

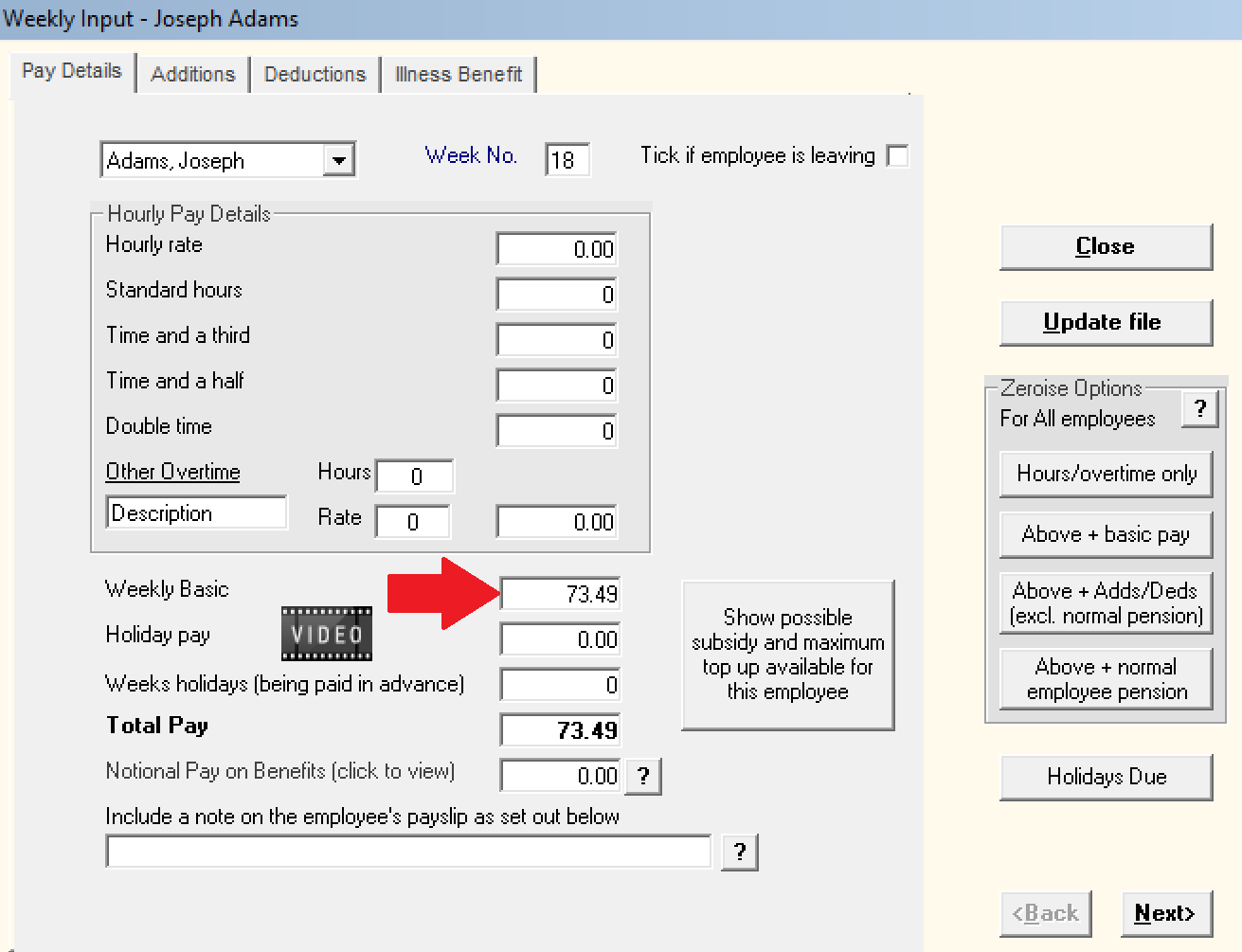

- Simply enter the appropriate top-up amount using the guidance provided.

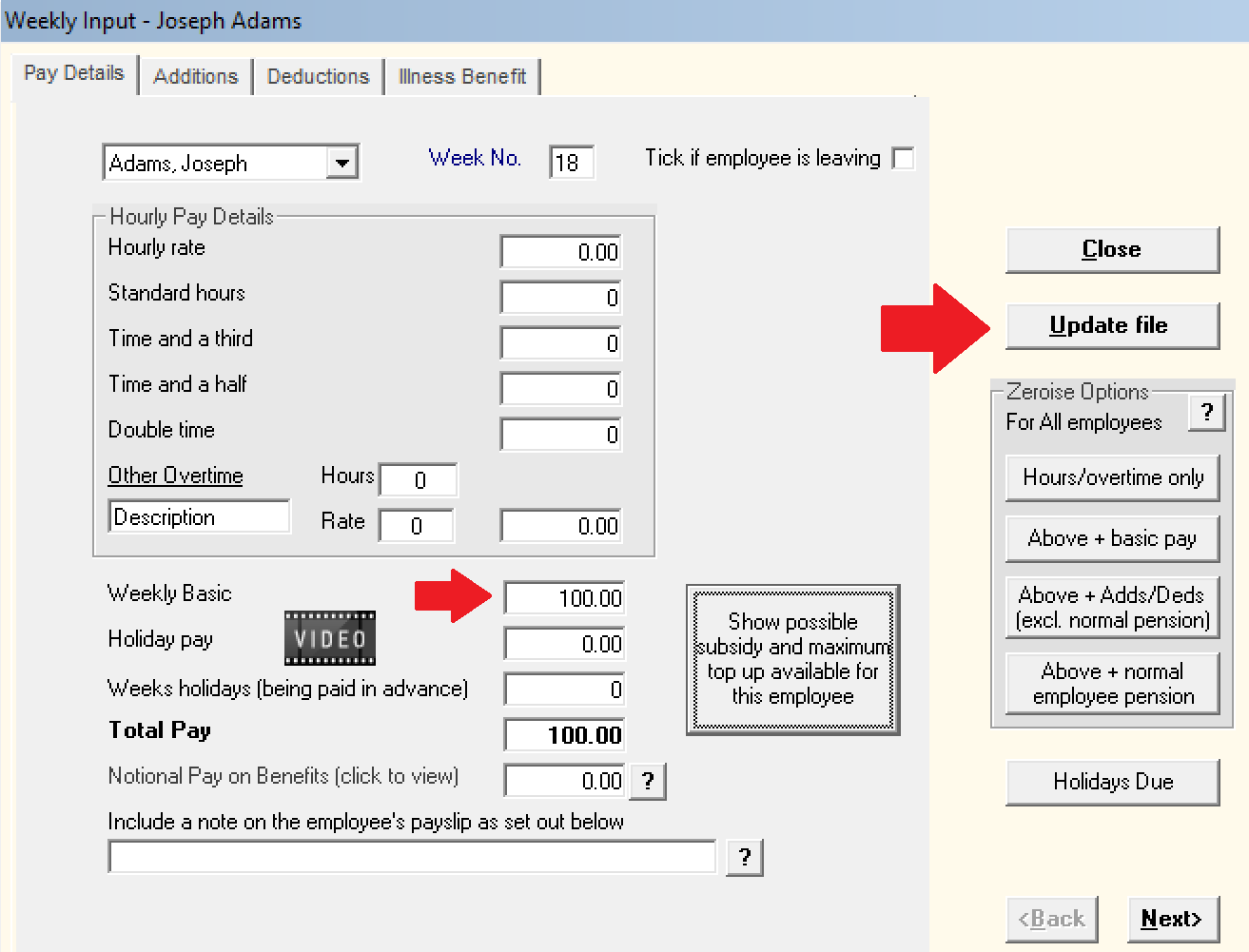

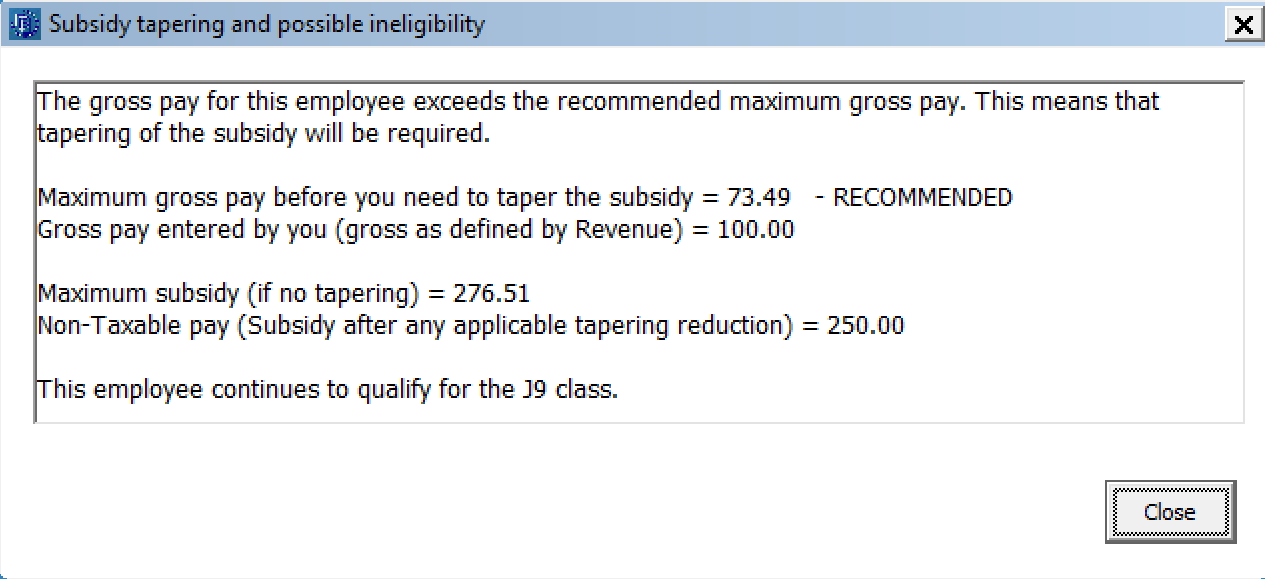

- In the event that you enter a top-up amount higher than the maximum gross pay amount instructed by Revenue, this will be brought to your attention when you click 'Update File'

- Where the top-up amount exceeds the recommended maximum gross pay amount instructed by Revenue, tapering of the subsidy will be required.

The information screen which will appear will confirm what the tax free subsidy amount will need to be reduced to if the gross pay is not decreased.

This screen will also confirm whether the employee will still qualify for the J9 class after tapering of the subsidy.

- To proceed, either reduce the employee's gross pay or reduce their subsidy amount, as required.

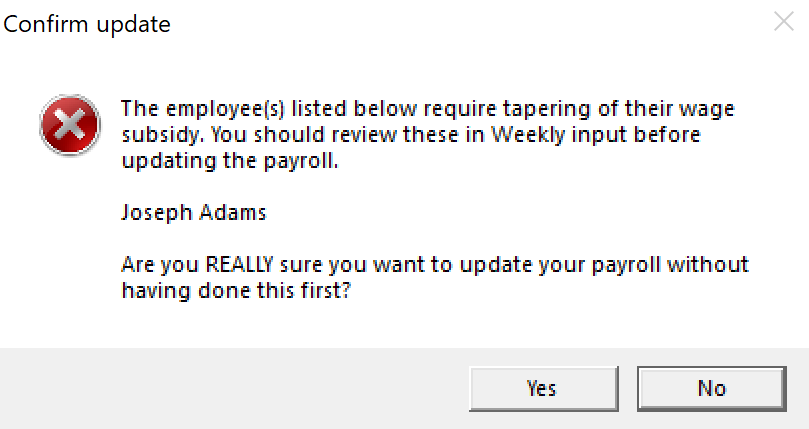

Please note: should you not reduce either, a further warning will be given at the time of updating your payroll:

- Repeat step 2 for each applicable employee, as required

- Update your payroll and submit your payroll submission (PSR) to Revenue in the normal manner.

Employees whose average weekly pay is higher than €960

The introduction of the operational phase means that the wage subsidy is now available to support employees where their pre-Covid salary was greater than €76,000, and their post-Covid salary has fallen below €76,000 (subject to the applicable tiering and tapering rules).

Removing an Employee from the Subsidy Scheme

To remove an employee from the Subsidy Scheme, simply change their PRSI Class from J9 back to their normal PRSI Class within the Revenue Details of their employee record.

Review the employee's payslip to ensure the correct gross pay is entered going forward.

Employer Refunds

During the Operational Phase, on receipt of your payroll submission, Revenue will refund the employer the subsidy amount that each applicable employee is eligible to receive (after any tapering required has been applied).

At a future date, Revenue will perform a reconciliation of employer refunds made to the employer from 26 March up to 4 May. Where necessary, Revenue will adjust the amount of future refunds that it will make to the Employer to take into account the difference between subsidy the employee was eligible for and the €410 that Revenue refunded to the employer during the Transitional phase.

Re-hires

Where employers re-hire staff who have been laid off due to Covid-19 or where one of their employees is re-hired by another employer, Revenue will issue an amended instruction which must be downloaded from ROS again and re-imported into the payroll software.

Employers/agents should therefore check before each pay run for any amended Revenue instruction.

Please note: where all employees have been processed as leavers within Thesaurus Payroll Manager, when ready to re-hire, the payroll can be advanced forward without updating each period in between.

This must be done before the new employees/re-hires are added to the payroll.

- Simply go to ‘Update Payslips’ and you will be asked for the period number you want to continue at.

- You will be prompted to enter the period number prior to the period you need to process e.g. if the next period employees are to be paid is week 21, enter week 20 at the prompt.

Also, when re-hiring an employee who has previously been made a leaver in the 2020 tax year, simply use the 'Leaver Rejoining?' option in Add/Amend Employees. This facility will allow you to 'Claim subsidy for this employee' or 'Do not claim subsidy for this employee' as per your requirements. A new Revenue instruction should then be checked for and imported into the software.

Disputes

Full Revenue guidance on the Operational Phase of the Temporary Wage Subsidy Scheme can be accessed here.

In the event that you wish to query the Revenue instruction you have received, you must contact Revenue directly.

The support team at Thesaurus Software will not be able to advise on these matters nor provide guidance which deviates away from the Revenue instruction you have received.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.