Do it all again!

Since the introduction of PAYE Modernisation, a dedicated facility is available within Thesaurus Payroll Manager in order to facilitate corrections that may be needed from time to time to your payroll.

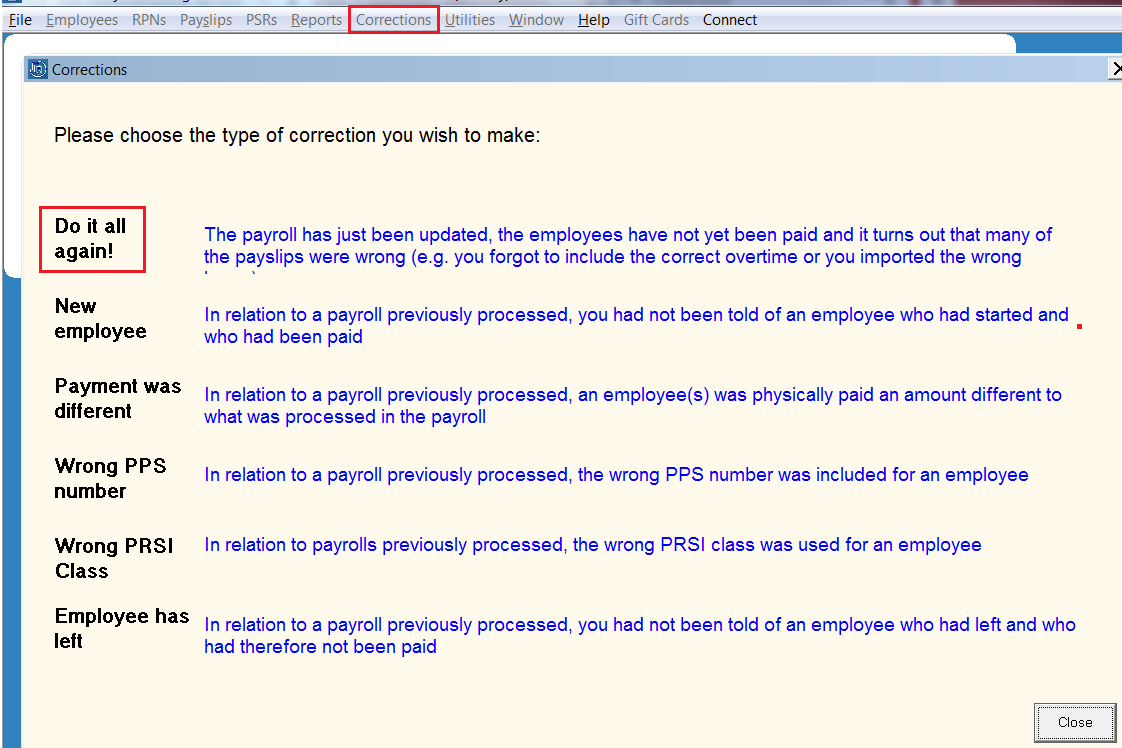

The Corrections utility can be accessed by clicking on 'Corrections' on the menu bar:

The correction type 'Do it all again', as highlighted above, is to be used the where the payroll has just been updated, employees have not yet been paid and one or more payslips need to be amended.

For example:

- you forgot to include overtime

- you imported the wrong hours

- you forgot to enter an employee's leave date in the current pay run

- you forgot to enter a new starter to be paid in the current pay run

Please note: since the introduction of PAYE Modernisation, the option to reverse an older update has been removed. Instead, corrections to earlier pay periods must be done on an individual basis. Please click here to return to the main Corrections menu in order to choose a relevant help topic from the listing based on the correction type you need to perform.

To perform this type of correction:

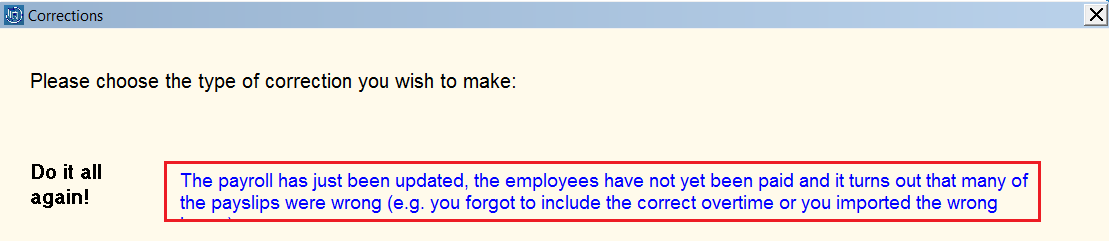

- Click on the statement for 'Do it all again':

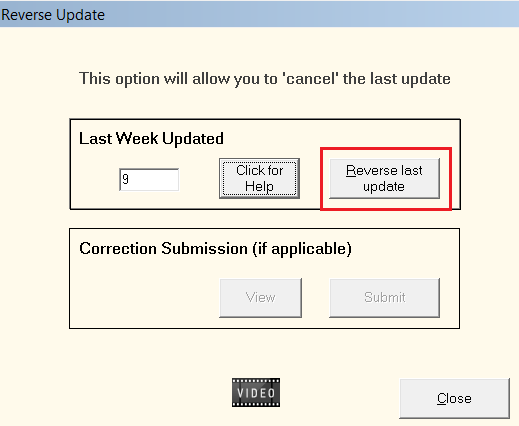

- You will now be prompted to reverse your last update.

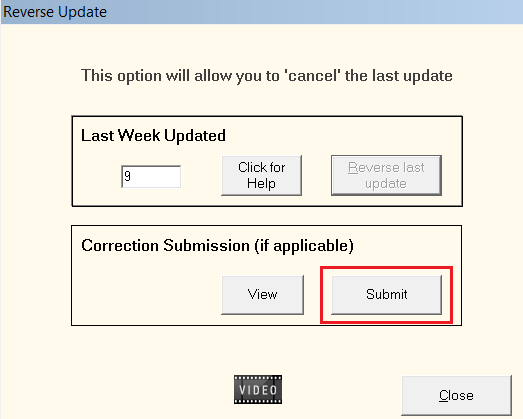

Click 'Reverse last update':

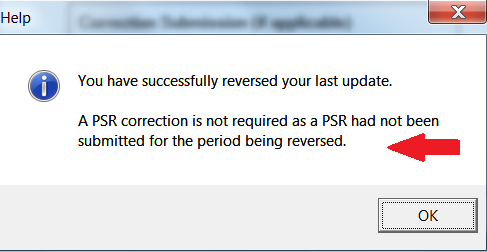

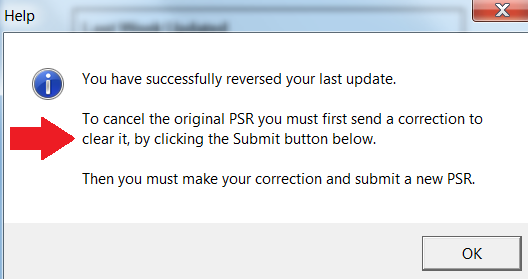

A confirmation message will now appear to confirm that you have successfully reversed your last pay period.

- If you had not yet submitted the PSR to Revenue for the period being reversed, it will be brought to your attention that a correction submission will not be required. Simply click 'OK' to proceed to carrying out the corrections you need to make:

- If, however, you had already submitted the PSR to Revenue for the period now being reversed, you will now be prompted to submit a correction submission to cancel it:

- Click 'Submit' to cancel the original PSR sent to Revenue:

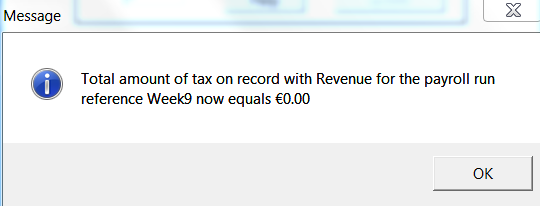

- A confirmation prompt will subsequently be received to confirm that the original PSR has now been cleared:

You are now ready to make the necessary corrections to your payroll.

It must be noted that all original pay details entered for the pay period just reversed will be retained by the software. Thus, it will not be necessary to re-enter payment details for all employees where corrections are only required for specific employees.

- On completion of the amendments required, it is recommended that a final payroll preview is performed using Process Icon No. 4

- Then when ready to do so, update the pay period using Process Icon No. 5

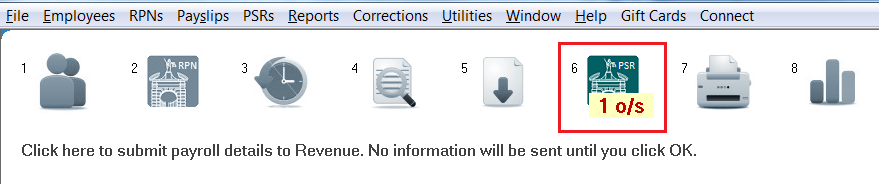

- A new PSR will now be automatically created for submission to Revenue. Simply click Process Icon No. 6 to submit this to Revenue:

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.