Making a payment through the Payments & Refunds utility in ROS

Revenue facilitate the following payment methods for your returns:

- credit card

- debit card

- using your bank account

- ROS Debit Instruction

- Fixed direct debit/ Variable direct debit

The following payment methods are available to use within either the Statement of Account utility or the Payments & Refunds utility within ROS:

- credit card

- debit card

- using your bank account

- ROS Debit Instruction (if registered for this)

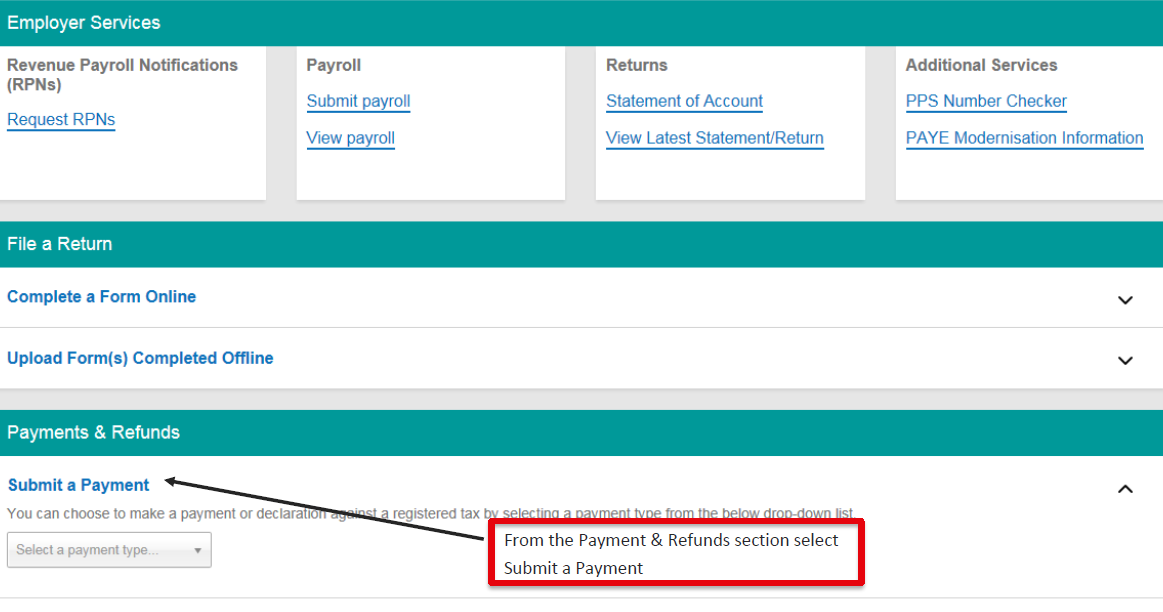

Making a payment through the Payments & Refunds utility in ROS

- Log in to your ROS account in the normal manner

- Go to My Services > Payments & Refunds > Submit a Payment

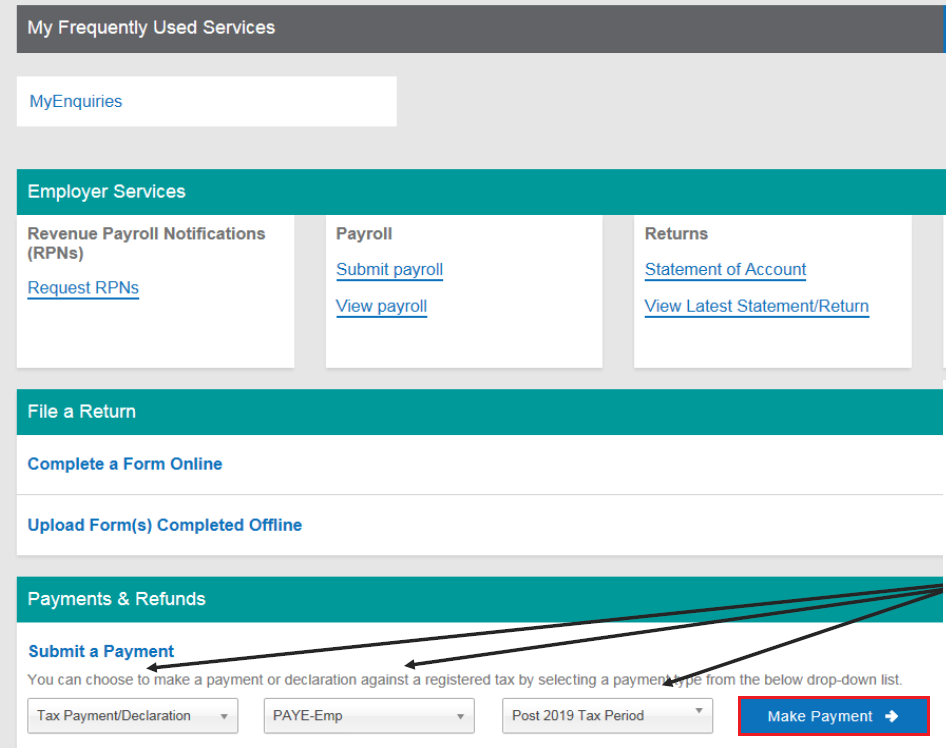

- For Payment Type, select Tax Payment/Declaration from the drop down listing

- For Tax Type, select PAYE-Emp from the drop down listing

- Select the applicable Period from the drop down listing

- Click Make Payment to continue

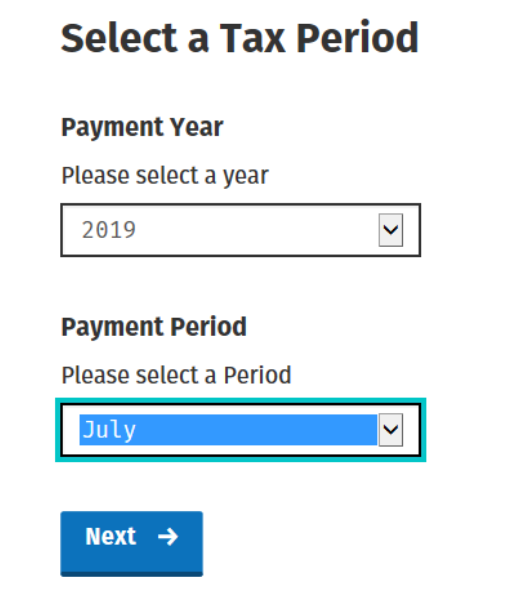

- On the next screen, select the Payment Year and Payment Period you wish to pay. Click Next.

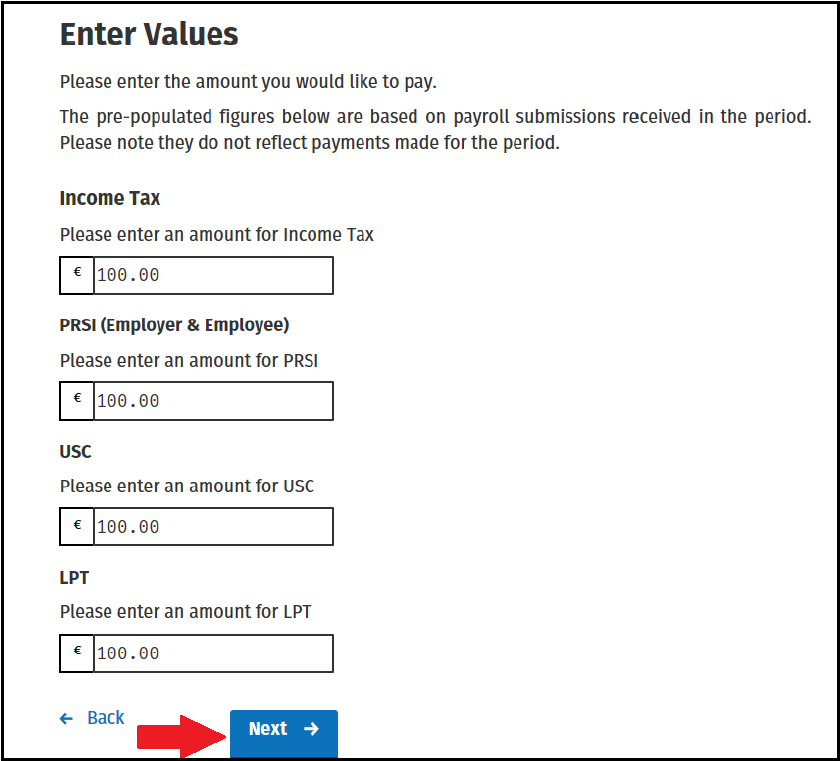

- The pre-populated figures displayed will be based on all the periodic payroll submissions received in the period selected for payment:

Please note: If any interim payments have been made already for this period, these will not be reflected here.

a) simply click Next if the pre-populated amounts are correct or

b) amend the figures accordingly, if required, before proceeding

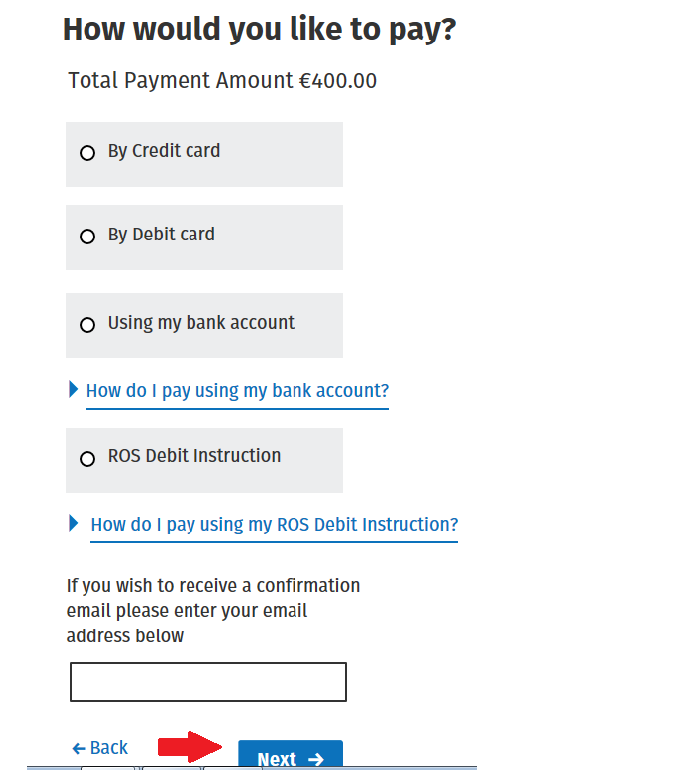

- On the next screen, select how you would like to pay.

Please note: the ROS Debit Instruction option will only be available if this has been set up in ROS. - Based on the payment method selected, complete the steps provided to you.

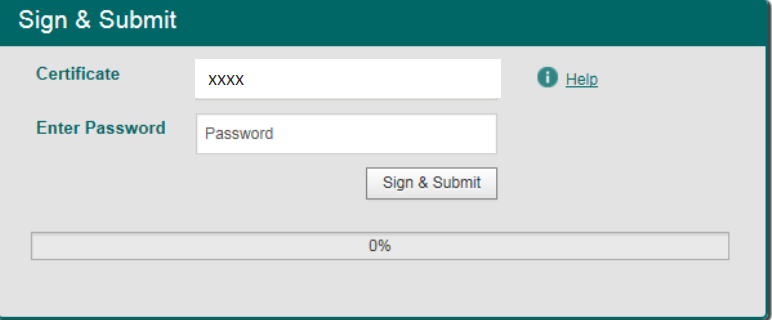

- Once all steps have been completed, you will be presented with the Sign & Submit screen.

Enter your certificate password and click Sign & Submit to submit your payment

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.