Universal Social Charge (USC) - Calculations

Some important points relating to the calculation of the Universal Social Charge (USC):

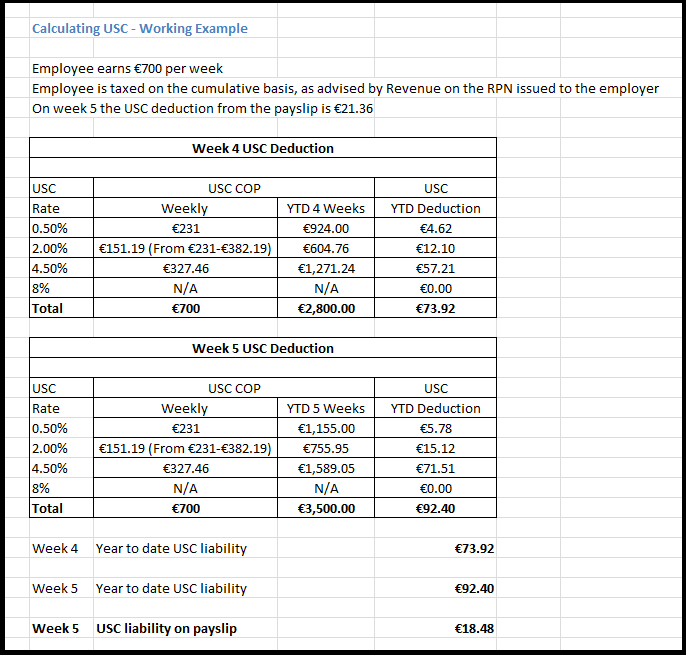

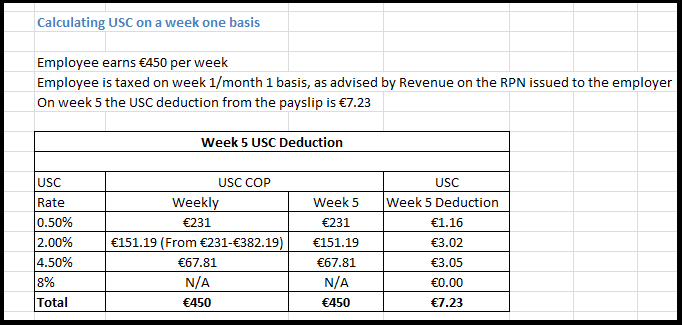

- The Universal Social Charge is collected in the same manner as PAYE and on the same calculation basis

- There is no USC relief on pension contributions

- USC is payable on gross income, including Notional Pay, before employee pension contributions.

Employers are notified of the specific USC deduction method for each individual employee in the same manner as they are notified about an employee's PAYE deductions, i.e. on the Revenue Payroll Notification (RPN) on an employee by employee basis.

USC Exemption Marker

Where the employer holds an RPN which does not show exemption and the employee/pensioner advises them that USC exemption applies to them, the employee/pensioner should be instructed to contact their local Revenue office to arrange to have a revised RPN issued. While awaiting a revised RPN the employer should continue to use the RPN currently held.

Calculating USC on Week 53

You will need to instruct the software if the additional USC cut off points are not applicable to an employee.

To prevent the additional USC cut off points being allocated go to:

Employees > Add/Amend Employees > Select the employee > Click the Revenue Details tab > Tick to indicate exemptions/exclusions apply > tick to exclude the employee from the week 53 USC concession > update to save the change.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.