2023 Budget - Employer Summary

Pay As You Earn (PAYE)

- There is no change to tax rates for 2023 - the standard rate will remain at 20% and the higher rate at 40%

- The Standard Rate Cut Off Point (SRCOP) has been increased by €3.200

- The Personal Tax Credit has been increased by €75 from €1,700 to €1,775

- The Employee Tax Credit has been increased by €75 from €1,700 to €1,775

Earned Income Tax Credit

- The Earned Income Credit has been increased by €75 from €1,700 to €1,775

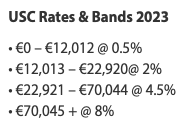

Universal Social Charge (USC)

- Exemption threshold remains at €13,000

- The 2% USC rate band has been increased by €1,625, from €21,295 to €22,920

- There are no changes to the rates of USC

- For 2023, USC will apply at the following rates for those earning in excess of €13,000:

- Medical card holders and individuals aged 70 years and older whose aggregate income does not exceed €60,000 will pay a maximum rate of 2%.

- The emergency rate of USC remains at 8%.

- Non-PAYE income in excess of €100,000 will continue to be subject to USC at 11%.

National Minimum Wage

- The National Minimum Wage will increase by 80 cent from €10.50 to €11.30 per hour from January 1st 2023.

Pay Related Social Insurance (PRSI)

- The weekly threshold for the higher rate of employer PRSI will increase to €441 from €410 - this is in line with the increase in the National Minimum Wage.

Social Welfare

- There will be a €12 increase in all weekly Social Welfare payments with effect from January 2023. The maximum personal rate of Illness Benefit will be increased to €220 per week. Maternity Benefit, Parent’s Benefit and Paternity Benefit will be increased to €262 per week.

VAT

- The reduced rate of 9% VAT for the tourism and hospitality sector will continue to apply until the 28th February 2023.

Extension of BIK Exemption for Electric Vehicles

- The BIK exemption for battery electric vehicles will be extended out to 2025 with a tapering effect on the vehicle value. This measure will take effect from 2023. For BIK purposes, the original market value of an electric vehicle will be reduced by €35,000 for 2023, €24,000 for 2024 and €10,000 for 2025.

- There are no changes to tax credits, cut off points or the rates of PAYE

- There are no changes to the rates of Universal Social Charge (USC)

- The Earned Income Tax Credit will increase by €150 to €1,500

- The Home Carer Tax Credit will increase by €100 to €1,600

- Benefit In Kind will remain as 0% on electric vehicles provided by an employer to an employee until 2022

MINIMUM WAGE INCREASE - 1st FEBRUARY 2020:

- The National Minimum wage will increase from €9.80 to €10.10 from 1st February 2020.

- Employers should also note that the minimum wage for younger workers will also increase as follows:

- Aged 19: €9.09

- Aged 18: €8.08

- Under 18: €7.07

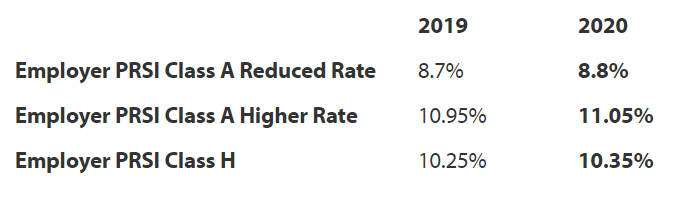

PRSI:

- The National Training Levy which is collected as part of Employer PRSI increases by 0.1% from 0.9% to 1% in 2020 to fund further and higher education.

- As a result of the change to the minimum wage from 1st February 2020, the Class A employer PRSI threshold will increase from €386 to €395, effective from the 1st February 2020 also.

PARENT'S LEAVE & BENEFIT BILL

The Parent's Leave and Benefit Act 2019 introduces two weeks' paid parents leave for any child born / adopted on or after 1st November 2019, in order to allow working parents to spend more time with their baby or adopted child during the first year.

- Parent's Leave is available to both parents and can be taken as a continuous period of two weeks or in two separate one week blocks.

- Such leave must be taken within 52 weeks of the birth of the child or in the case of adoption, from the date the child is placed with the employee. In the case of multiple births, a parent will only be able to claim parents leave once.

- Where an employee has enough PRSI contributions, they will be entitled to a Parent’s Benefit of €245 per week, paid by the Department of Employment and Social Protection (DEASP).

- Employers are not obliged to pay an employee while they are on parent’s leave, however some employers may choose to 'top up' an employee's pay during the leave period.

Further information on Parent's Leave and Parent's Benefit can be found here

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.