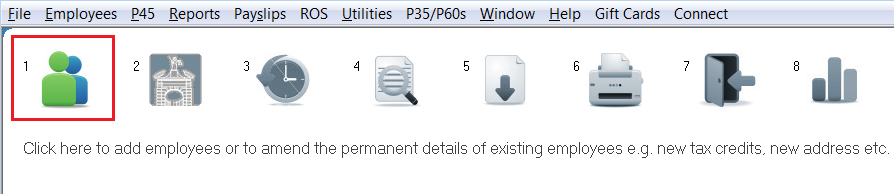

Setting up Additions

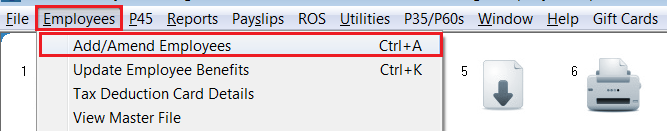

or Employees > Add/Amend Employees:

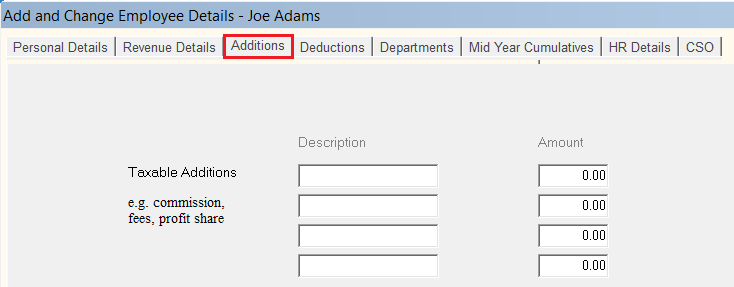

Within the employee record, select the 'Additions' tab:

Please note: before proceeding you must first determine if the addition you wish to set up for an employee is 'taxable' or 'non taxable'.

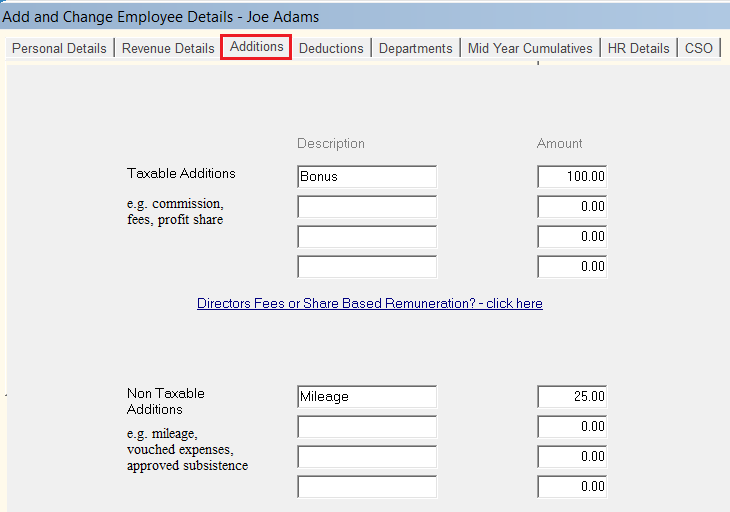

Taxable Additions (Commission, Bonus etc)

- Enter a Description of the Taxable Addition e.g. bonus

- Enter the Amount

- If this is a once off addition, remember to revert the amount entered to zero in the next pay period

Non-Taxable Additions (Subsistence, Mileage etc)

- Enter a Description of the Non-Taxable Addition e.g. subsistence, mileage etc.

- Enter the Amount

- If this is a once off addition, remember to revert the amount entered to zero in the next pay period

- Click Update to save the employee information

All additions entered will appear separately on the employee's payslip.

Specifying end dates for Additions

A utility is available within the software which allows you to specify a date on which a particular addition should end.

For assistance with this, click here

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.