Pension Related Deduction (PRD) or Pension Levy

Since 1st March 2009 the Pension Related Deduction must be applied to the remuneration of public servants.

Who does the Pension Related Deduction apply to?

What pay does the Pension Related Deduction apply to?

The Pension Related Deduction applies to all Schedule E remuneration covering all elements of gross pay, including overtime, arrears, all taxable allowances, Notional Pay on Benefits and taxable portions of Illness Benefit.

PRSI Relief on Pension Related Deduction Abolished

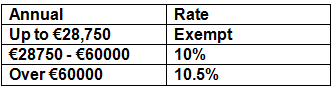

PRD RATES AND THRESHOLDS 2018

The exemption threshold for 2018 is €28,750.

Issuing P45 to an Employee with a Pension Related Deduction within two years of commencement

SETTING UP THE PENSION RELATED DEDUCTION WITHIN THESAURUS PAYROLL MANAGER

For the purposes of setting up the Pension Related Deduction within Thesaurus Payroll Manager the deduction will be known as Pension Levy throughout the program.

- Select the Employee to whom the deduction will apply.

- The Pension Levy must be entered into the “Other Allowable Deduction” field as indicated.

- To enter the Pension Levy simply type “Pension Levy” into this dedicated narrative field, once you start to type the narrative the program will automatically complete the field for you.

Payslips > Weekly Input/Monthly Input >

- Select the Employee from the drop down list to whose earnings the Pension Levy applies.

- Select “Deductions”. The Pension Levy deduction will automatically calculate in line with the rates and bands and this automated deduction amount will be shown.

- To view the calculation of the Pension Levy simply double click on the amount. A breakdown of earnings across each band and with the applicable rate will be shown.

Adjust the Pension Levy (override)

Should you disagree with the automated calculation of the Pension Levy calculated by the program then simply type the desired deduction over the automated deduction amount. This manually entered amount will now be applied to the employee’s salary.

Alternatively, you can enter an overriding PRD percentage to apply on a week one/month one basis e.g. 10%.

Payslips

The Pension Levy will display separately on the Employees Payslip under its official title of “Pension Related Deduction”.

Issuing a P45 to an employee

The Department of Finance indicates that once a P45 has been issued to an employee from whom the Pension Levy has been deducted a statement of Pension Related Deductions should accompany the P45.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.