Quick Edit Entry

Due to the nature of the Quick Edit screen (to allow ease and quick pay detail input), not all features that are available within the Weekly/Monthly/Fortnightly Input utility are available within the Quick Edit utility e.g. the option to enter a note on a employee's payslip.

The Quick Edit utility facilitates Gross to Net payments only.

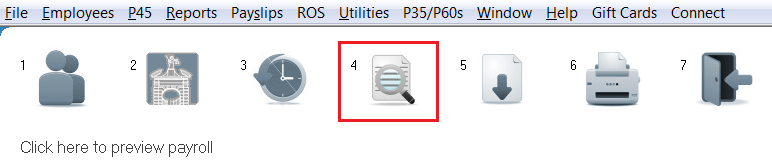

To use the Quick Edit utility, go to Process ICON no. 4 or Payslips > Payroll Preview/ Quick Edit:

If you Pay by the Hour

If you pay your employee(s) by the hour then enter hourly rate for the employee. Each period, enter the numbers of hours worked for that period within the relevant fields (Standard Hours, Time and a third, Time and a half, Double time) - the hourly rate will automatically be adjusted accordingly).

Remember that if you enter the hourly rate and the hours worked, then do not enter the amount again in the 'Weekly/Monthly/Fortnightly Basic' field - this will result in the number of hours multiplied by the hourly rate PLUS the periodic basic figure.

If you pay by a Weekly/Monthly/Fortnightly Basic

If you pay your employee(s) by a basic rate then enter the basic gross wage in the Weekly/Monthly/Fortnightly Basic field.

Holiday Pay

If you are including holiday pay within a pay period then enter the amount of additional pay within the 'Holiday pay' field to be added to this period payslip.

If processing weekly payroll and the holiday pay is to represent future pay weeks, then enter the number of ADDITIONAL weeks to which this holiday pay figure relates. The total pay will then be spread over the current week PLUS the number of additional weeks entered. The user will be prevented from processing any further payroll within the weeks flagged as holiday weeks as tax credits, SRCOP, PRSI and USC will have been automatically allocated to the total pay figure in advance. The employee will automatically be reactivated for processing once the holiday weeks have passed.

Recording Holiday/ Leave taken when using the Quick Edit option:

You may wish to wait to record holidays taken once all employees wage details have been updated, to save exiting this menu to access another menu and repeatedly changing menu options. To record the number of holidays/leave days taken, or to view the automated holiday entitlements calculated, you can access the employee's Holiday Calculator under Employees > Holidays, Sick Leave etc. Any automated calculations are calculated on the information entered by the user to date.

Weeks Sick Leave/Not Worked

If processing fortnightly or monthly payroll, if an employee isn't to be paid for one full week (or more if monthly payroll), e.g. if they haven't worked/been out sick, indicate this accordingly. This will adjust the number of insurable weeks the employee is entitled to.

Additions/Deductions

If you wish to include additions and/or deductions to your employee(s) salary, all the additions and deductions options are shown on screen. Simply type the associated narrative in the relevant box on the left hand side, under the appropriate addition or deduction heading, and enter the amount of the addition/deduction in the box to the right hand side. The narrative and amount will be displayed separately to the basic pay details on the payslip.

Click on OK to update the employee's pay details and to return to the main employee listing to select the next employee.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.