Guidance for businesses impacted by December 2021 public health restrictions

Please note: the Employment Wage Subsidy Scheme (EWSS) has now ended.

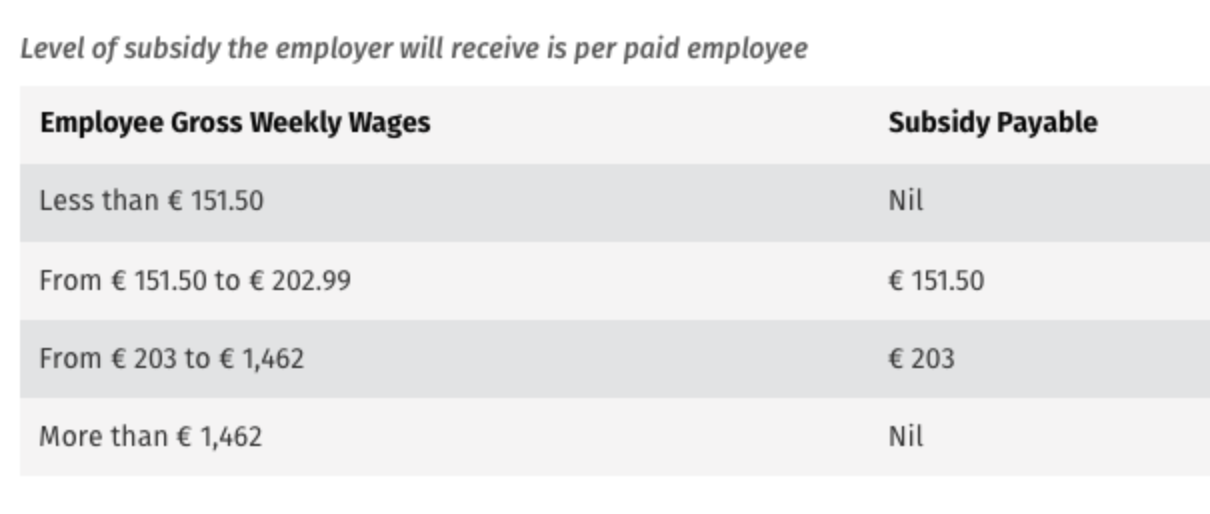

If you are a business that was directly impacted by the specific terms of the Public Health Restrictions (PHR) introduced in December 2021, additional support has been announced which extends the EWSS scheme for a further month, with the following subsidy payment structure in place:

- For February 2022 the enhanced rates of subsidy will continue to apply

- For March 2022, the following two-rate structure of €151.50 and €203 will apply:

- A flat rate subsidy of €100 will then apply for April and May 2022.

Employer PRSI:

In addition, the 0.5% rate of employers PRSI will continue to apply to employments that are eligible for the subsidy until the end of February 2022.

Operating EWSS for employees that qualify for the EWSS extension in Thesaurus Payroll Manager

From the 1st February 2022, for eligible businesses who meet the EWSS eligibility rules and wish to claim this additional EWSS support, this must be administered through the payroll.

The steps to complete within the software are provided below.

Step 1 - Start claiming for EWSS-PHR for Eligible Employees

Should you have any employees that qualify for the EWSS extension because your business was impacted by the Public Health Restrictions (PHR) introduced in December 2021, you must first instruct the software which employees you wish to claim this for.

This instruction will place an EWSS marker entitled 'EWSS_PHR' on your payroll submission for each applicable employee, which in turn will notify Revenue which employees you wish to claim EWSS-PHR for.

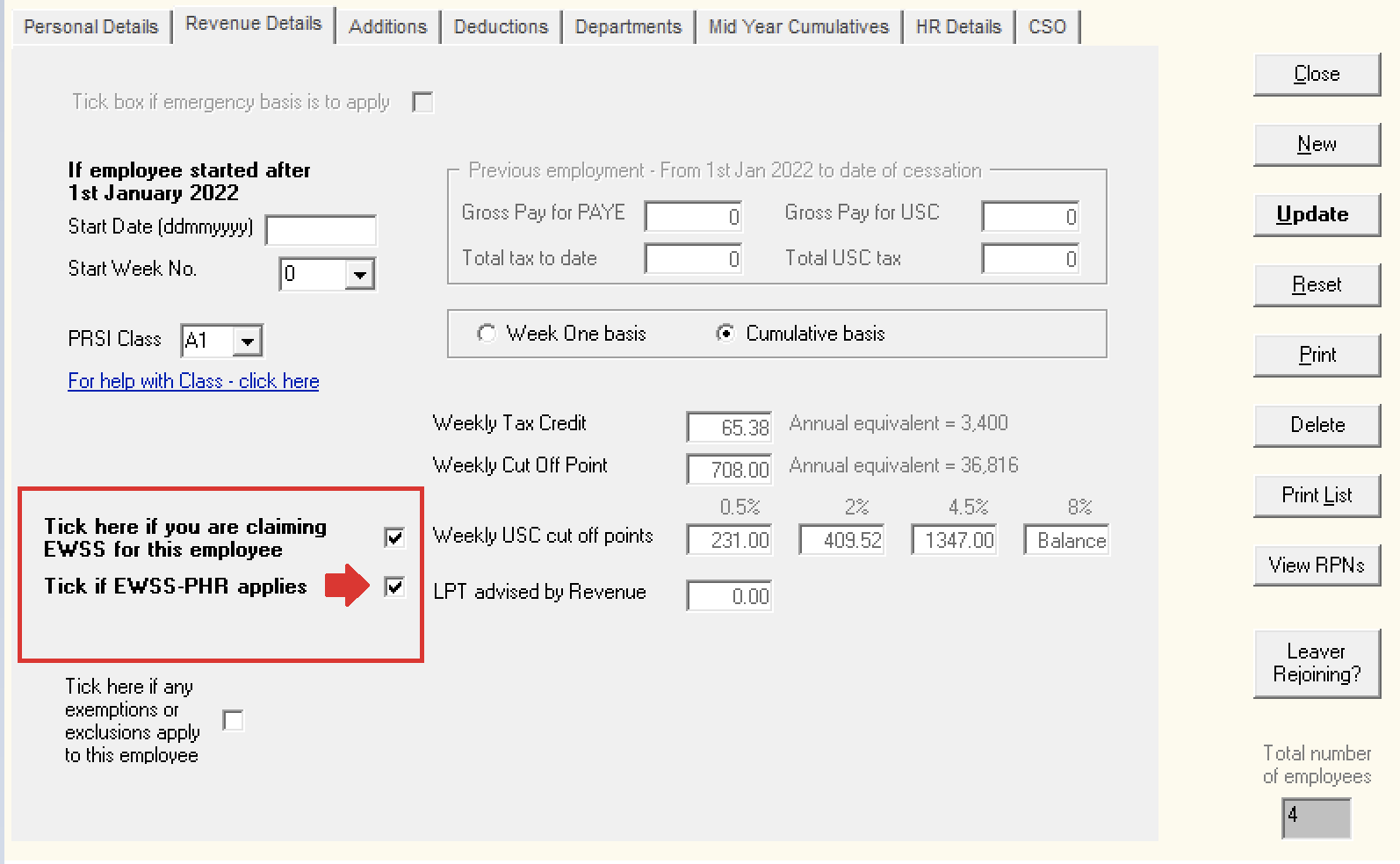

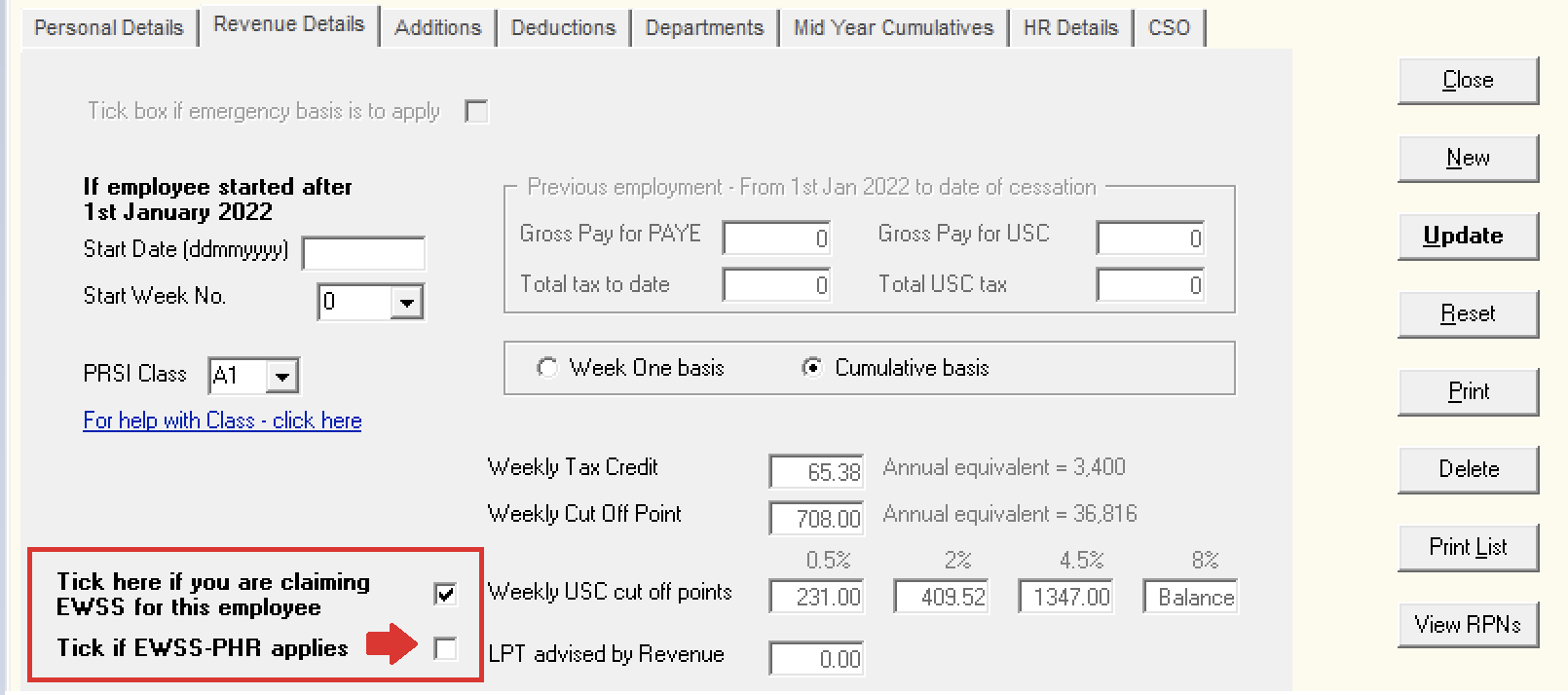

a) This instruction can be done on an individual basis by accessing an eligible employee's record within 'Add/Amend Employees'.

- Within 'Revenue Details', tick to indicate that 'you are registered for EWSS and this employee is being claimed for', followed by 'Tick if EWSS-PHR' applies'

- Click 'Update'

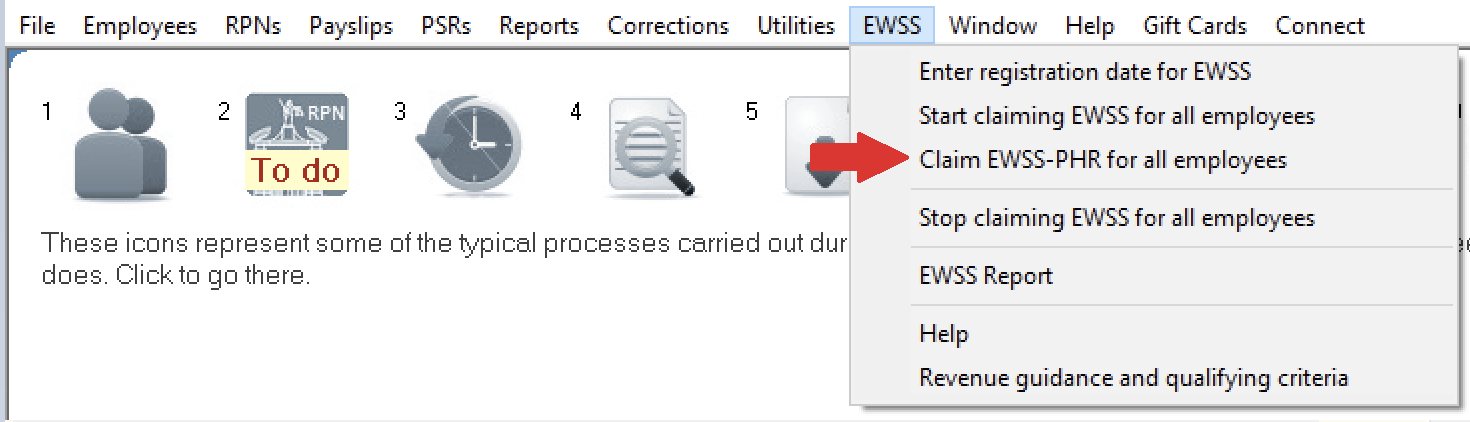

b) Alternatively, a utility is available within the EWSS menu to simultaneously set the EWSS-PHR marker for all employees on your selected pay frequency, should this apply:

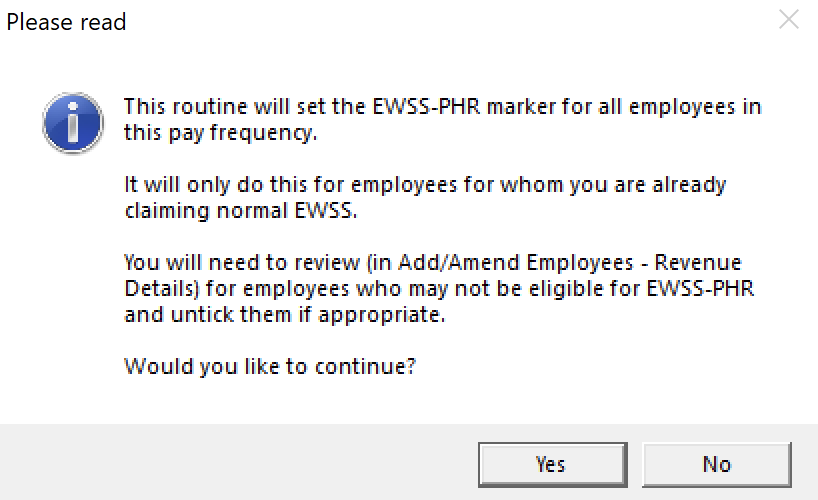

Important Note

When using this utility, the following message prompt will advise you to subsequently review any employees afterwards within Add/Amend Employees who may not be eligible for EWSS-PHR:

Where you are aware that an employee isn't eligible for EWSS-PHR, simply access their employee record within Add/Amend Employees and untick the EWSS-PHR marker within their Revenue Details utility, followed by 'Update':

Step 2 - Process your Payroll

After performing step 1, simply process your payroll in the normal manner.

Under EWSS, employers are required to pay the employee as normal, calculating income tax, employee PRSI and USC in the normal manner.

On finalising each pay run, your associated payroll submission (PSR) will notify Revenue of the employees you wish to claim the EWSS-PHR for. Submit this to Revenue in the normal manner.

On receipt of your payroll submission, Revenue will then determine the applicable subsidy amount payable.

Important Note

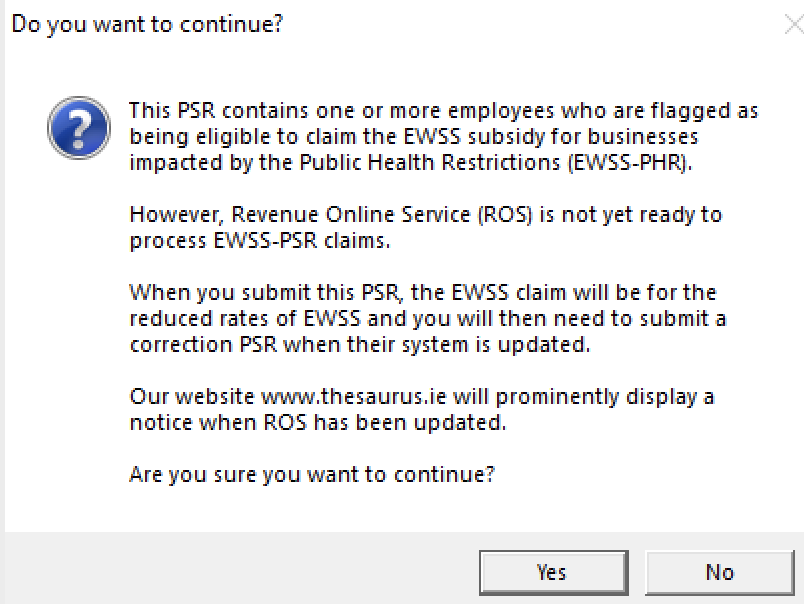

While Revenue have instructed that PSRs with EWSS-PHR claims can be made for employees paid after 1st February 2022, they have also advised that ROS may not be ready to process such a PSR until 4th February 2022.

Where it is detected that you are attempting to submit such a PSR before Revenue's systems are ready, this will be brought to your attention on screen.

In this instance, you should still submit the relevant PSR, however the EWSS subsidy amounts you will initially receive will be for the reduced rates of EWSS only.

Once Revenue's systems are ready to process EWSS-PSR claims, a correction PSR must subsequently be sent from within Thesaurus Payroll Manager to claim the correct amount of EWSS-PHR due to you.

Our website www.thesaurus.ie will prominently display a notice when ROS has been updated to notify you accordingly.

How to submit a Correction PSR:

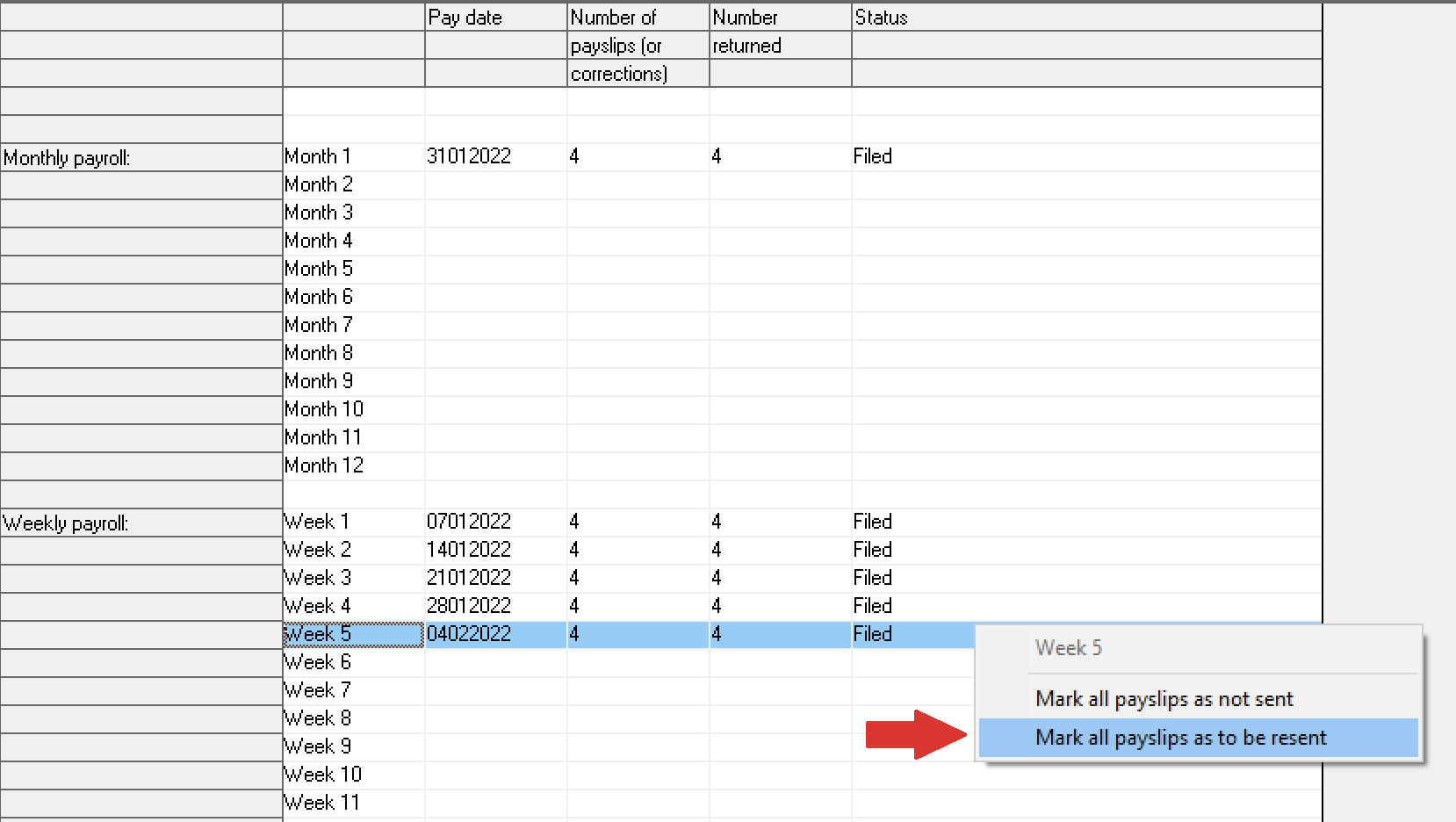

- Go to PSR > Control Panel

- Right click on the relevant PSR, followed by 'Mark all payslips as to be resent'. Select 'Yes' to continue.

- Double-click on the same PSR to now re-submit to Revenue.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.