Processing a Post Cessation Payment - Out of Year

Thesaurus Payroll Manager facilitates the processing of a post cessation payment to an employee who has left your employment in the prior year.

Firstly, an employee record must be set up for the employee:

- go to Employees > Add/Amend Employees and select 'New'

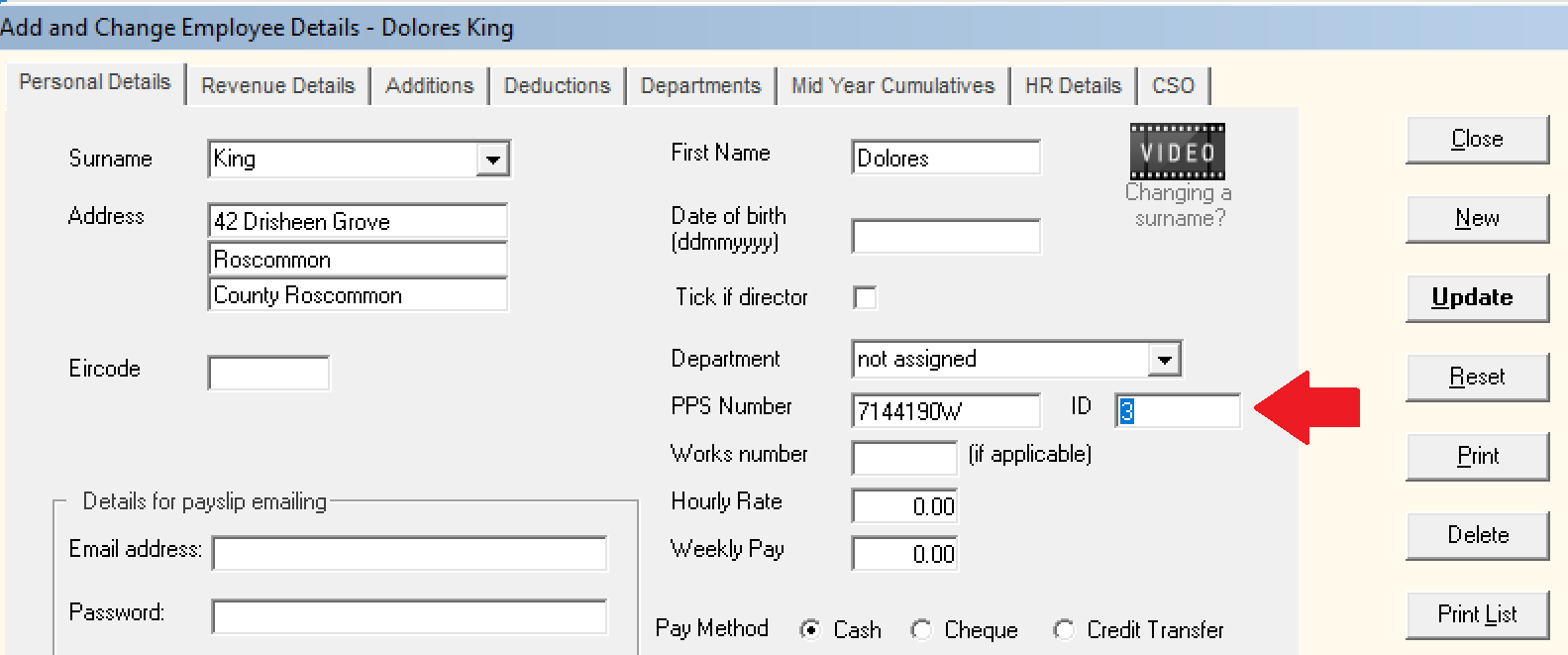

- Complete the Personal Details accordingly

- In Revenue Details select the employee's PRSI class

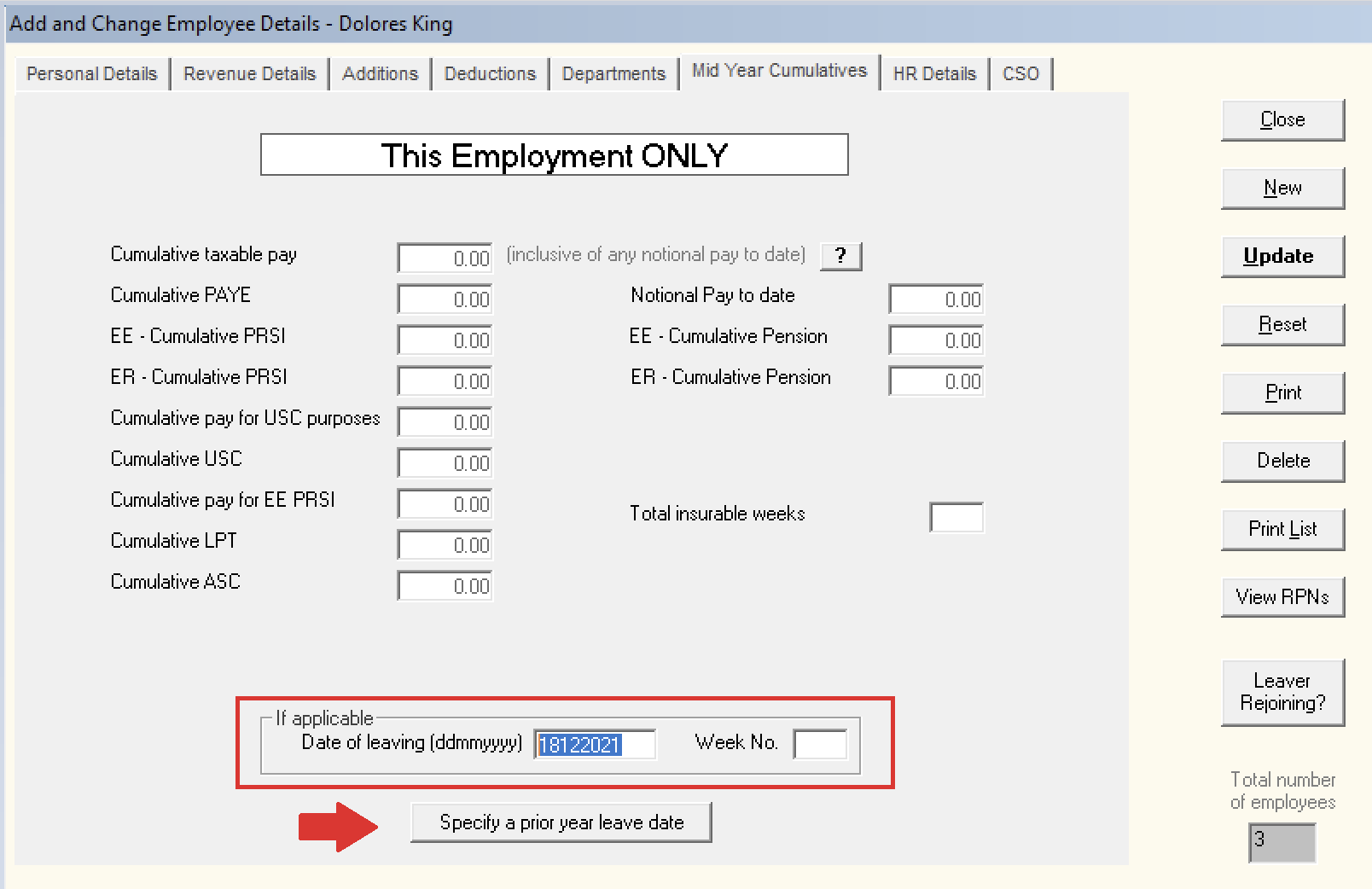

- In Mid Year Cumulatives, click 'Specify a prior year leave date' and enter the employee's original cessation date in the field provided

- You must now ensure that the Employment ID in this employee record agrees with previous submissions made for this employee.

If this needs to be amended, return to the employee's Personal Details screen and enter in the correct Employment ID

- Click Update to save the employee's record.

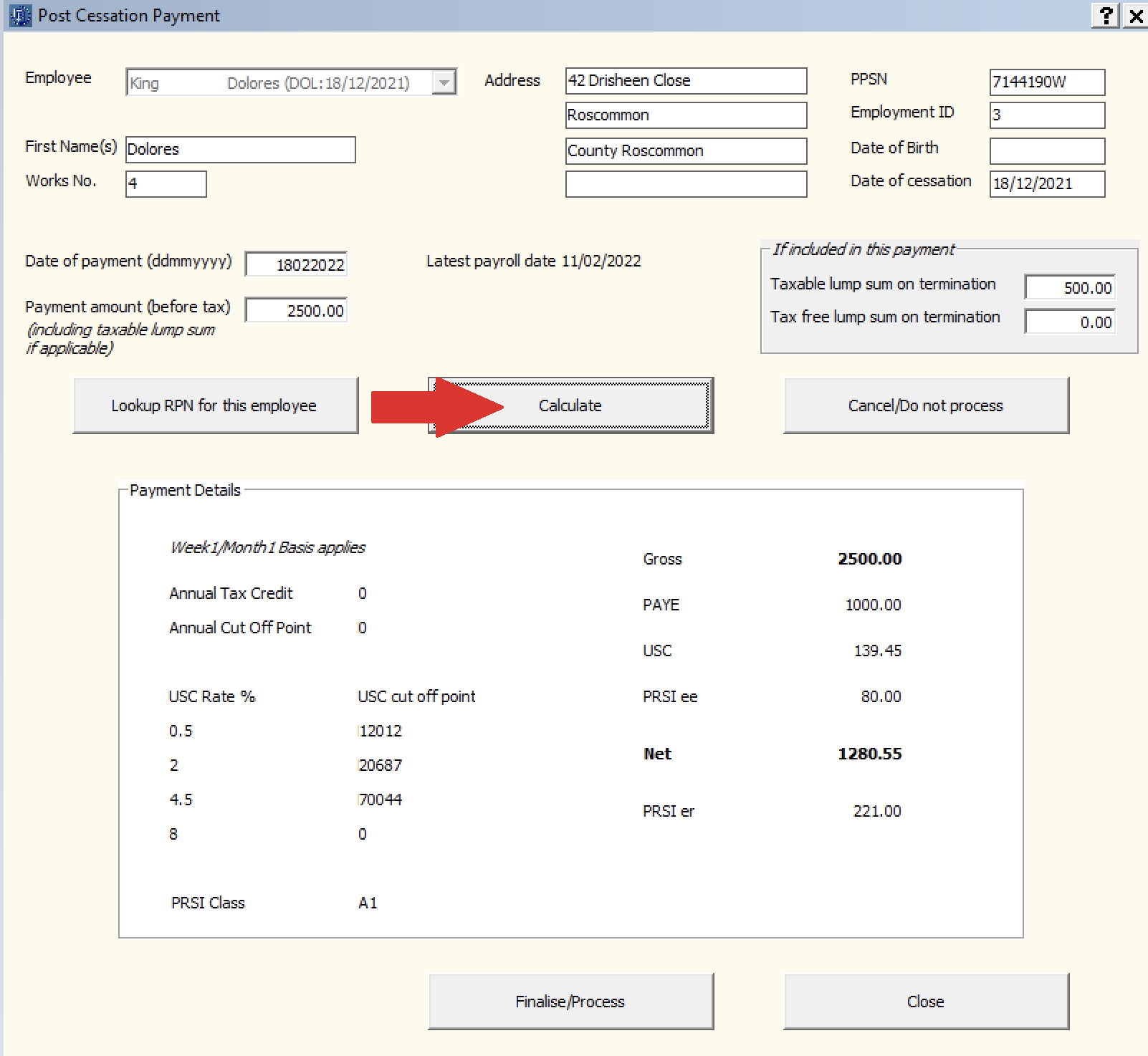

You are now ready to process the post cessation payment:

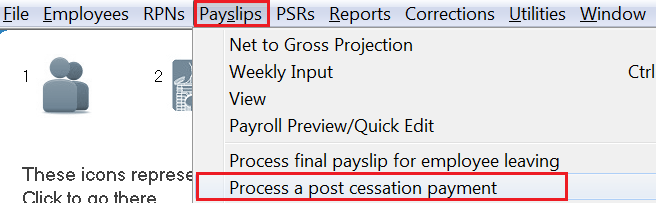

- go to Payslips > Process a post cessation payment

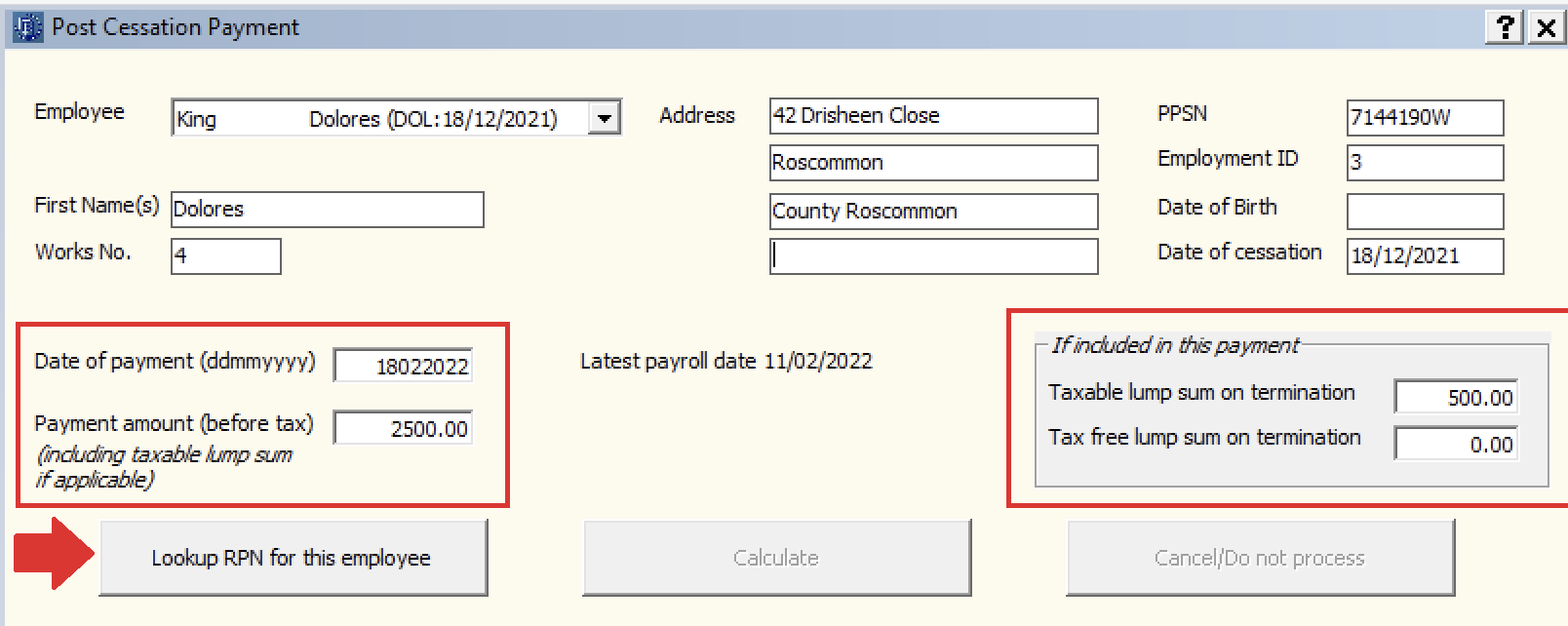

- select the employee using the drop down listing

- Enter the Date of payment in the field provided

- Enter the Payment amount (before tax) - this is the gross payment amount, including any taxable lump sum amount if applicable.

- If a taxable or non-taxable lump sum on termination is to be included in the payment, enter these accordingly in the dedicated fields provided.

- Next, click Lookup RPN for this employee.

The software will automatically connect to Revenue and retrieve the tax credits and cut off points to apply to the payment.

- Click Calculate. A breakdown of the deductions and the employee's Net Pay will be displayed on screen.

- Click Finalise/Process to complete the process.

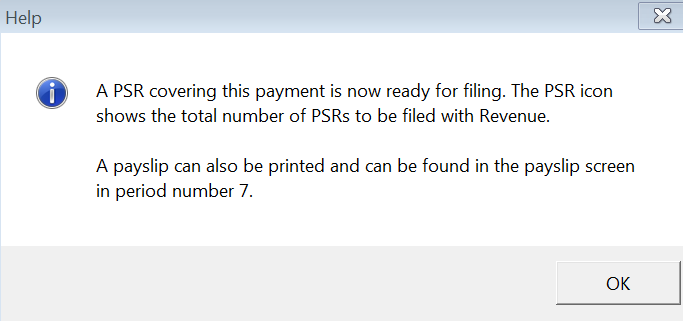

A PSR containing details of the post cessation payment will now be created for submission to Revenue, when ready. This PSR will also include the employee's original employment ID and original cessation date, in order for Revenue to know this is a post cessation payment.

A payslip for the employee will also be available for printing/emailing within the Print/Email Payslips utility (Process icon no. 7).

- Click OK, followed by Close.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.