Entering Mid Year Cumulatives

Important Notes

- This section of the software is only to be used if you have chosen to start using Thesaurus Payroll Manager mid tax year and you already have payroll records for your employees in the tax year up to this point and you wish to continue where you have left off.

- This is one of the most important sections within the payroll software. Cumulative pay information entered here will then determine the amount of PAYE, USC etc. that the employee will pay going forward. With this in mind, users should ensure that the cumulative details for each employee are correct before proceeding to process any payroll.

Entering Mid Year Cumulatives

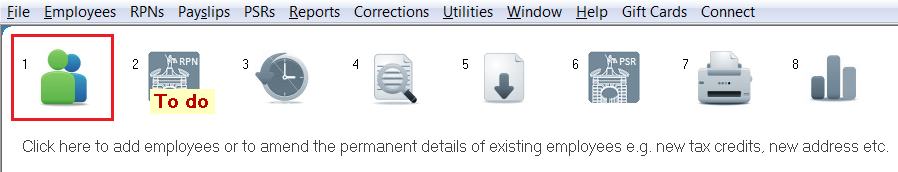

To enter mid year cumulatives, go to Process ICON no. 1:

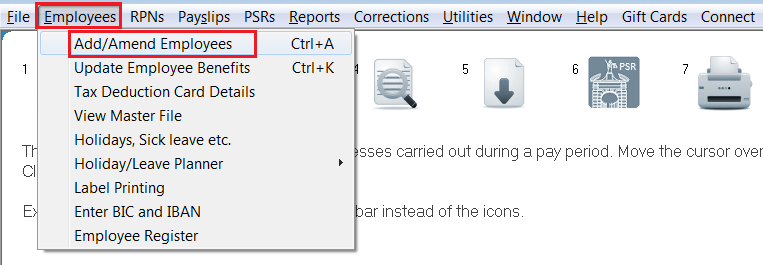

or Employees > Add/Amend Employees:

- Specify the Start Week/Month number for which Thesaurus Payroll Manager is to process as the first pay period

- Complete the employee's personal details screen, revenue details screen etc. as required

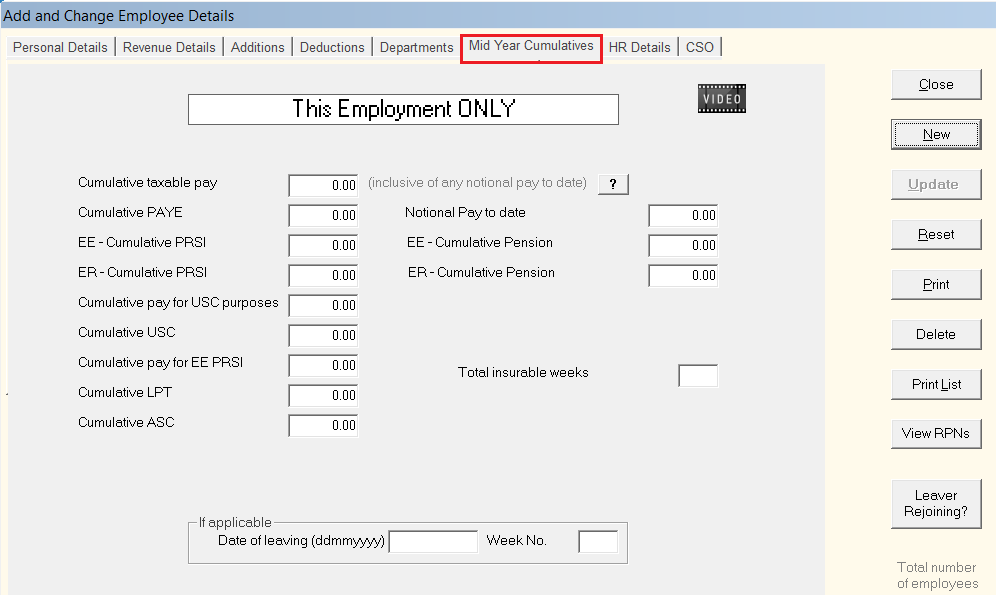

- Within the employee record, select the 'Mid Year Cumulatives' tab:

-

Enter the Cumulative Taxable Pay (This employment only)

-

Enter the Cumulative PAYE (This employment only)

-

Enter the Employee Cumulative PRSI (This employment only)

-

Enter the Employer Cumulative PRSI (This employment only)

-

Enter the Cumulative Pay for USC (This employment only)

-

Enter the Cumulative USC (This employment only)

-

Enter the Cumulative Pay for EE PRSI (This employment only)

-

Enter the Cumulative Local Property Tax (LPT ) (This employment only)

-

Enter the Cumulative ASC (Additional Superannuation Contribution) (This employment only)

-

Enter the Notional Pay to date if applicable

-

Enter the Cumulative Pension EE if applicable

-

Enter the Cumulative Pension ER if applicable

-

Enter the Total insurable weeks of employment - this refers to the number of weeks the employee has been paid so far in this tax year in this employment.

-

Click Update to save the employee's pay information

Please Note: If the employee has income and deductions from a previous employment that has taken place in the same tax year, then the employee's Revenue Details section will be automatically updated with their previous employment amounts when the first RPN is retrieved for them in the software (unless employee is on a week 1/ month 1 basis in the RPN).

It is only the income and deductions from THIS employment which should be entered to the Mid Year Cumulatives screen.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.