New Employee

Following the introduction of PAYE Modernisation, a dedicated facility has been introduced within 2019 Thesaurus Payroll Manager in order to facilitate corrections that may be needed from time to time to your payroll.

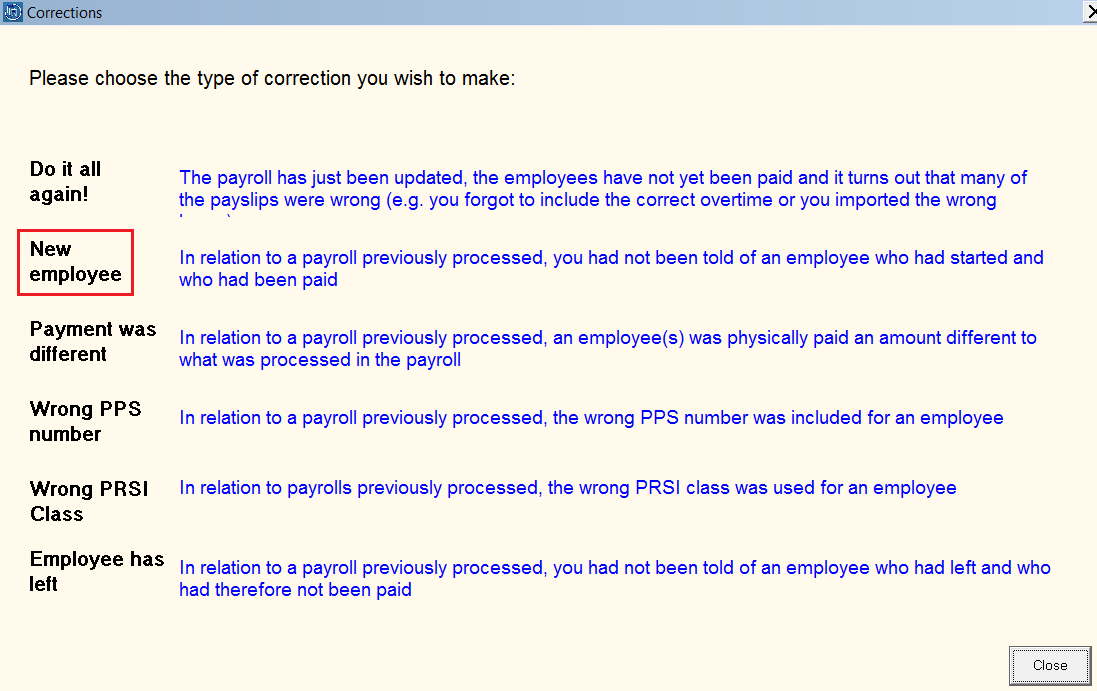

The Corrections utility can be accessed by clicking on 'Corrections' on the menu bar:

The correction type 'New employee' as highlighted above is to be used where, in relation to a pay run previously processed, you had not been told about a new starter and the new starter had also been paid.

To perform this type of correction:

- First ensure that an employee record is set up for the new employee in Add/Amend Employees. For assistance with this click here

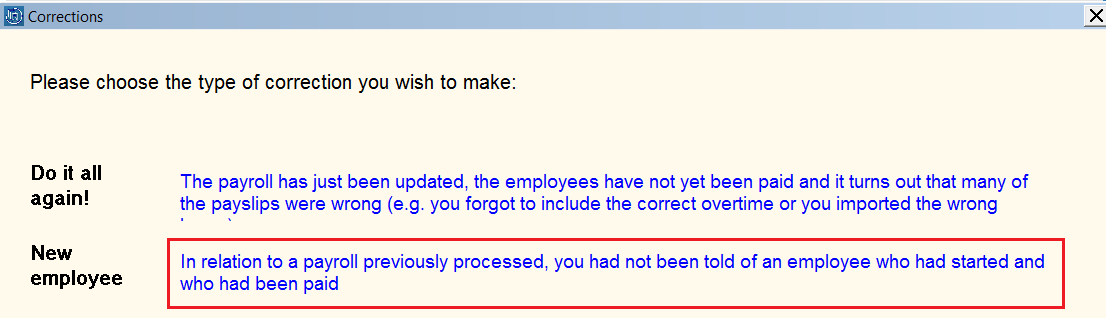

- Next, select 'Corrections' on the menu bar, then click on the statement for 'New employee':

This will open the 'Payment details for missed employees' utility.

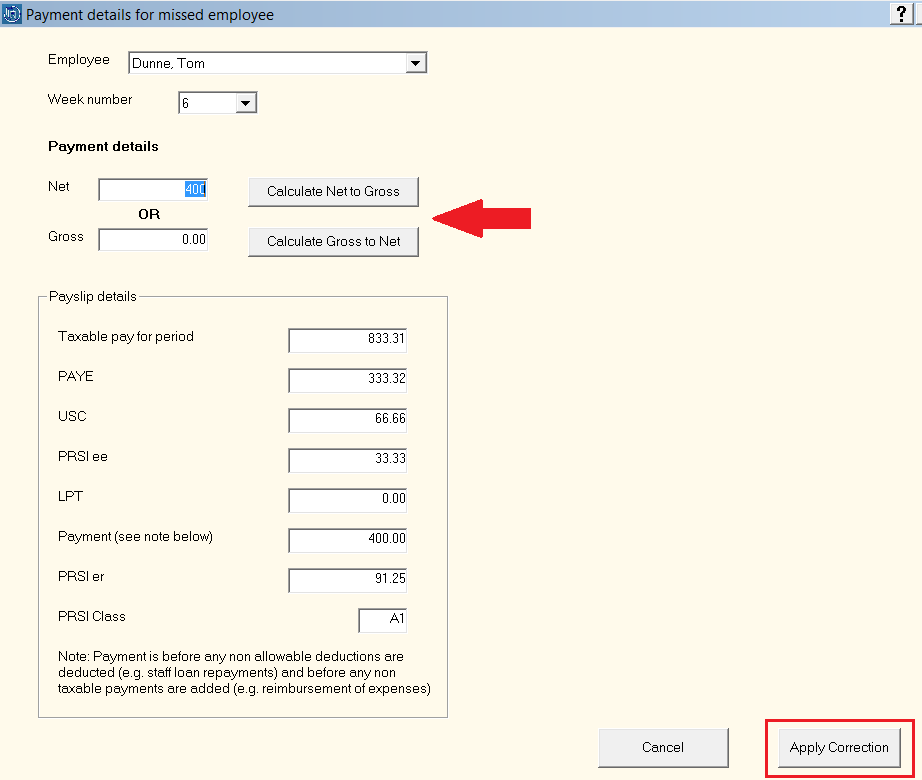

- Select the missed employee from the drop down menu

- Based on the employee's start date that has been entered within their employee record, the utility will default to the pay period the start date aligns with.

- Under Payment Details, enter the employee's net or gross pay figure accordingly.

a) If entering a net figure, click Calculate Net to Gross

b) If entering a gross figure, click Calculate Gross to Net

The software will now determine the applicable deductions based on the pay entered.

Please note: the payment amount displayed is before any allowable deductions are deducted (e.g. staff loan repayments) and before any non taxable payments are added (e.g. expense reimbursements).

- If happy to proceed, simply click 'Apply Correction'. The relevant number of Correction PSRs will now be prepared by the software.

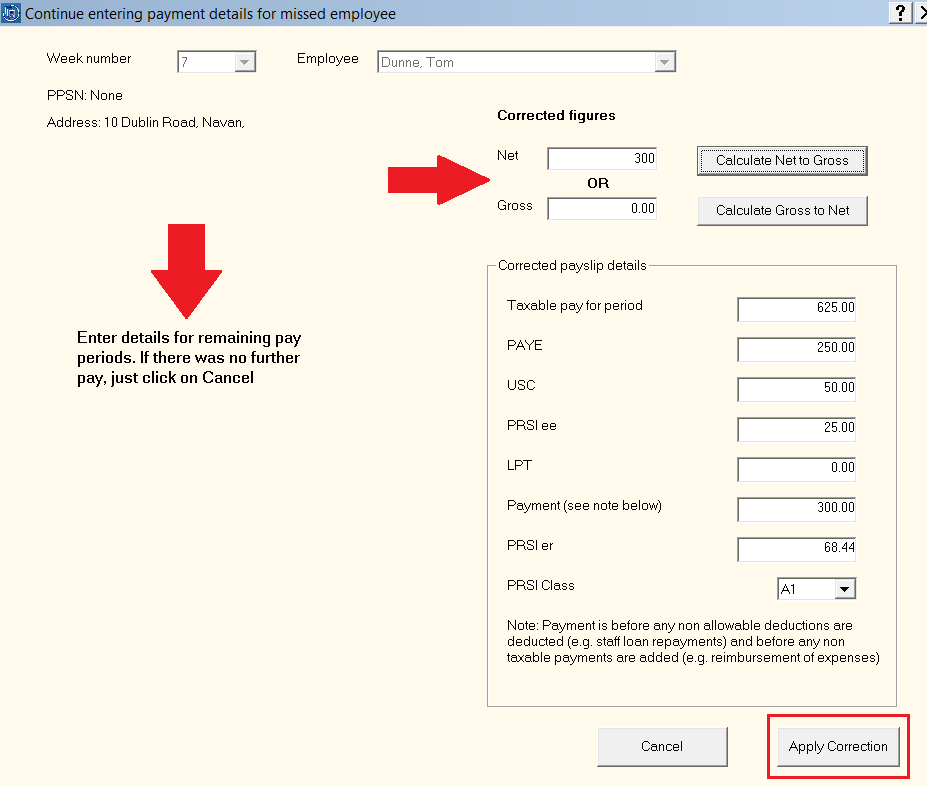

- If there are further pay periods for which the new employee received pay, repeat the same process by entering either the periodic gross pay or net pay amount that the employee received and clicking 'Apply Correction'.

- When all applicable pay periods have been completed, click Close.

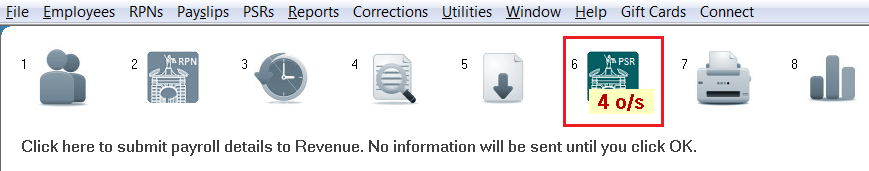

Process Icon No. 6 will now indicate the number of Correction PSRs you must now submit to Revenue.

- access Process Icon No. 6 where only one Correction PSR is outstanding and submit to Revenue.

- where more than one Correction PSR is outstanding, simply go to 'PSRs > Control Panel' to submit these one by one to Revenue.

Please note: as soon as a new employee correction is applied, a corresponding payslip will be created and will be available for printing/emailing within the Print/Email Payslip utility.

This payslip can be accessed by going to Process Icon No. 7 or Payslips > Print/Email Payslips

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.