Revenue Payroll Notifications - Transition to the new tax year

- RPNs for 2020 will be available in early December 2019, however 2020 RPNs will not be updated in real time until 2020

- If an employee’s payment date is 2020, employers must use the 2020 RPN

- A 2019 RPN cannot be used in 2020 (Income Tax Regulations 2018)

- Employers are advised not to make payroll submissions with a 2020 pay date until a 2020 RPN is available (otherwise emergency tax will apply)

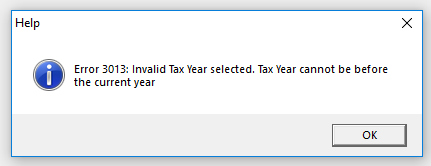

- 2019 RPNs will no longer be available for retrieval after 31st December 2019. Therefore attempting to retrieve an RPN in 2019 Payroll Manager after this date will return an error:

Where payroll remains outstanding for 2019, employers in this instance will need to use the most recently retrieved RPN to process their employees' payroll.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.