Remittance to Revenue - Overview

With the introduction of PAYE Modernisation, the employer P30 return will be discontinued with effect from 1st January 2019.

Revenue will instead issue you with a monthly statement based on the periodic payroll submissions you have made within the tax month in question. This statement of account will be available to view within your ROS account by the fifth day of the following month.

When your monthly statement is available, you will be able to:

- View the statement in your ROS account

- Accept the statement in your ROS account

- Identify any errors

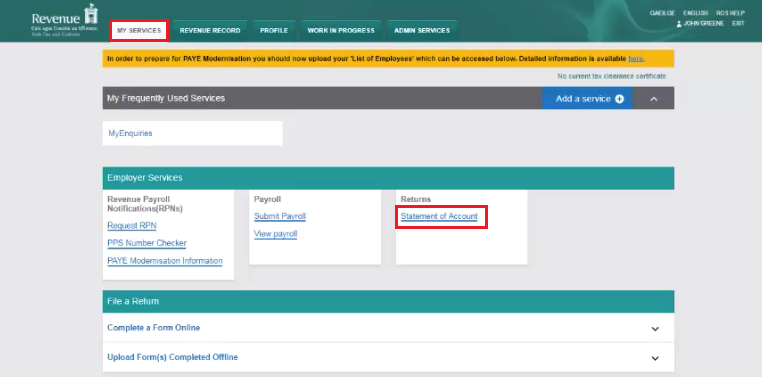

To view/accept your monthly statement in ROS

- Log in to your ROS account in the normal manner

- Go to My Services > Employer Services > Statement of Account

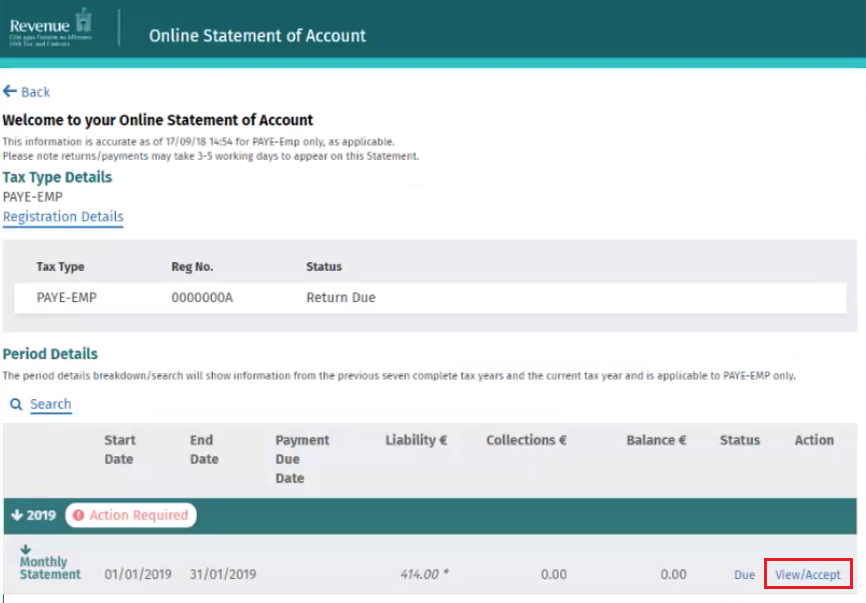

- Click View/Accept to view your current monthly statement on screen:

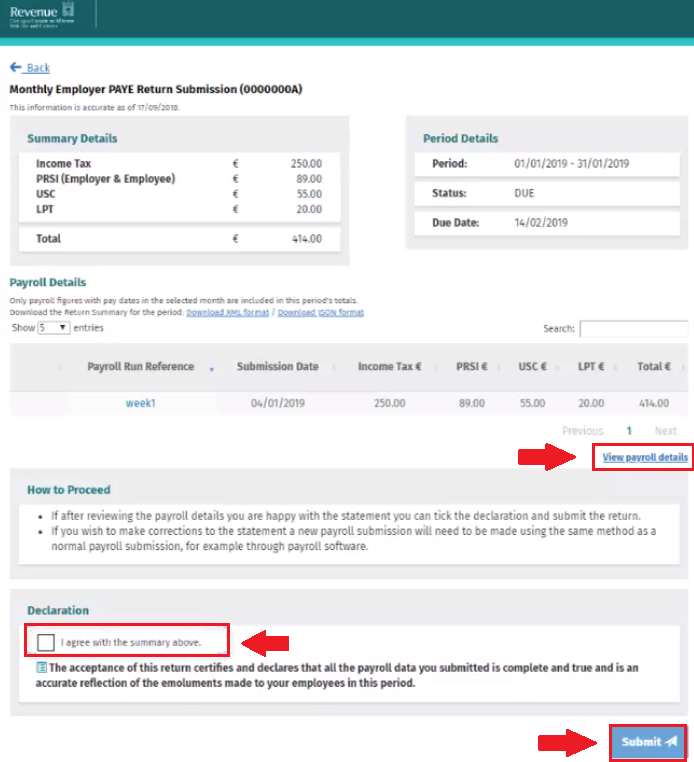

The monthly statement will show a summary of the total liability due, as well as the individual breakdown of your liability for income tax, USC, PRSI and LPT.

- The amounts displayed will be based on payroll submissions received by Revenue. To view these payroll submissions in more detail, click 'View payroll details'

- To subsequently accept the statement, tick the Declaration check box, followed by Submit:

- Enter your ROS password on the next screen, followed by Sign and Submit to accept your statement

Returns

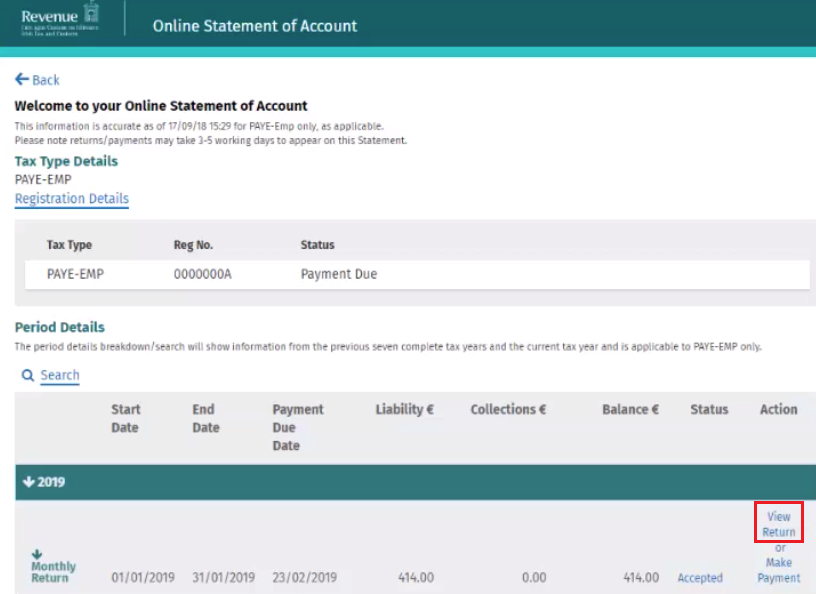

When the monthly statement is accepted, it becomes your Return.

Should you take no action at all, then your monthly statement will automatically be deemed as your return by the 14th of the following month.

To view a return at any time:

- Log in to your ROS account in the normal manner

- Go to My Services > Employer Services > Statement of Account

- Click View Return for the return you wish to view

Payment Due Dates for Returns

It is important to note that payment due dates for employers remain unchanged under the new system.

If you are a quarterly or annual remitter, you will now have a monthly statement issued by Revenue to you, which will become your monthly return, however your payment due dates will not change.

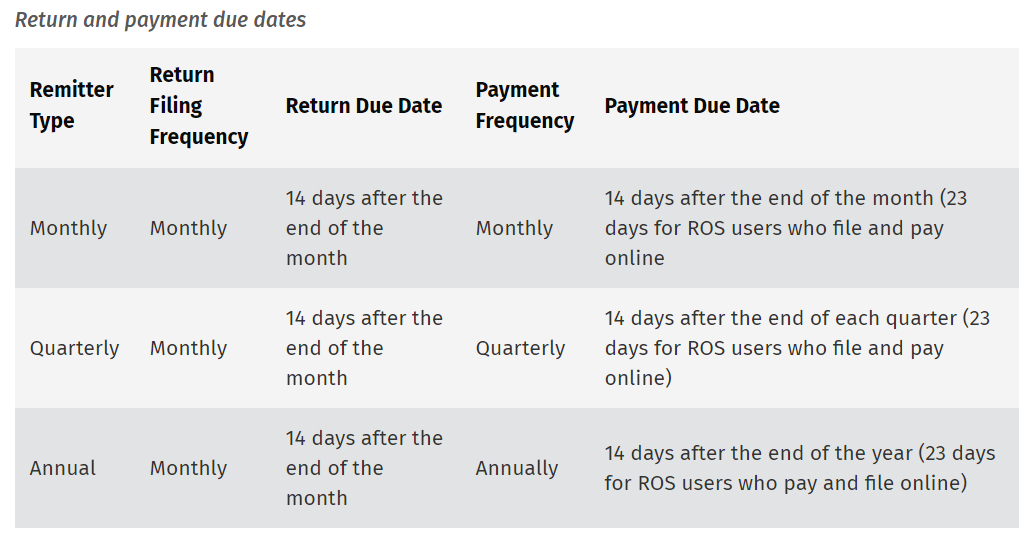

The following table summarises each Remitter Type and their respective return and payment due dates:

Making Payment to Revenue

Revenue facilitate the following payment methods:

- credit card

- debit card

- using your bank account

- ROS Debit Instruction

- Fixed direct debit/ Variable direct debit

The following payment methods are available to use within either the Statement of Account utility or the Payments & Refunds utility within ROS:

- credit card

- debit card

- using your bank account

- ROS Debit Instruction (if registered for this)

For further guidance on how to make payment through the Statement of Account utility within ROS, click here

For further guidance on how to make payment through the Payments & Refunds utility within ROS, click here

Payment by Direct Debit

- If availing of Revenue's fixed direct debit scheme, employers must ensure that the cumulative monthly payments are sufficient to cover the annual liability.

- Since 25th January 2019, employers may avail of Revenue's variable direct debit scheme. Under the variable scheme, Revenue will obtain permission to request the value of your actual monthly liability, as opposed to a fixed amount each month.

Employers can apply to set up a variable direct debit through ROS.

If you are currently on a fixed direct debit scheme with Revenue, you will need to cancel this before setting up a new variable direct debit. This will ensure that Revenue only requests one payment from your bank.

It is also important to note that if you are currently a quarterly or annual remitter, setting up a variable direct debit will place you on a monthly remittance schedule instead.

Further information on setting up a direct debit scheme can be sought from Revenue.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.