Payslip Workings

A detailed payslip working/calculation is available for every payslip.

This feature provides a detailed explanatory step by step guide to the calculations behind the PAYE, USC and PRSI deductions made on each employee payslip.

If required, the workings can be printed/emailed to an employee to explain their payslip in detail.

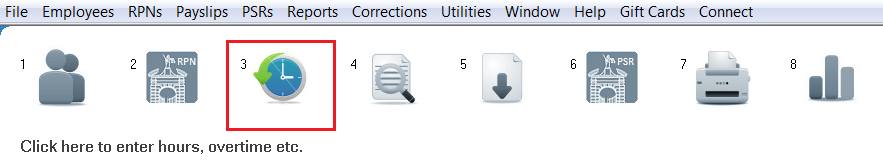

To view Workings before updating the pay period, go to Process Icon No. 3 or go to Payslips> Weekly/Monthly/Fortnightly Input:

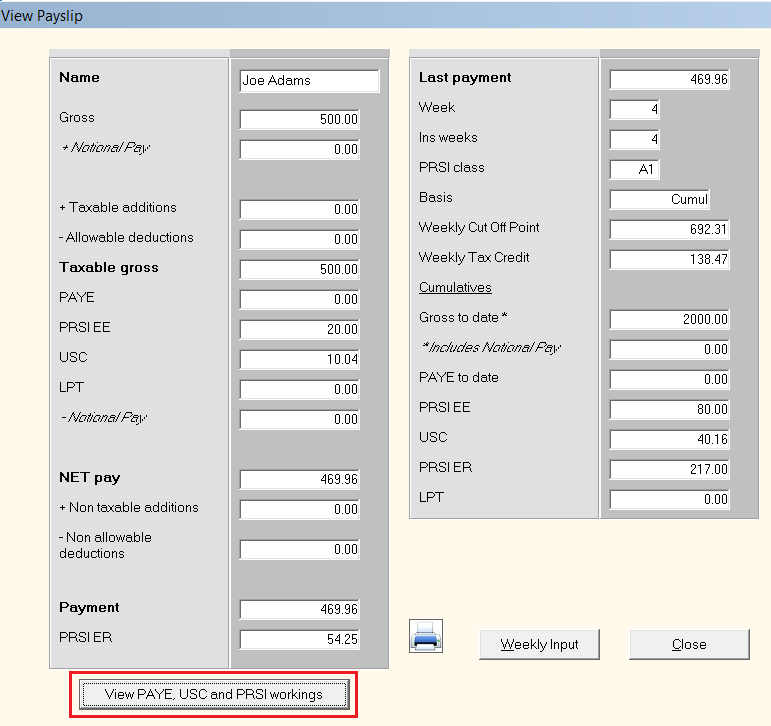

Enter the employee's pay information, followed by Update File.

This will provide you with a payslip preview.

Click "View PAYE, USC and PRSI workings" to display the workings/calculations behind the payslip you are previewing:

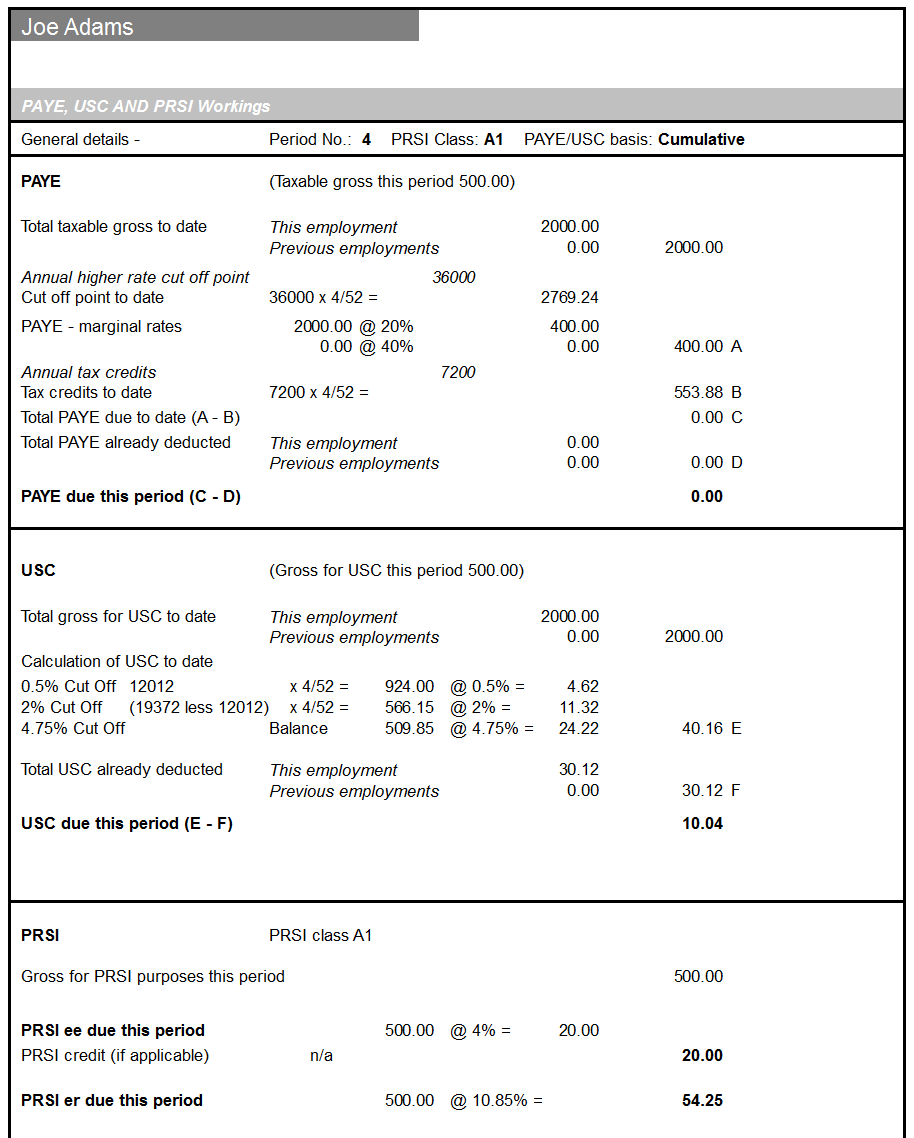

The Workings will now be displayed on screen. Press Print, if required.

Viewing Historical Workings

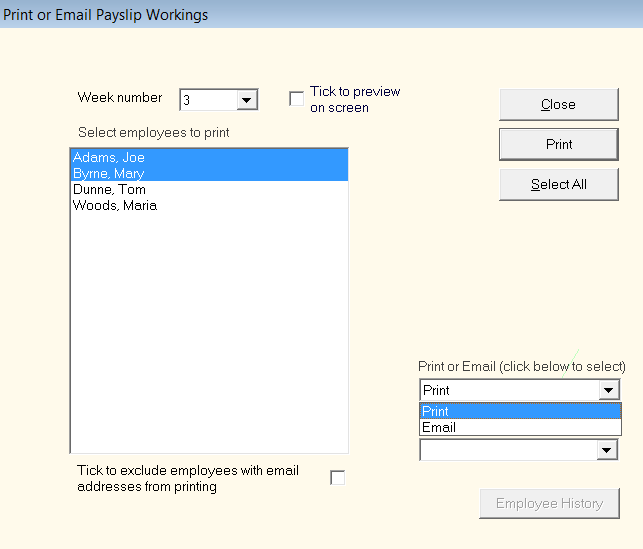

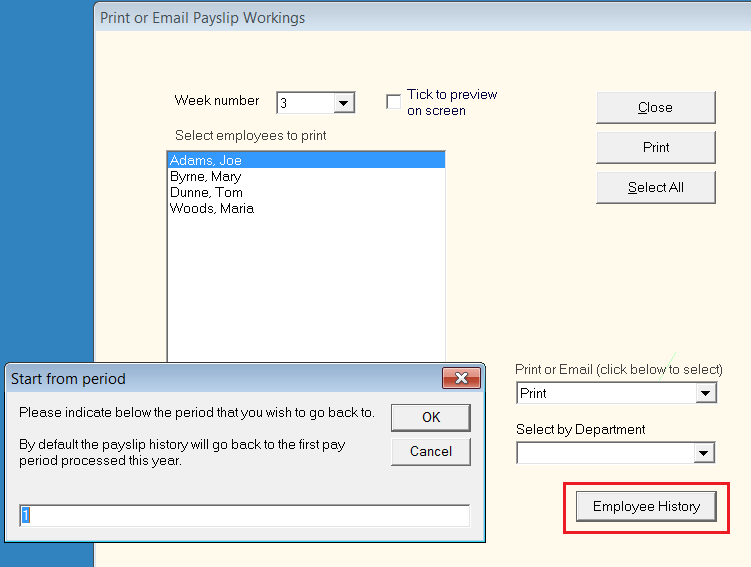

Once payslips are finalised, a Working for any historical payslip can be printed or emailed by going to Payslips > Print/Email PAYE, USC and PRSI Workings

Select the pay period which you wish to print/email the workings for and select the relevant employees.

Choose Print or Email, as required

To batch print historical workings for an employee:

- Select Print from the drop down menu

- Highlight the employee's name

- Click Employee History

- Indicate the period you wish to print from and click OK - workings will then print from the period indicated to the most recent period processed