Directors Fees

Where a Director is in receipt of income which is classified as Directors fees and not remuneration this portion of income is subject to Class S PRSI rates.

Director's fees are defined as fees relating solely to attending board meetings and other specific directors duties and not remuneration under a contract of service.

Therefore, this portion of income, is not subject to Employer PRSI.

You may need to confirm this treatment with your accountant/tax advisor or if you are in any doubt to whether or not any portion of income is to be treated as Directors Fees.

Calculating PRSI with Directors Fees

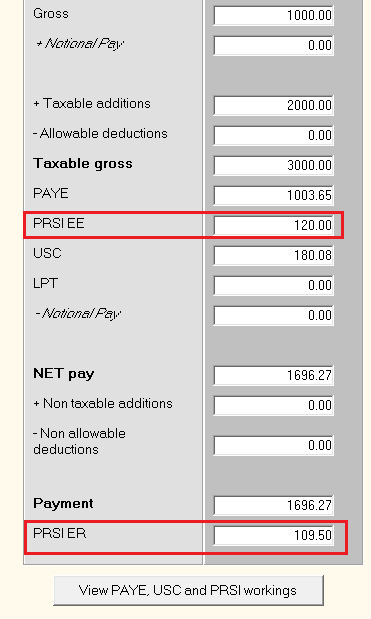

Employee PRSI (assuming the Director is a Class A contributor)

Directors Weekly Salary/Remuneration €1000.00

Director's Fees €2000.00

Salary/Remuneration (Subject to PRSI Class A1) €1000.00

€1000.00 @ 4% = €40.00

Directors Fees (Subject to PRSI Class S) €2000.00

€2000.00 @ 4% = €80.00

Total Employee PRSI deduction = €120.00

Employer PRSI

Directors Weekly Salary/Remuneration €1000.00

Director's Fees €2000.00

Salary/Remuneration (Subject to PRSI Class A1) €1000.00

€1000.00 @ 10.95% = €109.50

Directors Fees (Subject to PRSI Class S) €2000.00

No Employer PRSI chargeable under Class S

Total Employer PRSI deduction = €109.50

Revenue submissions will all reflect PRSI contribution for the period at Class A1, as Class A takes precedence over any other PRSI class within a contributory period.

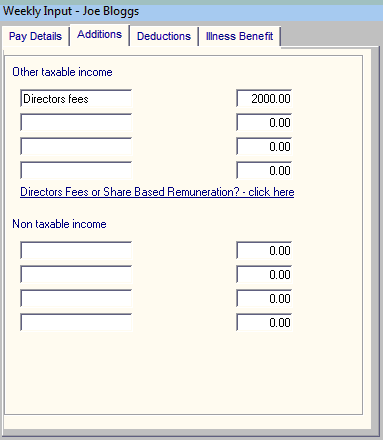

Entering Directors Fees in Thesaurus Payroll Manager

To enter director's fees, go to Process Icon No. 3 or Payslips > Weekly/Monthly/Fortnightly Input

- Select the employee

- Select their "Additions" tab

- Within an available "Other Taxable Income" field, enter "Directors Fees" as the narrative, in order to allocate this field to Directors Fees and to allocate the correct PRSI treatment to any amount entered.

- Once you start to enter "Directors Fees" the field will auto fill.

- The PRSI will be deducted accordingly

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.